- Analysts level to BTC’s historic alignment with earlier market cycles, indicating robust potential for a sustained rally.

- Each merchants and long-term holders are driving demand, exhibiting rising confidence within the asset’s prospects.

Over the previous month, Bitcoin [BTC] has gained a powerful 47.52%, solidifying its place as one of many market’s prime performers. Within the final 24 hours alone, it has risen by 1.78%, as shopping for exercise reveals no indicators of slowing.

With bullish sentiment dominating and growing optimism amongst traders, BTC seems prepared to increase its upward momentum within the coming weeks.

Historic traits point out BTC is primed for an upswing

Analysts level to the BTC Market Cycle Backside ROI, a dataset monitoring Bitcoin’s efficiency throughout market cycles, as proof of its potential for additional good points.

The information reveals that BTC’s present trajectory aligns carefully with the patterns noticed within the final two cycles. If this pattern holds, Bitcoin might expertise regular, incremental development from its present value ranges.

Supply: X

The bull runs of 2017 and 2021 adopted related cycles, suggesting that the continued rally may prolong into 2025 if historical past repeats itself.

AMBCrypto performed additional evaluation to evaluate whether or not present market circumstances assist this long-term bullish outlook.

BTC prepares for long-term development as purchaser exercise will increase

Bitcoin (BTC) continues to indicate robust bullish alerts as market members place themselves for a possible long-term rally.

