- Bitcoin was buying and selling at round $96,000 at press time.

- Indicators are making a robust case for it rising to $100K.

Bitcoin’s [BTC] latest value motion has sparked widespread curiosity because the cryptocurrency consolidates inside a decent vary under the $100,000 mark.

Analysts recommend this era of range-bound buying and selling is a mandatory pause following a big rally, permitting the market to stabilize earlier than the following breakout.

Consolidation or preparation?

Bitcoin’s value motion on the every day chart revealed a consolidation section between $95,000 and $98,000, with diminished volatility signaling indecision available in the market.

Technical indicators, nonetheless, mirrored an general bullish construction.

The shifting averages remained firmly in a golden cross sample, with the 50-day shifting common holding above the 200-day shifting common, underscoring the continued bullish momentum.

Supply: TradingView

The Bollinger Bands have tightened, which generally precedes a pointy directional transfer.

In the meantime, the Relative Energy Index (RSI) sat at 64.76, edging near overbought territory however nonetheless permitting room for extra upside.

The Parabolic SAR dots, positioned under the candles, additional reinforce the upward momentum.

MVRV ratio and change reserves

On-chain knowledge offered further context to Bitcoin’s consolidation. The MVRV ratio, which measures market valuation towards the realized value, was close to 2.7 at press time.

Whereas not at excessive highs, this stage suggests Bitcoin is approaching overvaluation, a possible warning for short-term traders. Traditionally, a ratio above three has usually preceded intervals of profit-taking and value corrections.

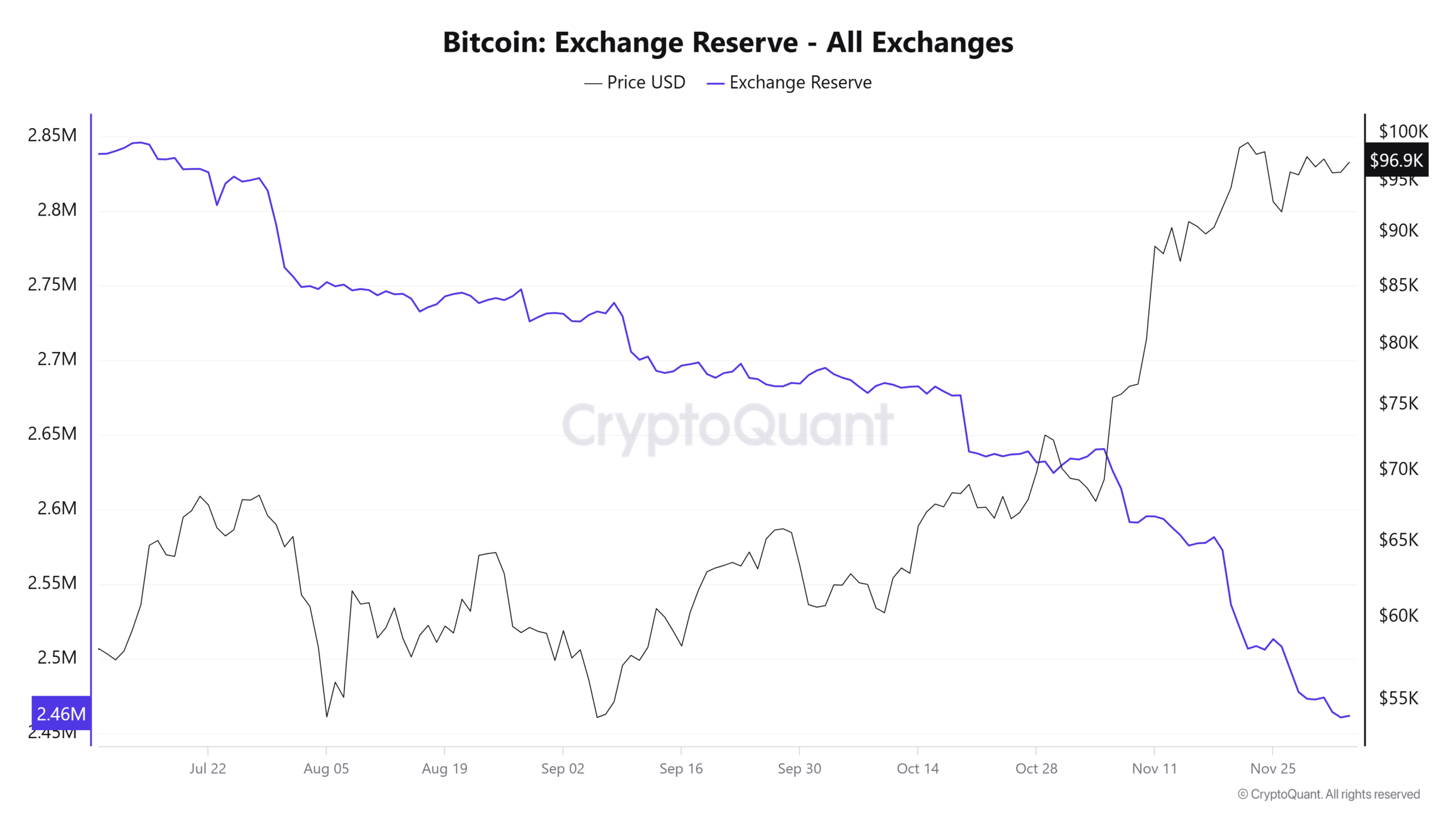

Alternate reserves, in keeping with knowledge from CryptoQuant, proceed to say no, a bullish indicator reflecting diminished promoting stress from holders.

