- Why has Bitcoin been promoting off proper earlier than and at each U.S. market open?

- Bitcoin and its ETFs are set to surge.

Bitcoin’s [BTC] latest phenomenon in the course of the U.S. market open has caught the eye of merchants and analysts.

The king coin has been experiencing constant sell-offs proper earlier than and in the course of the U.S. market open, the place costs initially pump to shake out shorts adopted by a gradual decline to shake out longs, earlier than the precise market transfer happens.

This sample could also be pushed by components similar to pre-market buying and selling, market sentiment, provide and demand dynamics, and the buying and selling habits of institutional traders.

This phenomenon has notably impacted Bitcoin ETFs within the U.S.

Supply: TradingView

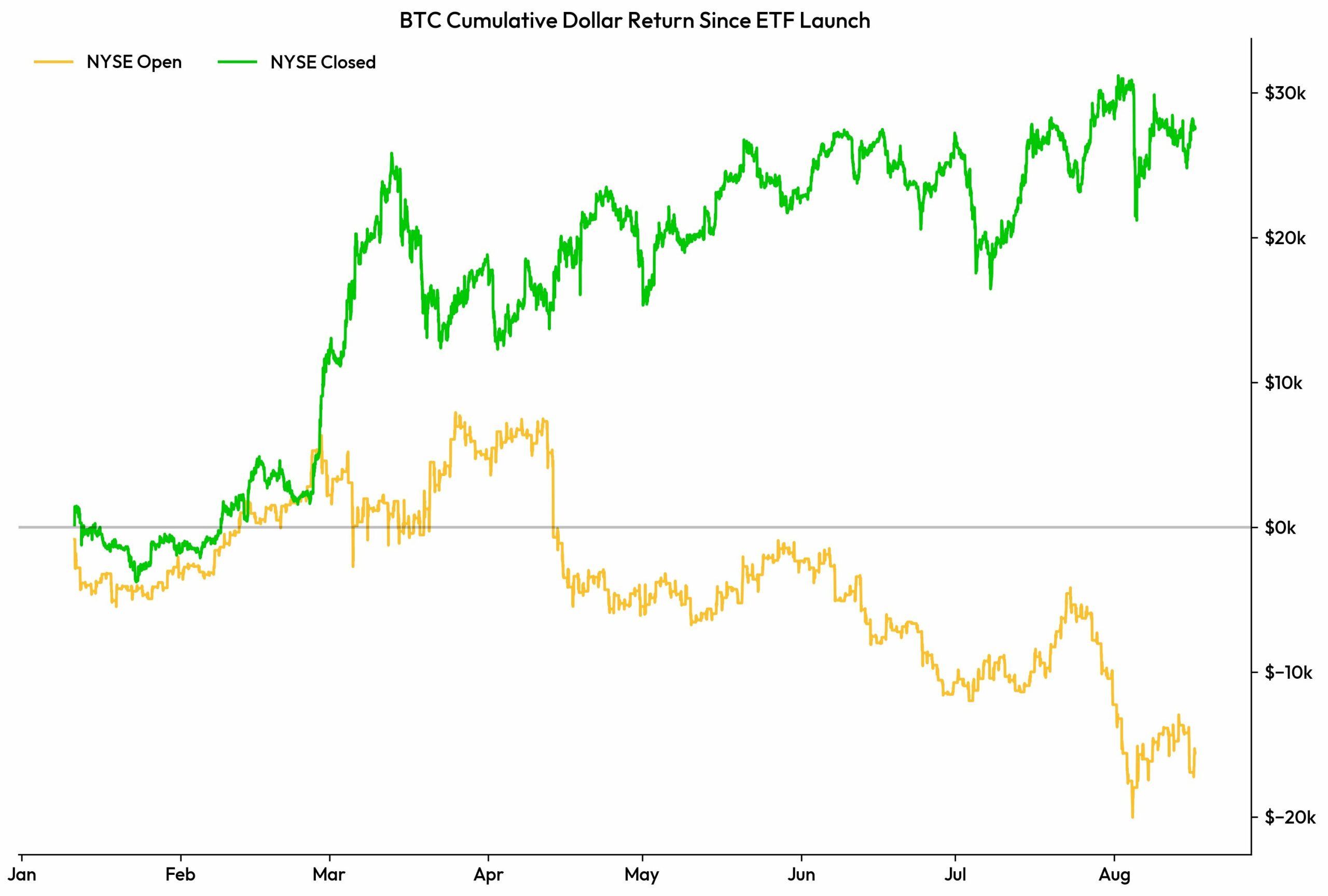

Bitcoin cumulative greenback return since ETF launch

Because the launch of those ETFs, Bitcoin’s cumulative greenback return has proven a definite sample: it tends to say no when the NYSE is open and rise when the NYSE is closed.

Conventional finance, now closely concerned in crypto markets, has probably contributed to this pattern the place the value actions of Bitcoin throughout market hours are influencing the efficiency of ETFs.

Supply: Velo Information

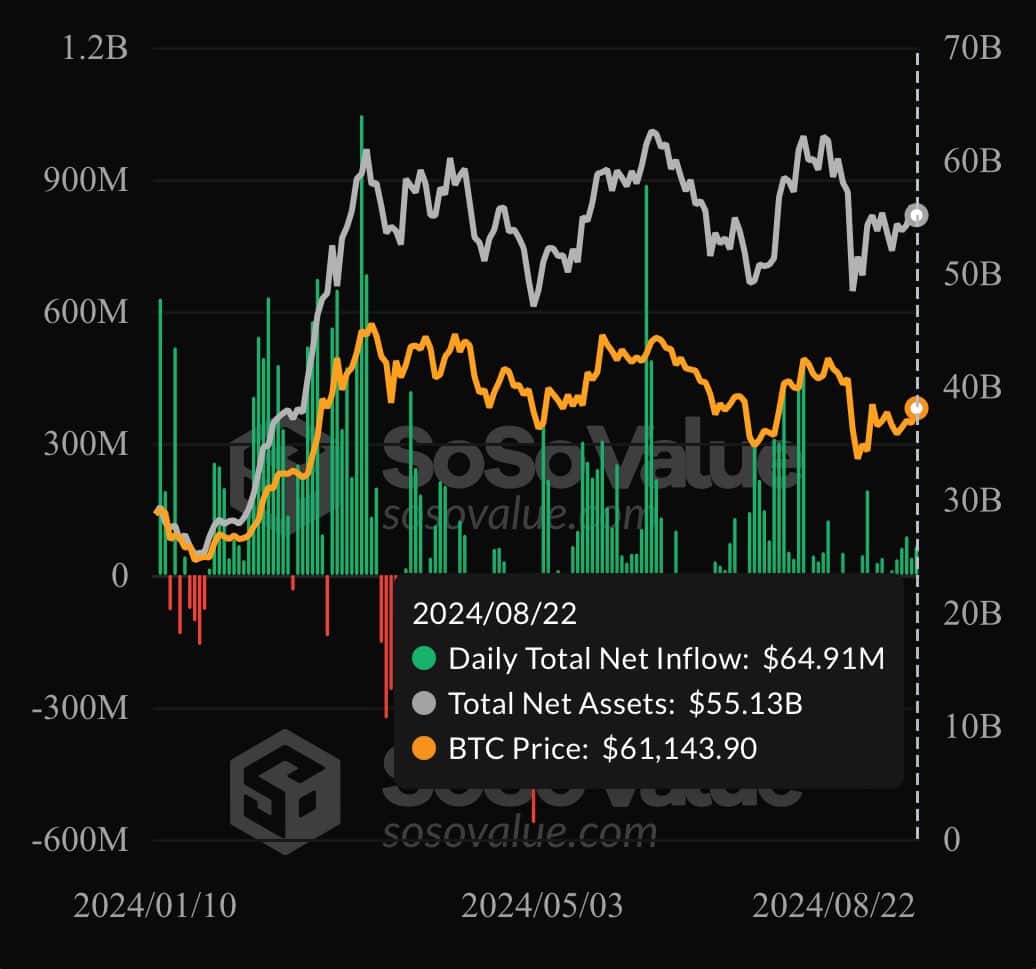

Bitcoin ETF movement & each day buying and selling quantity

Bitcoin ETFs recorded $65 million in each day web inflows yesterday, marking the sixth consecutive day of inflows.

