- Bitcoin could possibly be on the verge of breaking out of its bullish flag sample.

- Assessing the potential for resistance build-up at important degree.

Bitcoin [BTC] delivered a formidable bullish cost within the final two weeks. Simply the opposite day, the cryptocurrency struggled to sum up sufficient momentum for a sustained uptrend, or push nicely above the $60,000 worth vary.

Quick ahead to the current and Bitcoin has obliterated the $60,000 resistance degree, and pushed even larger. The value of 1 BTC on the time of writing, was $63,404, which is equal to an 18.35% rally within the final 14 days.

With solely 10 days remaining in September, Bitcoin is on observe to shut the month within the inexperienced if it may well maintain present ranges. Nevertheless, will seemingly expertise some resistance forward, if it pushes into the subsequent main resistance zone at $65,000.

Why $65,000 degree is important for Bitcoin

BTC’s worth swings between March and the current have fashioned a bullish flag sample. If it follows the sample, then meaning a bullish breakout will ultimately happen. Now looks as if a super time for that breakout.

Supply: CryptoQuant

A powerful push above $65,000 would seemingly break the decrease highs development we noticed over the previous few months. Breaking this that sample means worth will seemingly begin one other cost into worth discovery territory.

The just lately introduced charge reduce would possibly change into the subsequent catalyst for the liquidity essential to gas one other sturdy bullish sentiment.

Can the Bitcoin bulls preserve the present momentum?

Looksonchain just lately famous that 5 miner wallets which have been lively since 2009 just lately moved their BTC. This raises the potential for setting off some promote strain. The findings point out that roughly 250 BTC price over $15 million was transferred.

Bitcoin miner reserves continued to say no within the final 24 hours, reaching a 5-week low of 1.81 million BTC.

Supply: CryptoQuant

A surge in Bitcoin miner reserves would point out confidence in its means to maintain sustaining its upside. Nevertheless, the present commentary signifies the alternative. This additionally coincides with the danger for urge for food on the most important trade.

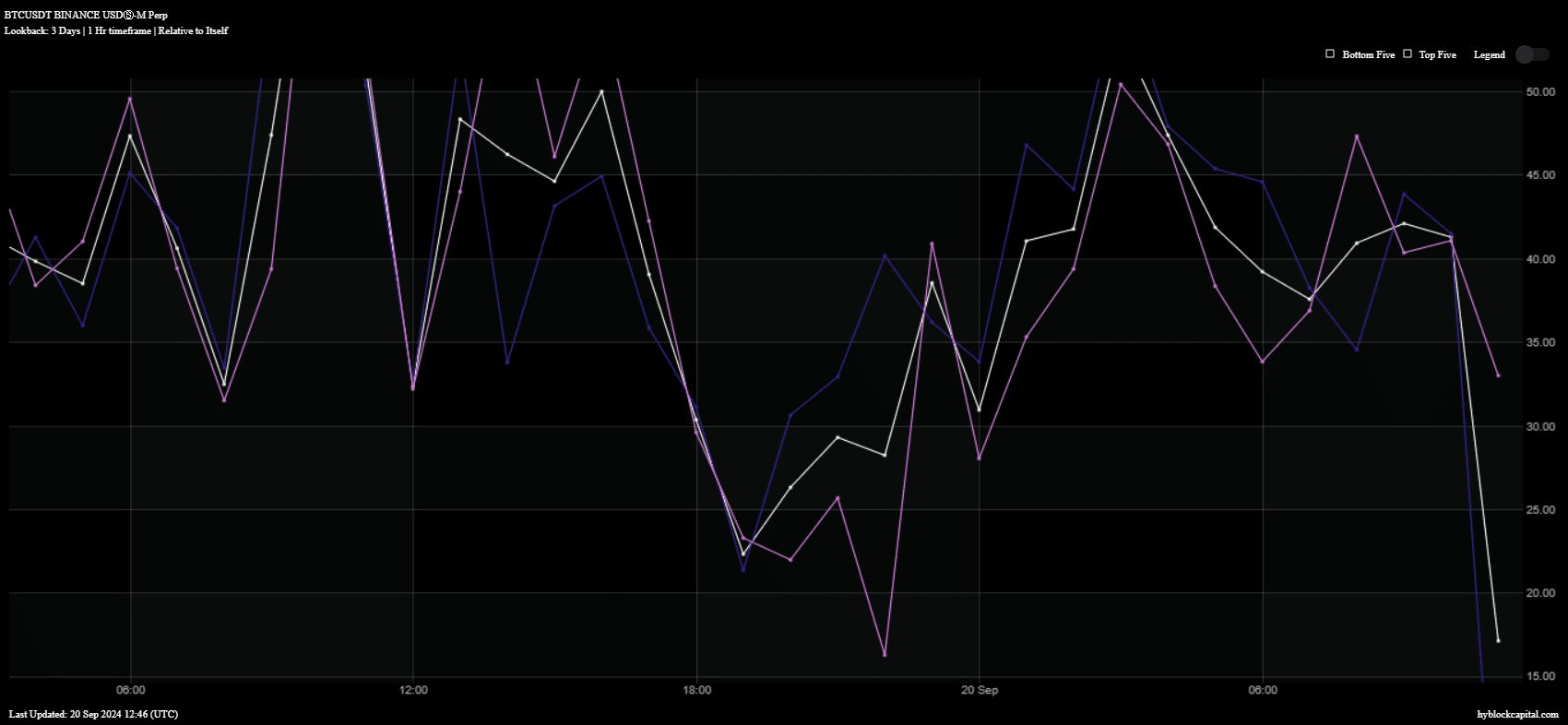

Web longs dipped sharply within the final 24 hours, indicating decrease confidence in Bitcoin’s potential upside within the near-term.

HyblockCapital

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Web shorts remained comparatively larger, than internet longs, regardless of additionally displaying indicators of some decline. This might additionally point out that there’s some uncertainty concerning the potential pullback.

Bitcoin holders might even see the latest upside as an indication of momentum construct up for the subsequent main long run rally. This may increasingly affect them to change from swing buying and selling to a long-term HODL technique.