- The inflow of institutional demand has possible been one of many main elements that defined why Bitcoin hovered across the earlier cycle ATHs.

- Buyers needn’t concern decrease timeframe volatility, as metrics assist a buy-and-hold technique.

Bitcoin [BTC] was in a downtrend on the weekly chart however an uptrend on the month-to-month chart. It has consolidated throughout the $50k-$70k area since March.

Whereas merchants and traders is perhaps annoyed with the dearth of motion, BTC remained extraordinarily bullish on the upper timeframes.

As a well-liked crypto analyst identified, Bitcoin has closed six month-to-month buying and selling classes above the March 2021 month-to-month session shut.

Even the halving occasion and quite a few FUD occasions throughout the market weren’t sufficient to push the king of crypto off its perch.

Unprecedented Bitcoin worth efficiency

Supply: BTC/USDT on TradingView

When it comes to pure share good points, earlier Bitcoin cycles had been stronger. But, this run has one thing that has not occurred earlier than. Throughout the 2024 BTC halving occasion in April, the value was above the $61k mark.

It has traded at or very near the earlier cycle’s ATH throughout and after the halving occasion. Throughout the 2020 cycle’s halving, BTC costs had been near 60% down from ATH, in comparison with roughly 10% this cycle.

Therefore, decrease timeframe volatility apart, Bitcoin remained extraordinarily bullish for long-term traders.

