- After a 20% month-to-month fall, BTC’s worth appreciated by 2% within the final 24 hours

- Most metrics steered that BTC would stay bullish within the short-term

Bitcoin’s [BTC] worth has been falling on the charts for a number of weeks now. 6 July was an exception although, with the crypto managing to remain inexperienced.

Nevertheless, its insignificant 24-hour restoration was not comparable with cryptos that registered double-digit share hikes over the past 24 hours. That being mentioned, the world’s largest cryptocurrency would possibly quickly flip a nook.

Bitcoin turns inexperienced

The previous month was considerably of a massacre for the king of cryptos as its worth declined by practically 20%. An analogous declining pattern was additionally seen final week. Whereas the final 24 hours have introduced higher information for Bitcoin holders, the crypto continues to be removed from hitting its former highs, with BTC buying and selling slightly below $57k at press time.

AMBCrypto’s have a look at CryptoQuant’s information revealed that BTC’s alternate reserves rose final month, which means that buyers have been promoting their holdings. Moreover, BTC’s accumulation pattern rating remained someplace within the vary of 0.16–0.11. Ordinarily, the nearer the metric is to 1, the better the shopping for stress.

Right here, it’s value mentioning that the Accumulation Pattern Rating is an indicator that displays the relative measurement of entities which can be actively accumulating cash on-chain, by way of their BTC holdings.

Supply: Glassnode

Will BTC get better anytime quickly?

Whereas that occurred, Captain Faibik, a preferred crypto analyst, shared a tweet revealing a potential cause behind BTC’s fall on the charts.

As per the analyst’s findings, BTC’s worth has been consolidating inside a widening, falling wedge sample. The tweet additionally talked about that Bitcoin bulls must clear the $61k resistance space to regain bullish momentum.

Supply: X

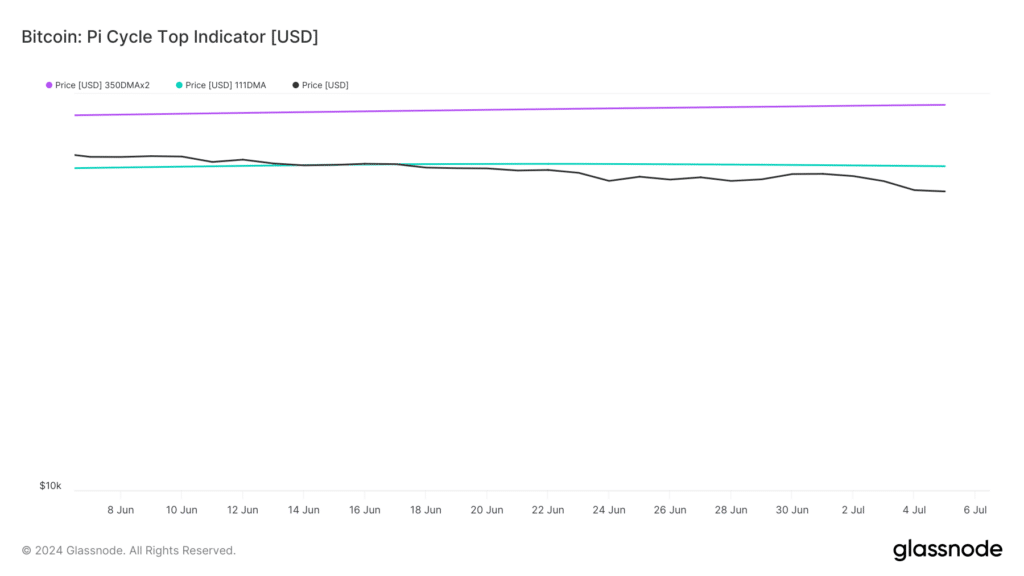

Moreover, AMBCrypto’s evaluation of BTC’s Pi Cycle Prime indicator highlighted that the crypto has been resting beneath its potential market backside for fairly a while now.

As per the identical, BTC’s potential market backside and tops have been $65k and $93k, respectively. Furthermore, BTC’s worry and greed index confirmed that it had a price of 23, which means that the market was in a “fear” part. Each time that occurs, the prospect of a worth hike are excessive.

Supply: Glassnode

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Other than this, it appeared fairly optimistic on the derivatives market entrance too.

AMBCrypto’s evaluation of Coinglass’ information recognized that BTC’s lengthy/brief ratio elevated too. A hike on this metric implies that there are extra lengthy positions available in the market, in comparison with brief positions.

On this case, the lengthy/brief ratio steered that the market sentiment round BTC has been largely bullish over the past 24 hours.

Supply: Coinglass