- BTC was experiencing a powerful downward momentum at press time, as BTC dropped by 2.45%.

- An analyst predicted a bearish reversal, based mostly on two momentum indicators.

Bitcoin [BTC], the biggest cryptocurrency, has skilled excessive volatility in 2024. The yr has seen BTC surge to a report excessive of $73794 in March. Since then, nevertheless, it failed to keep up its momentum, hitting a low of $49K.

As of this writing, BTC was buying and selling at $55774 after a 2.45% decline on every day charts. This drop continued a month-to-month lengthy of decline. Over the previous 30 days, it has dropped by 2%.

Due to this fact, the press time, market situations raised questions on whether or not Bitcoin was on the verge of additional decline.

Inasmuch, CryptoQuant analyst Yansei Dent prompt BTC was experiencing a bearish reversal, citing MVRV and Energetic Deal with.

Market sentiment

In an X (previously Twitter) publish, the analyst marked that making use of shifting averages on MVRV and energetic tackle revealed a demise cross. Such a sample was noticed through the bearish reversal of the 2021 cycle.

Supply: X

Primarily based on this evaluation, the 30DMA dropped beneath the 365DMA, indicating a slowdown in energetic addresses, which is a bearish sign for the close to time period. Lowered new and energetic addresses prompt much less on-chain exercise.

Additional, the evaluation confirmed that the 50DMA was trending downwards, though it was nonetheless beneath the 200DMA. Nonetheless, if 50DMA falls beneath 200DMA, it signaled a bearish development.

Due to this fact, each energetic tackle momentum (30DMA beneath 365DMA) and the attainable convergence of the 50 DMA and 200 DMA prompt the market is coming into a short-term bearish section.

