- Bitcoin was down by greater than 6% within the final seven days.

- Market indicators have been bearish on the coin.

Bitcoin [BTC] has been on a bull rally for the final seven days as its worth has elevated significantly. Nevertheless, this bullish development won’t final lengthy as a key indicator hinted at a doable worth correction quickly.

Let’s take a look at what’s occurring with Bitcoin.

Bitcoin’s liquidation is rising

CoinMArketCap’s knowledge revealed that Bitcoin’s worth elevated by greater than 6% within the final seven days. On the time of writing, BTC was buying and selling at $67,055.86 with a market capitalization of over $1.32 trillion.

Within the meantime, Ali, a preferred crypto analyst, posted a tweet highlighting an fascinating replace. As per the tweet, $30.33 million might be liquidated if Bitcoin rebounds to $68,838.

Usually, an increase in liquidation ends in worth corrections. Due to this fact, AMBCrypto deliberate to have a greater have a look at BTC’s state to see whether or not it’s preparing for a correction or if the highway forward is obvious.

Which means is BTC headed?

AMBCrypto then deliberate to try the king of crypto’s metrics to see what to anticipate from them. As per our evaluation of Santiment’s chart, BTC’s MVRV ratio registered an uptick final week, which could be inferred as a bullish sign.

Moreover, its weighted sentiment additionally moved into the optimistic zone. This clearly meant that bullish sentiment across the coin was growing out there.

Nevertheless, the remainder of the metrics regarded bearish. For instance, its provide on exchanges registered an uptick, suggesting an increase in promoting stress.

On prime of that, the king of cryptos’ NVT ratio additionally registered an uptick. Each time the metric rises, it implies that an asset is overvalued, indicating that the possibilities of a worth correction are excessive.

Supply: Santiment

Evaluation of BTC’s each day chart

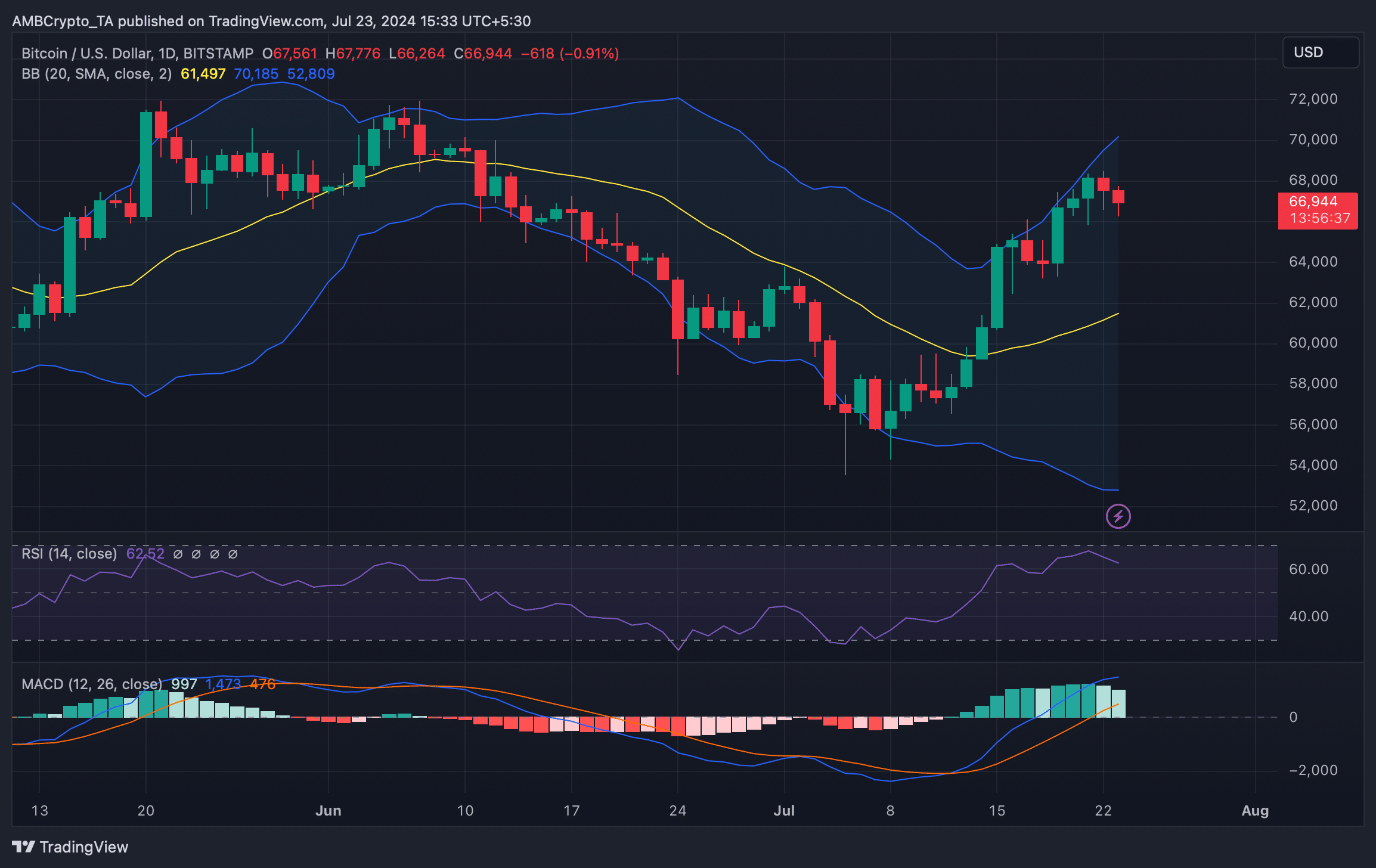

AMBCrypto then deliberate to take a look on the coin’s each day chart to see what market indicators recommend. We discovered that BTC’s worth touched the higher restrict of the Bollinger Bands, which frequently ends in worth corrections.

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

Bitcoin’s Relative Power Index (RSI) additionally registered a downtick. Each of those indicators advised that the possibilities of a worth correction have been excessive.

Nonetheless, the technical indicator MACD displayed a bullish benefit out there, hinting at a continued worth rise within the coming days.

Supply: TradingView