- BTC has continued to commerce under the $61,000 value vary.

- BTC noticed over $142 million liquidated up to now two days.

Bitcoin [BTC] has skilled declines over the previous few days, resulting in a big quantity of liquidations. As Bitcoin’s worth has decreased, merchants and traders have needed to navigate these unstable situations, contributing to the current swings in market sentiment.

Bitcoin proceed declines

An evaluation of Bitcoin (BTC) on a every day timeframe chart revealed its most important decline in 4 months.

Based on AMBCrypto, BTC dropped by 5.93% on 2nd August, from roughly $65,293 to round $61,418. This was the most important single-day decline since April.

By the top of buying and selling on third August, BTC had slipped additional to about $60,674, marking a 1.24% decline and falling under the $61,000 value vary.

Supply: TradingView

As of this writing, the decline continues, with Bitcoin buying and selling at round $60,143, representing a further almost 1% lower. These consecutive declines prompted BTC to interrupt its help degree, which was maintained by the lengthy transferring common (blue line) at round $61,000.

Moreover, the Relative Energy Index (RSI) has dropped under 40, indicating an intensifying bearish pattern.

Lengthy Bitcoin liquidations proceed

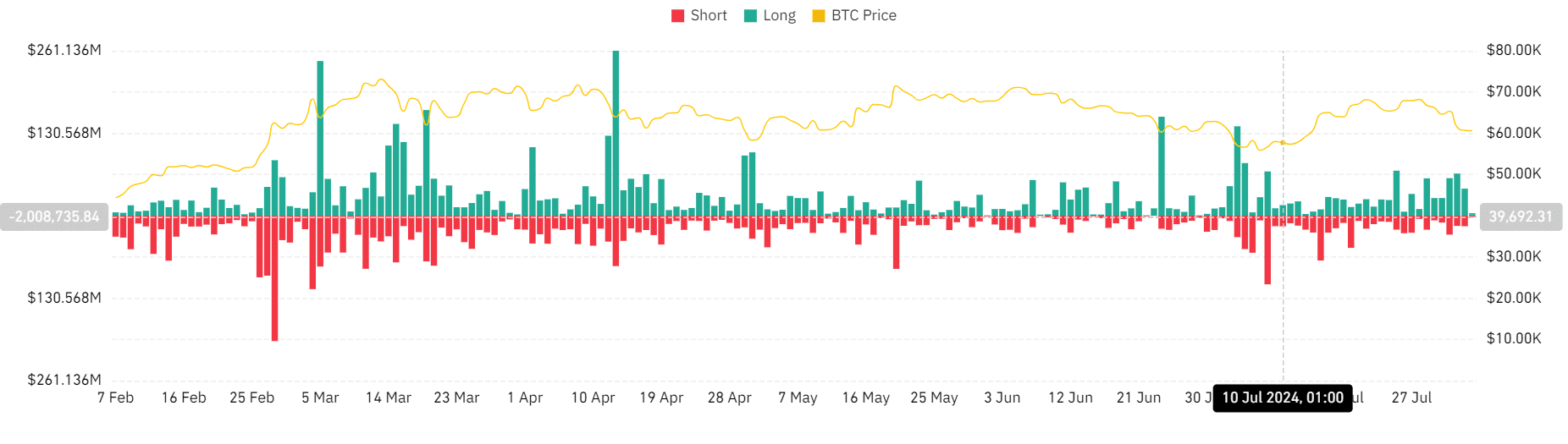

Prior to now seven days, Bitcoin has skilled a notable dominance of lengthy liquidation volumes.

Over the past two days, the full liquidation quantity exceeded $142 million. On third August, the liquidation quantity was almost $60 million, with lengthy positions accounting for nearly $43 million.

The overall liquidation quantity within the earlier buying and selling session reached roughly $83 million, with lengthy positions making up almost $67 million.

Supply: Coinglass

Moreover, the funding charge has exhibited volatility over the previous few days.

On the finish of the latest buying and selling session, the funding charge considerably dropped to round 0.0036% from roughly 0.008%.

Nonetheless, it noticed fluctuations within the final eight hours, rising once more to round 0.008% earlier than dropping again to about 0.004%. These actions point out appreciable uncertainty and volatility available in the market, affecting each liquidation volumes and funding charges.

New addresses see combined actions

As Bitcoin’s value makes an attempt to stabilize, the variety of every day new addresses has additionally proven volatility.

Within the final three days, there was a notable decline within the variety of new addresses.

Learn Bitcoin (BTC) Worth Prediction 2024-25

Based on information on Glassnode, the variety of new addresses was round 334,000 originally of the month, following a slight spike on the finish of the earlier month.

Nonetheless, this quantity has since declined to roughly 304,000 as of this writing. This lower in new addresses could replicate a cautious sentiment amongst potential new members available in the market amid the present value instability.