What Bitcoin’s chart signifies

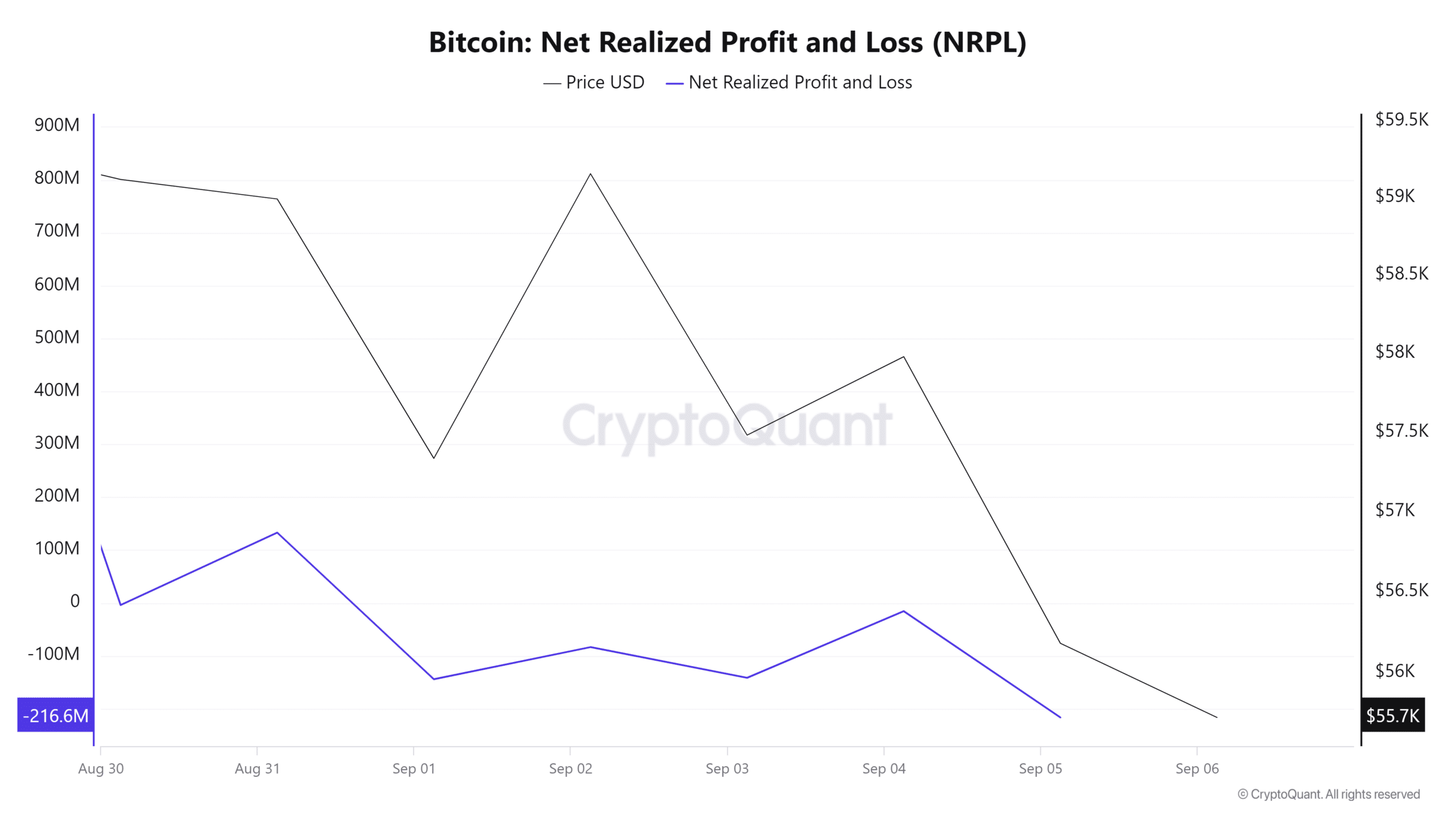

Supply: CryptoQuant

Including to the fray, Bitcoin’s Web realized revenue/loss has been unfavorable over the past seven days. Typically, a unfavorable NRPL confirmed that the market was experiencing a bearish section, as buyers bought at a loss.

When buyers lack confidence in crypto’s future worth actions, they have an inclination to promote to scale back their losses.

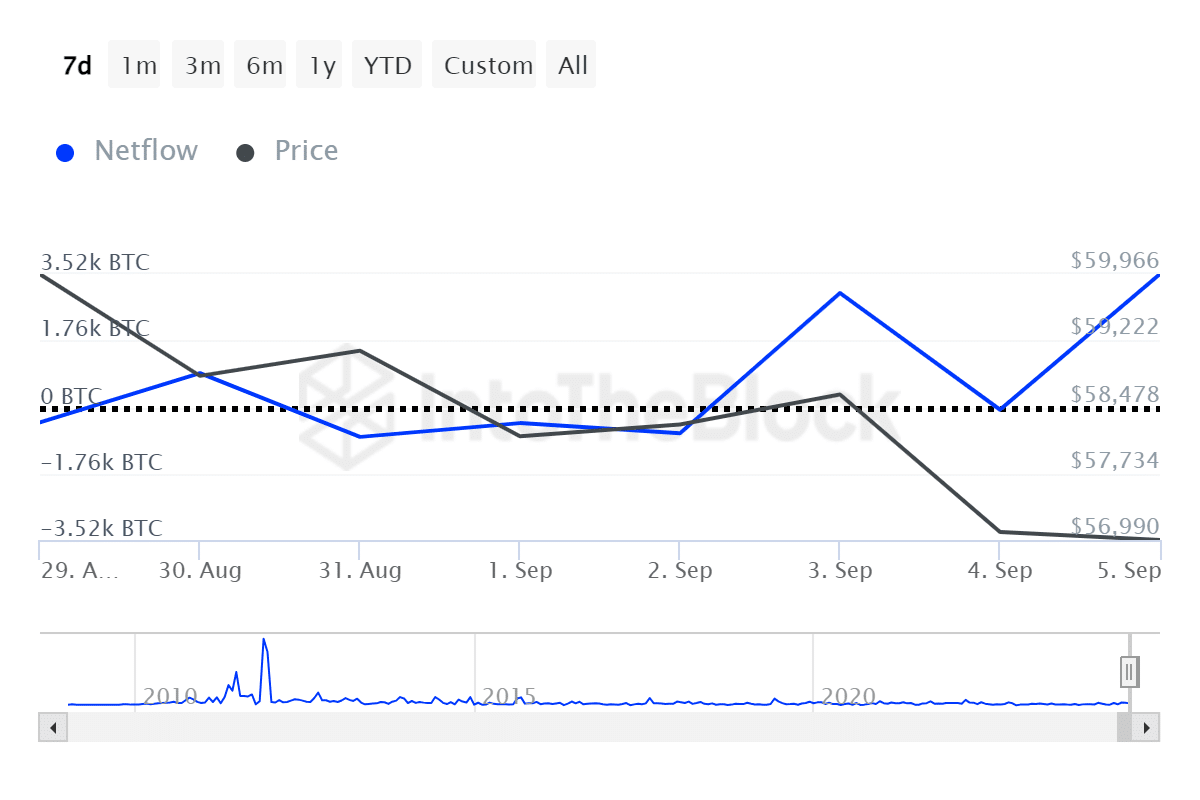

Supply: IntoTheBlock

Moreover, within the final seven days, 4 days noticed unfavorable giant holders influx. If giant holders flip to transferring their belongings to exchanges, it ends in promoting stress.