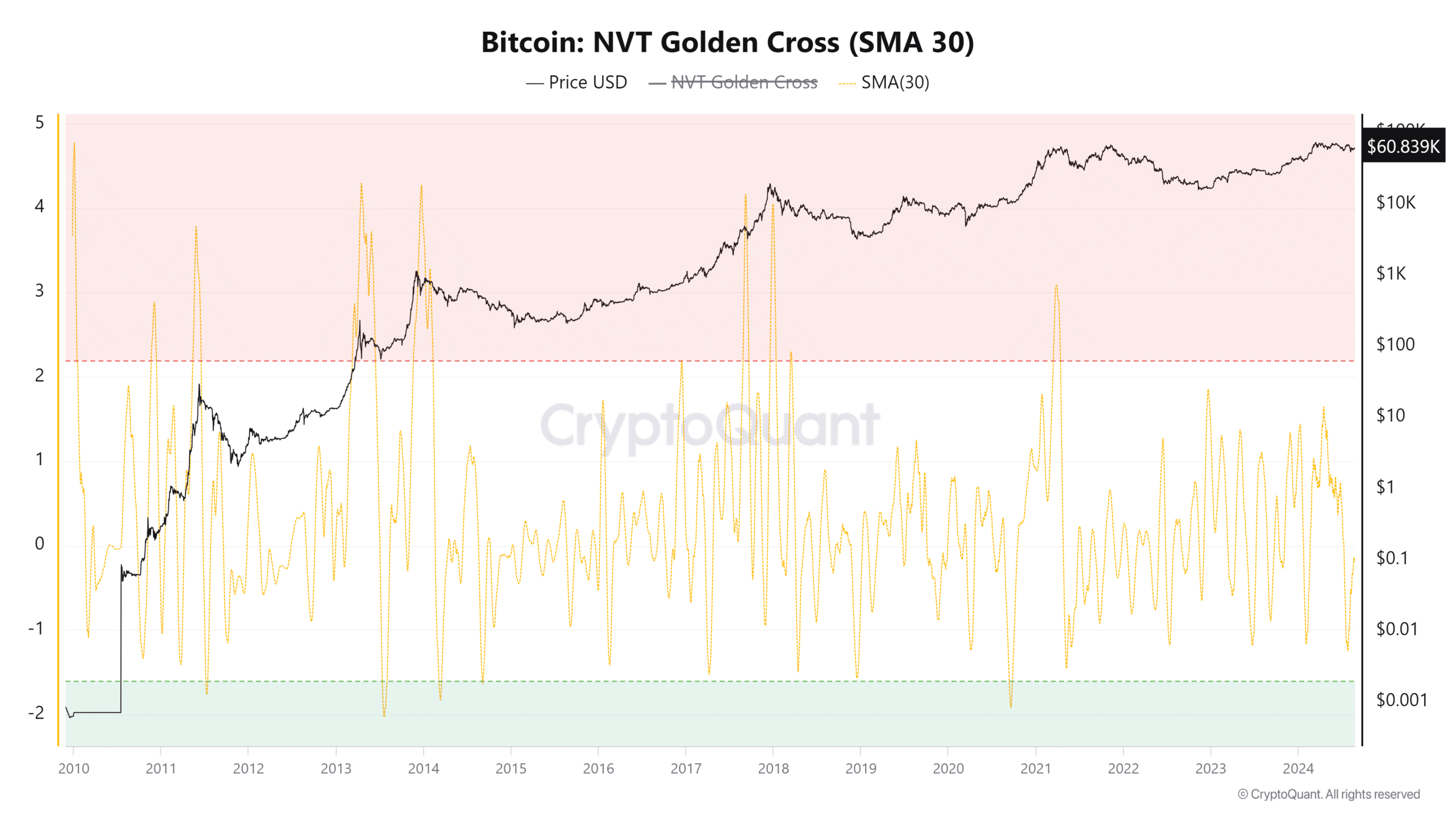

The NVT values inspired consumers

Supply: CryptoQuant

The 30-day easy shifting common of the NVT golden cross was at -0.14. Usually, values above 2.2 point out a cycle high, and beneath -1 a doable backside. Therefore, the Bitcoin bull run has a protracted approach to go.

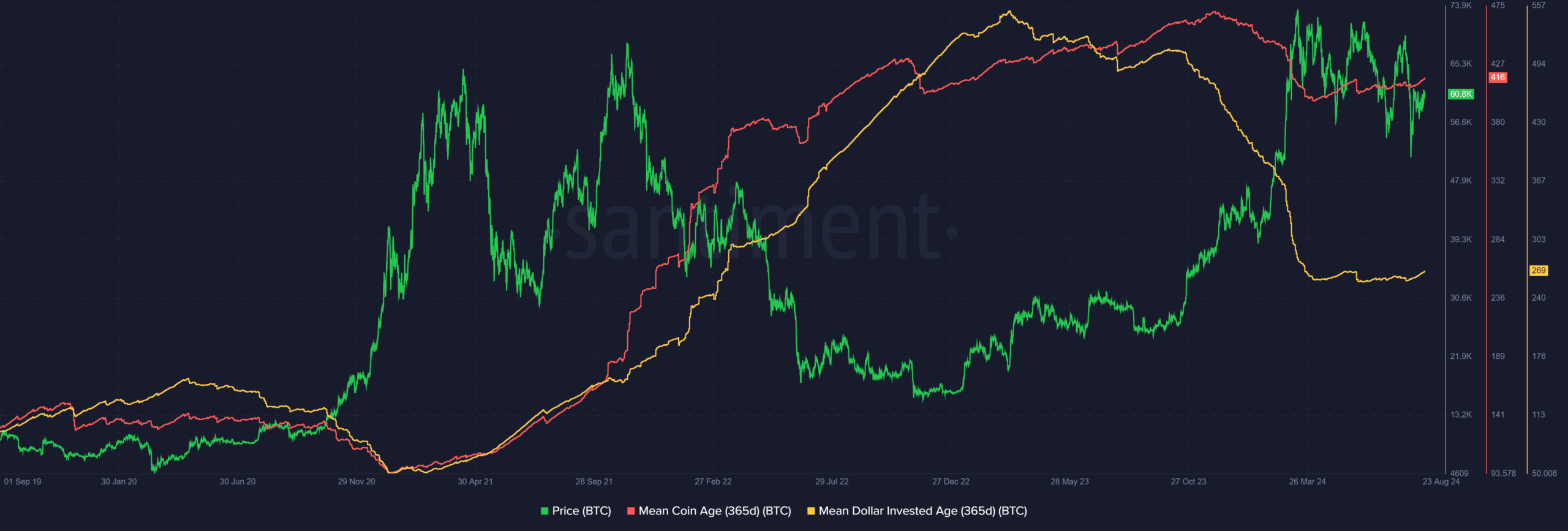

Supply: Santiment

The Imply Greenback Invested Age started to fall in November 2023, as costs elevated quickly. Over the previous few months, it has been comparatively flat.

A falling MDIA is an indication of investments flowing again into circulation and of newer investments.

The MDIA may proceed to fall a lot farther from 269 to the earlier cycle lows at 51 earlier than its continued uptrend would start to point community stagnancy.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

The imply coin age started to slowly pattern greater after the sharp drop in February and March, as the short worth good points led to profit-taking exercise and promoting stress.

A continuation of this uptrend would denote network-wide accumulation.