- Bitcoin has fallen 22.5% from its peak, with present minor features inadequate for restoration.

- Current futures market information suggests a bearish sentiment, doubtlessly setting the stage for future bullish tendencies.

Over the previous weeks, Bitcoin [BTC] has recorded a major plunge in its worth, dropping by 22.5% from its all-time excessive above $73,000 in March.

Though the asset has struggled to make a rebound this week following the ‘Red Monday’ it has not been sufficient. At the moment, BTC is up by 0.6% up to now 24 hours nevertheless, the asset continues to be down by 11% on the 7-day chart.

Futures market sentiment

ShayanBTC, an analyst from CryptoQuant, shared insights on the Quicktake platform highlighting the affect of perpetual markets and long-squeeze occasions on Bitcoin’s value.

In keeping with Shayan, the important thing driver behind Bitcoin’s current value drop could possibly be attributed to elevated promoting exercise inside these markets. This was additional evidenced by the sharp drop in funding charges, an important indicator of market sentiment.

Funding charges have just lately turned detrimental, signaling a bearish sentiment dominated by quick sellers. This shift means that the futures market is cooling down, doubtlessly setting the stage for a extra steady bullish development sooner or later.

Shayan significantly famous:

“The funding rates have now turned negative, reflecting an overall bearish sentiment and the dominance of short sellers. However, this could also be seen as a positive sign, as it suggests the futures market is no longer overheated. This scenario could create conditions for a more sustainable bullish trend in the coming months, provided there are no drastic changes.”

Bitcoin restoration on the horizon?

Regardless of the gloomy short-term outlook, there are indicators that counsel a possible path to restoration.

Knowledge from IntoTheBlock exhibits a rise in massive Bitcoin transactions (exceeding $100,000), which spiked from beneath 16,000 to over 23,000 transactions on fifth August, earlier than settling at round 16,560 at this time.

Supply: IntoTheBlock

This fluctuation in whale exercise might signify renewed curiosity from massive buyers, presumably hinting at a strategic accumulation of property at decrease costs.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

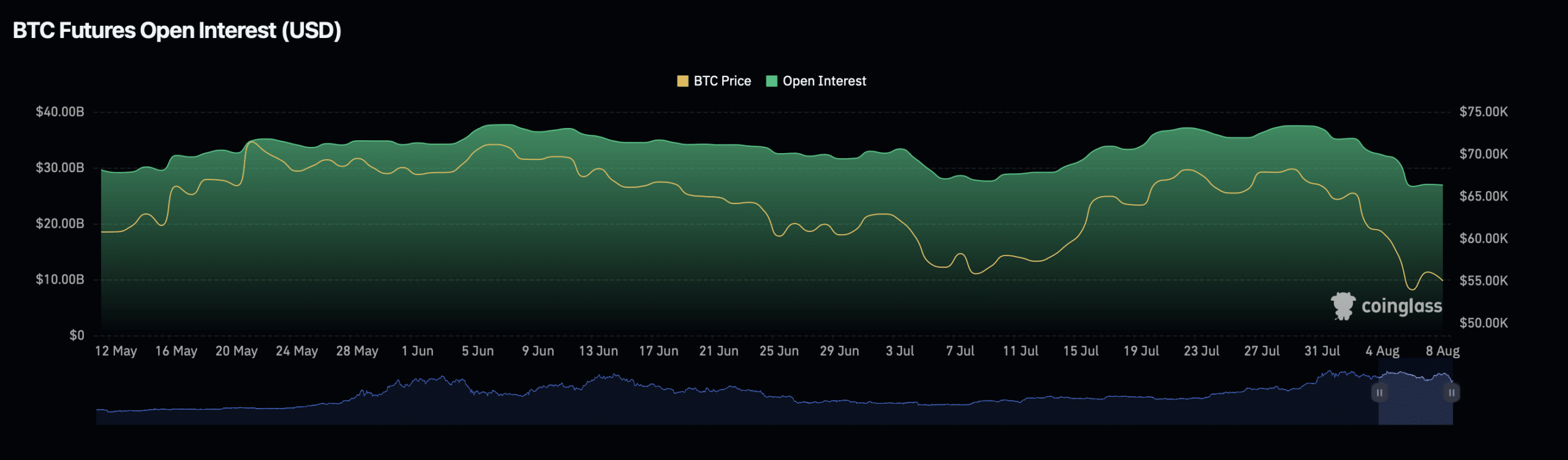

Moreover, Bitcoin’s open curiosity has seen a slight decline of 0.2% up to now day, totaling roughly $27.56 billion. This coincides with a 7% drop in open curiosity quantity, which now stands at $76.14 billion.

Supply: Coinglass

These shifts in open curiosity metrics might point out a cooling off of leveraged positions, presumably lowering the danger of additional lengthy squeezes and contributing to market stabilization.