Such motion by whales might result in a worth decline, because it reveals a insecurity in future prospects. That is one other bearish sign, as giant holders are anticipating decrease costs or deciding to appreciate their present positive factors to keep away from extra losses.

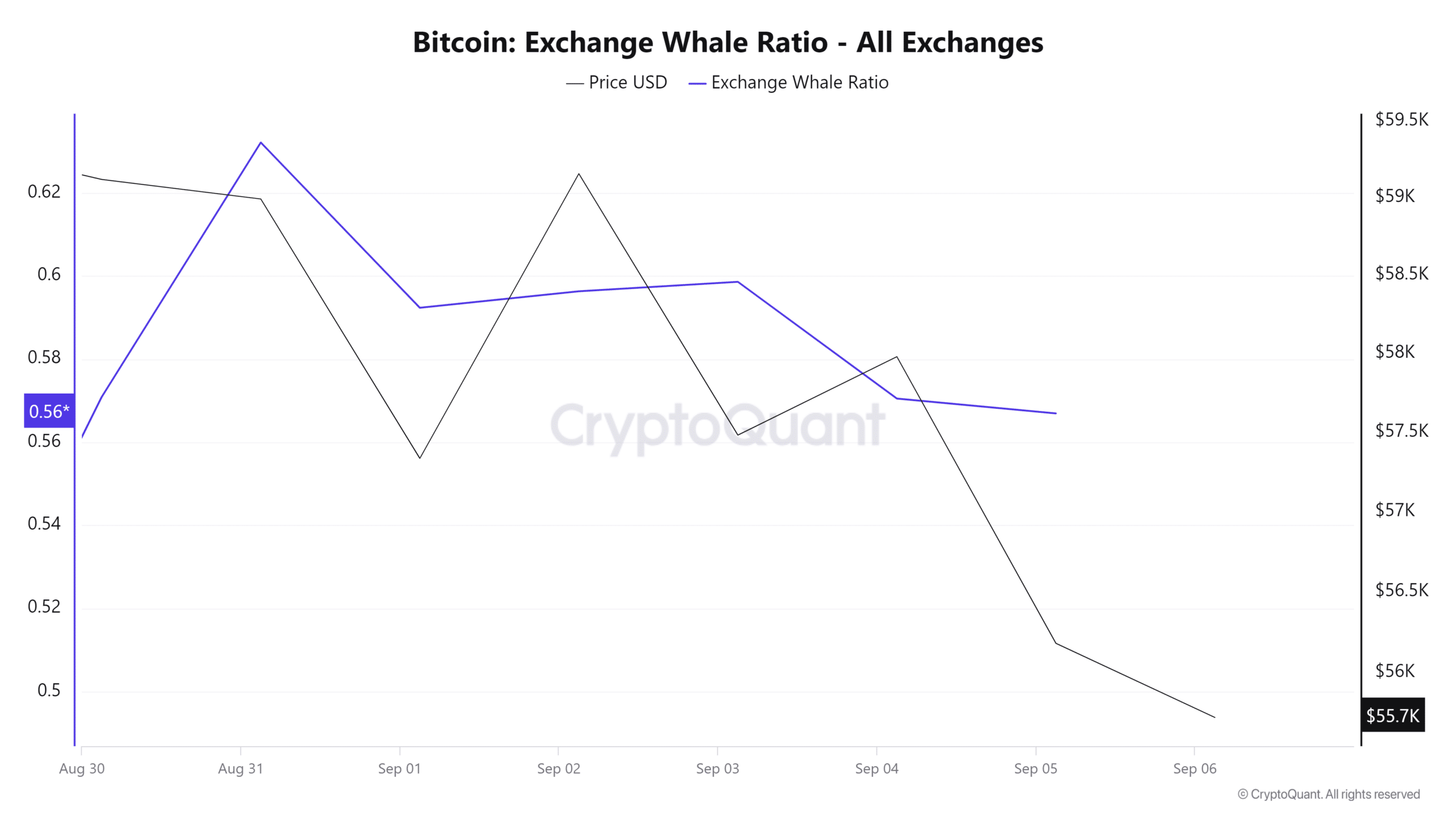

Supply: CryptoQuant

Lastly, BTC’s whale alternate ratio remained at 50% on common over the previous seven days. This confirmed that fifty% of inflows into exchanges are arising from whale exercise.

When whales transfer their belongings to exchanges, it reveals they’re getting ready to promote, which could lead to promoting stress.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Due to this fact, as Yonsei Dent posited, the present market situations confirmed potential additional decline.

Due to this fact, if the prevailing market sentiments persist, BTC will drop to $50670. For a development reversal, the bulls have to carry a $55k help area.