This pattern highlighted a rise in each web movement and each day buying and selling volumes, with whole web property now reaching $55.13B.

As an illustration, the BlackRock spot Bitcoin ETF ($IBIT) lately recorded a buying and selling quantity of $758 million, contributing to a complete each day quantity of $1.4 billion for ETFs, as Bitcoin Archive famous on X (previously Twitter).

Supply: SosoValue

This surge in buying and selling exercise has supported Bitcoin’s worth, permitting it to retest key ranges which implies if a better low is established round $67k, the king coin may proceed its upward pattern, concentrating on $70k.

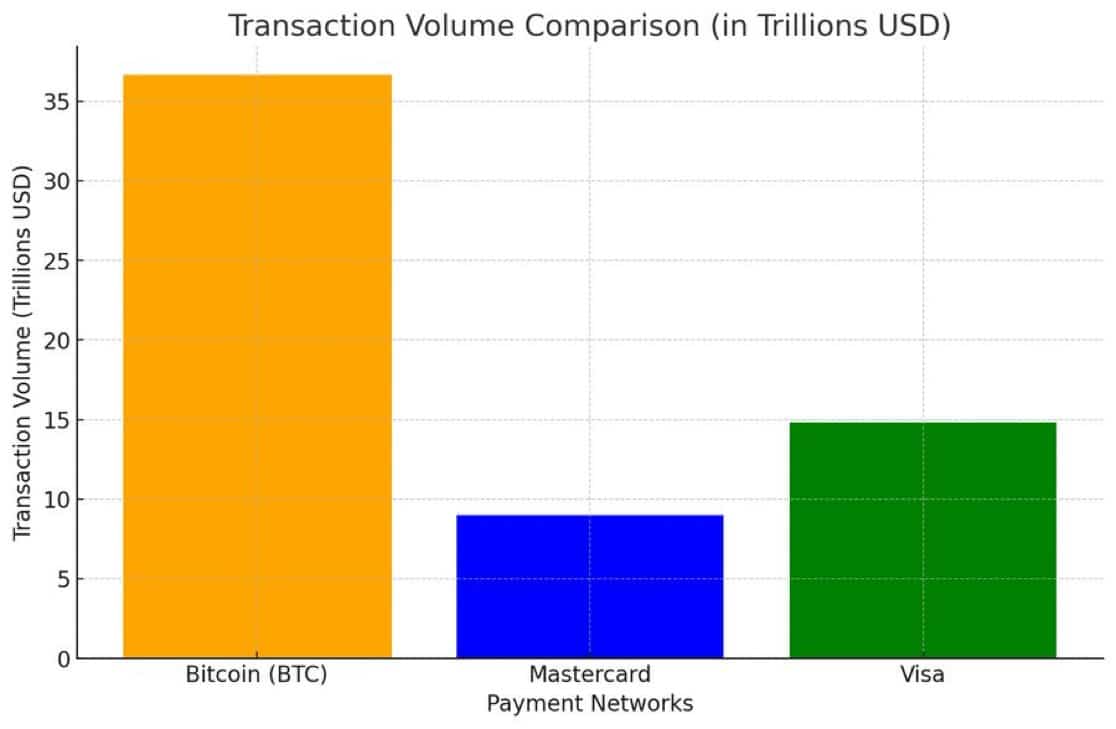

Transaction quantity comparability

Moreover, Bitcoin’s transaction quantity additionally remained strong, with the community processing $36.6 trillion in 2023, surpassing each Visa and Mastercard mixed.

Supply: Bitcoin Archive/X

Nevertheless, ETF holders miss out on this direct participation in Bitcoin’s transactional progress, as their holdings are tied to custodians and represented by paper shares.

This limitation in ETF constructions wants addressing, nevertheless it doesn’t diminish Bitcoin’s long-term prospects.