The development suggests traders are opting to maintain their Bitcoin off exchanges, signaling confidence within the asset’s long-term potential.

Supply: CryptoQuant

Market sentiment: Derivatives and accumulation

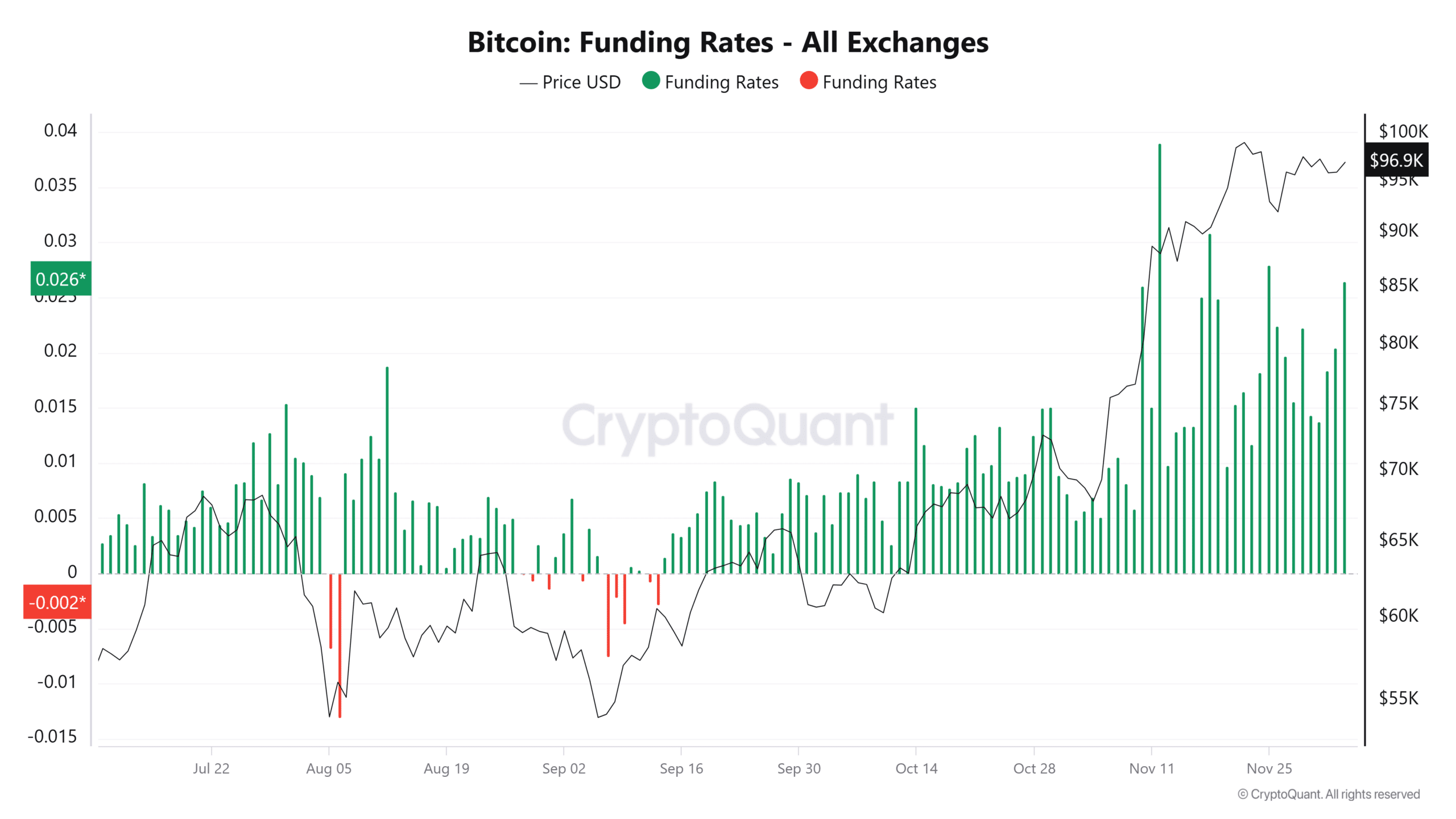

Bitcoin Funding Charges throughout main exchanges have turned constructive, reflecting bullish sentiment within the derivatives market.

Merchants appeared keen to pay a premium for lengthy positions, signaling confidence in additional value positive aspects. This optimism is additional supported by on-chain knowledge exhibiting a continued accumulation by whale addresses.

Giant-scale traders have elevated their holdings, reinforcing the narrative of long-term confidence in Bitcoin’s upward trajectory.

Supply: CryptoQuant

Retail exercise, in distinction, has declined, indicating that bigger traders drive the present rally. This divergence usually provides stability to cost motion, as whale accumulation usually helps increased value ranges.

Outlook: Bitcoin to $100K

Bitcoin’s consolidation is a wholesome section in its market cycle, making a basis for a possible breakout towards $100,000.

A transfer past $98,000, backed by elevated buying and selling quantity, might verify the resumption of the uptrend.

Nonetheless, traders ought to stay cautious of any sudden spikes in change reserves or an overextension within the MVRV ratio, which might sign a reversal or correction.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Regardless of these dangers, the broader market construction stays favorable.

As Bitcoin digests latest positive aspects, it seems well-positioned for additional upward motion, with sturdy technical and on-chain indicators supporting the case for a breakout.