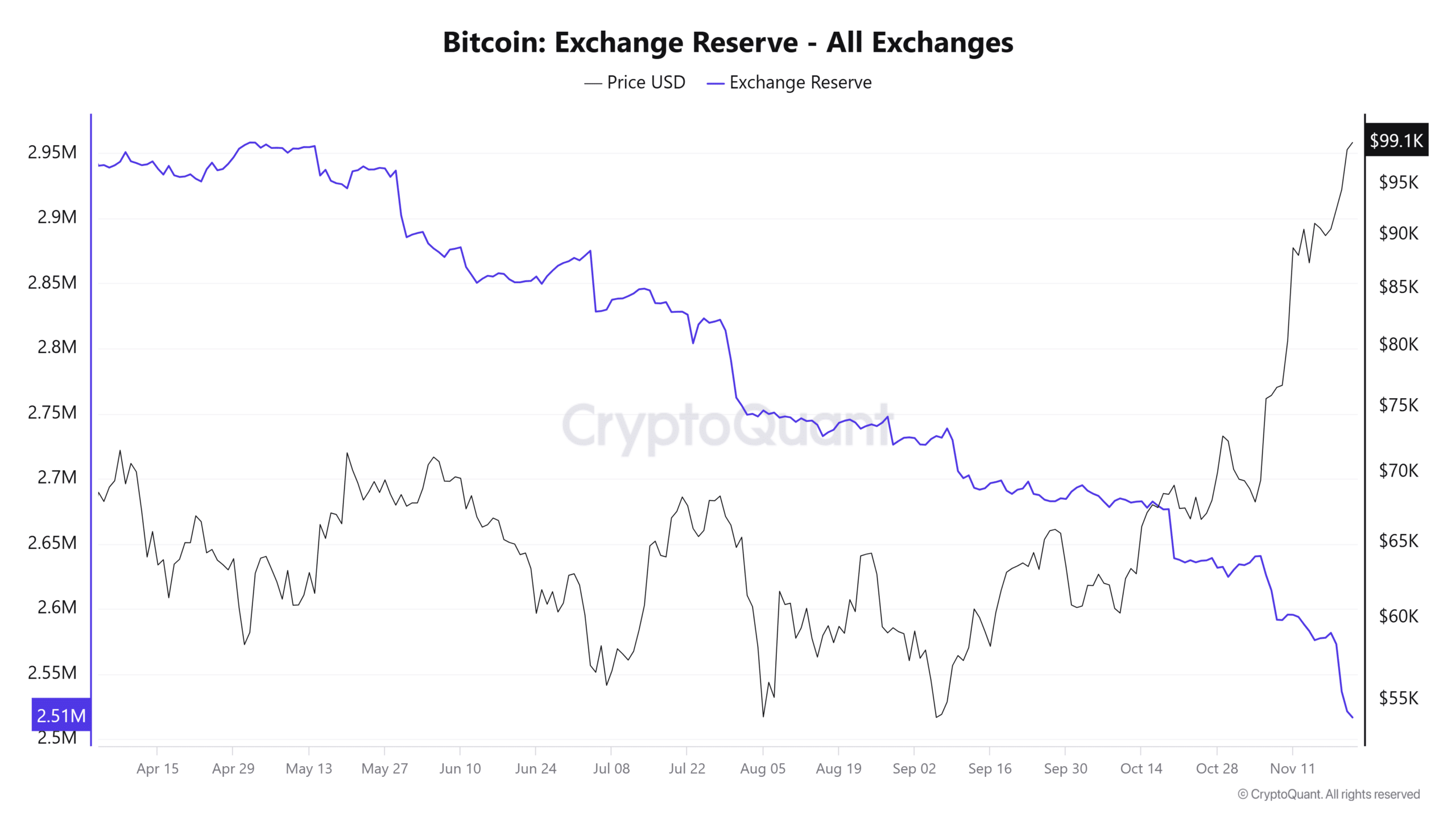

The Alternate Reserve, which tracks the quantity of BTC obtainable on exchanges, has sharply declined. Solely 2.516 million BTC stay on exchanges, following a 0.72% drop previously 24 hours and a cumulative lower of two.63% within the final 7 days.

This diminished provide suggests growing demand, a pattern typically linked to upward value momentum.

The Alternate Netflow helps this outlook, recording a major drop of 87.02% over the previous day. Greater than 15,000 BTC have been moved from exchanges to non-public wallets, signaling a choice for holding slightly than buying and selling.

Supply: Cryptoquant

Detrimental netflows—the place outflows exceed inflows—usually point out that traders are getting ready for long-term value appreciation.