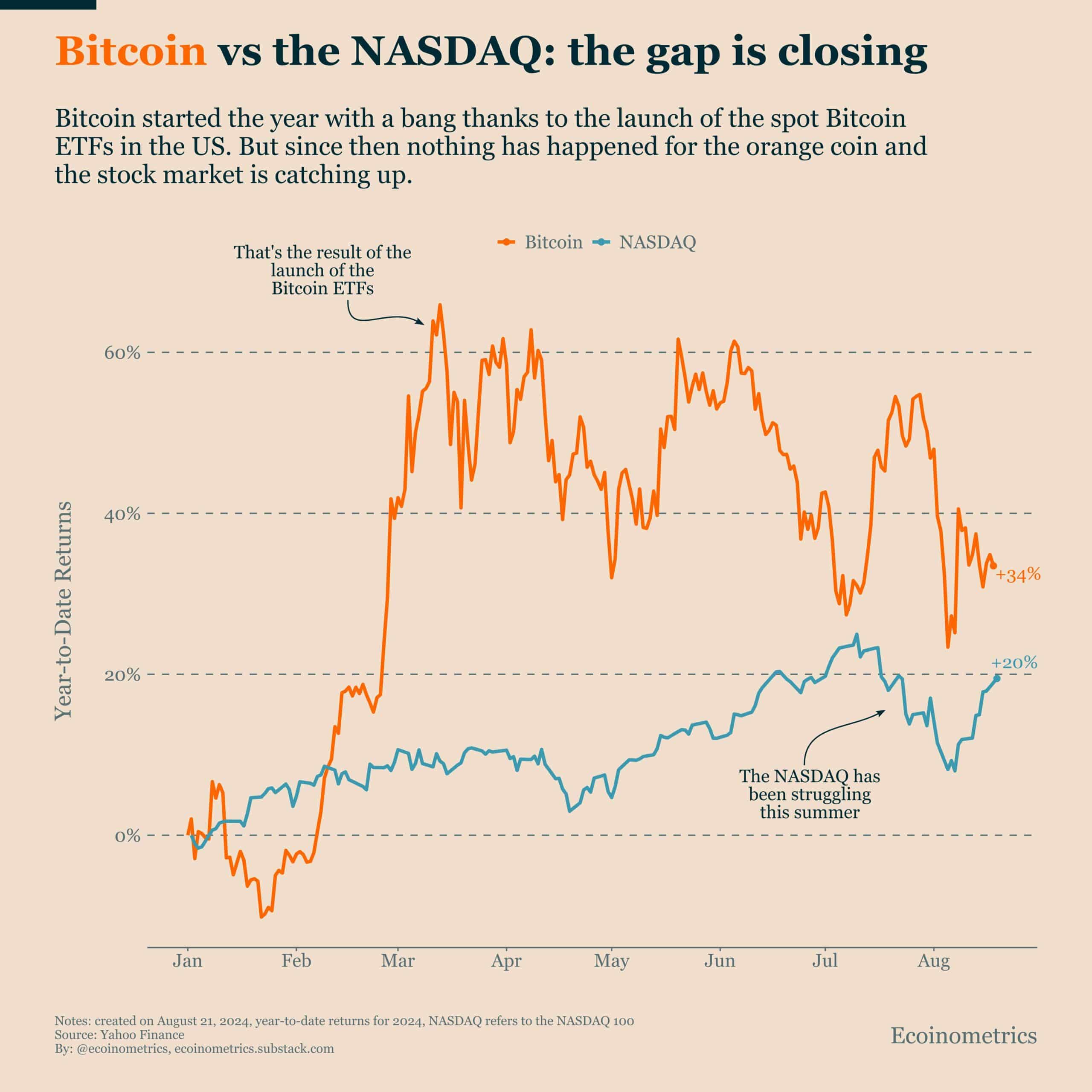

Bitcoin nonetheless outperforms shares in year-to-date returns

Furthermore, Bitcoin continued to outperform conventional shares in year-to-date returns, with a 34% acquire in comparison with NASDAQ’s 20%.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Though the hole has narrowed lately, the continuing restoration in crypto markets means that Bitcoin’s future positive factors might be substantial, particularly if extra bullish drivers emerge.

Supply: Econometrics

Regardless of a comparatively quiet 12 months, the early increase from the ETF launch and the potential for additional market catalysts point out that Bitcoin’s worth may rise considerably within the close to future.