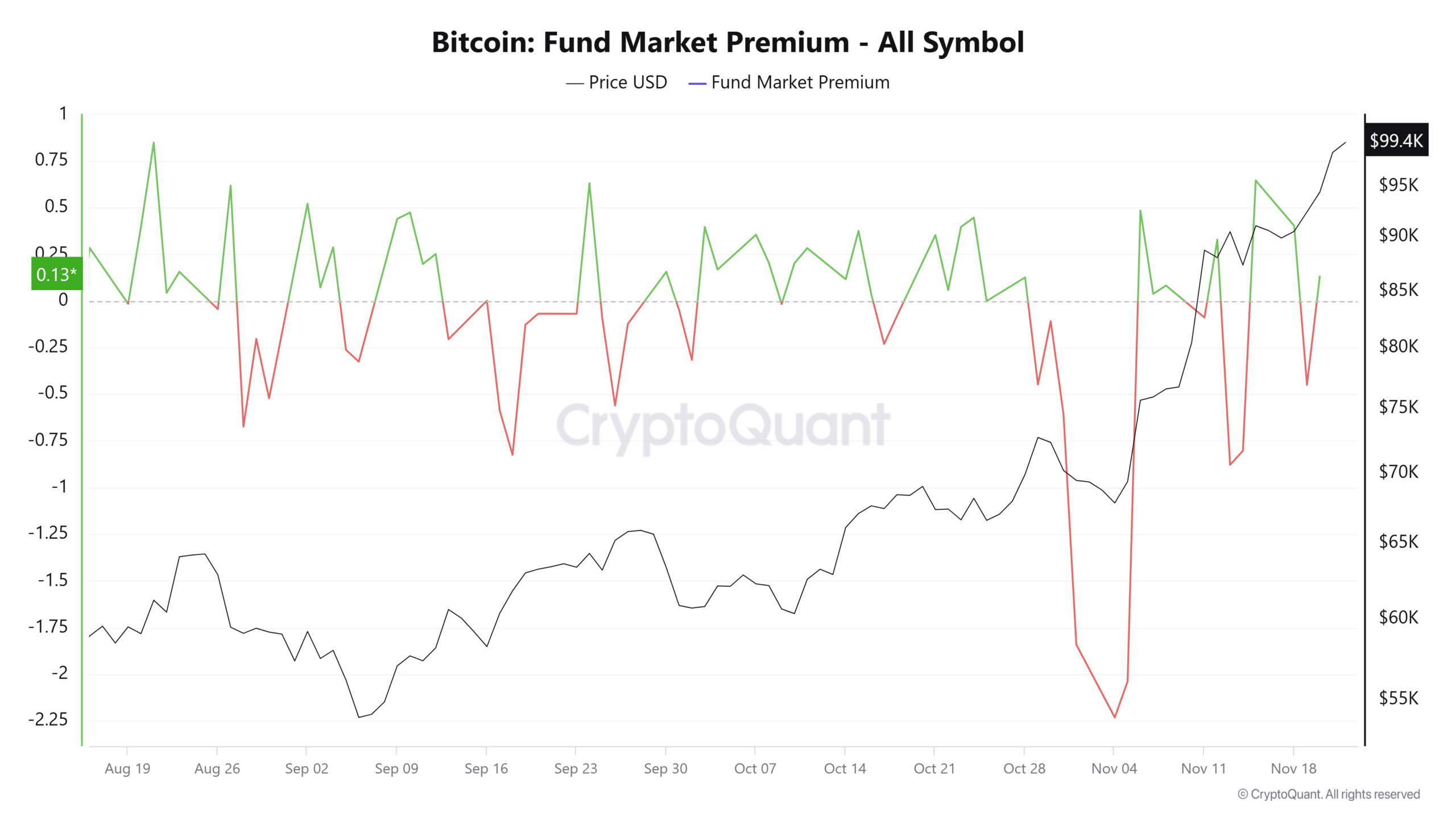

Including additional confidence is the Fund Market Premium, which has stayed constructive, with a present studying of 0.13074 after crossing above the zero mark yesterday.

This metric, which measures the hole between a fund’s market value and its web asset worth (NAV), is usually used for exchange-traded funds (ETFs) and closed-end funds like Grayscale.

A constructive premium highlights robust investor demand and reinforces the bullish sentiment.

Supply: Cryptoquant

With declining trade reserves, diminished netflows, and a constructive fund premium, BTC seems well-positioned for sustained long-term development.

Broader market sentiment fuels BTC’s bullish momentum

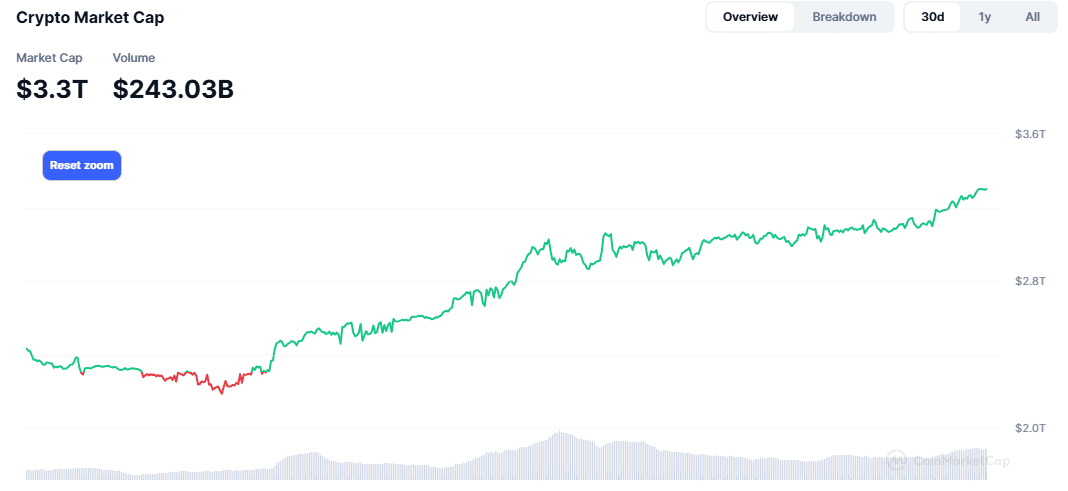

The broader cryptocurrency market continues to exhibit bullish sentiment, growing the chance of additional good points for Bitcoin.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

At press time, the full crypto market capitalization has risen by 4.63%, reaching $3.3 trillion, with Bitcoin accounting for a major share at $1.97 trillion. This highlights BTC’s dominant place and rising attraction amongst traders.

Supply: CryptoMarketCap

If the crypto market capitalization continues to climb, it might drive extra liquidity into Bitcoin, additional solidifying its attract for traders and supporting its upward trajectory.