- Bitcoin has a bullish construction after flipping $67k to assist.

- The shortage of quantity would possibly minimize quick an uptrend.

Bitcoin [BTC] has gained shut to three.6% from the lows of Friday the thirty first of Could. Again then, the king of crypto was buying and selling simply above the $67k assist stage and confirmed little bullish momentum.

This may need begun to vary. Nonetheless, the buying and selling quantity was unconvincing, and bulls wanted to do way more to power a convincing breakout. Is the market prepared for a rally, or will we see an prolonged consolidation?

Resolving the conflicting quantity indicators

Supply: BTC/USDT on TradingView

The late February rally noticed a retracement to $59k in mid-April. This stage was solely the 61.8% retracement stage and since then BTC has recovered effectively. The RSI on the each day chart climbed above impartial 50 to sign a shift in momentum.

Nonetheless, regardless of the value’s vary breakout, the OBV was resolutely inside a variety. It was on the lows from April, which was a regarding improvement.

It indicated that the current positive factors had been more likely to be worn out shortly as a result of lack of shopping for strain.

Conversely, the CMF jumped above +0.05 to focus on vital capital inflows. The quantity indicators opposed one another’s findings.

Total, whereas the bullish bias was stronger, the shortage of buying and selling quantity previously two weeks weakened Bitcoin worth prediction’s bullish arguments.

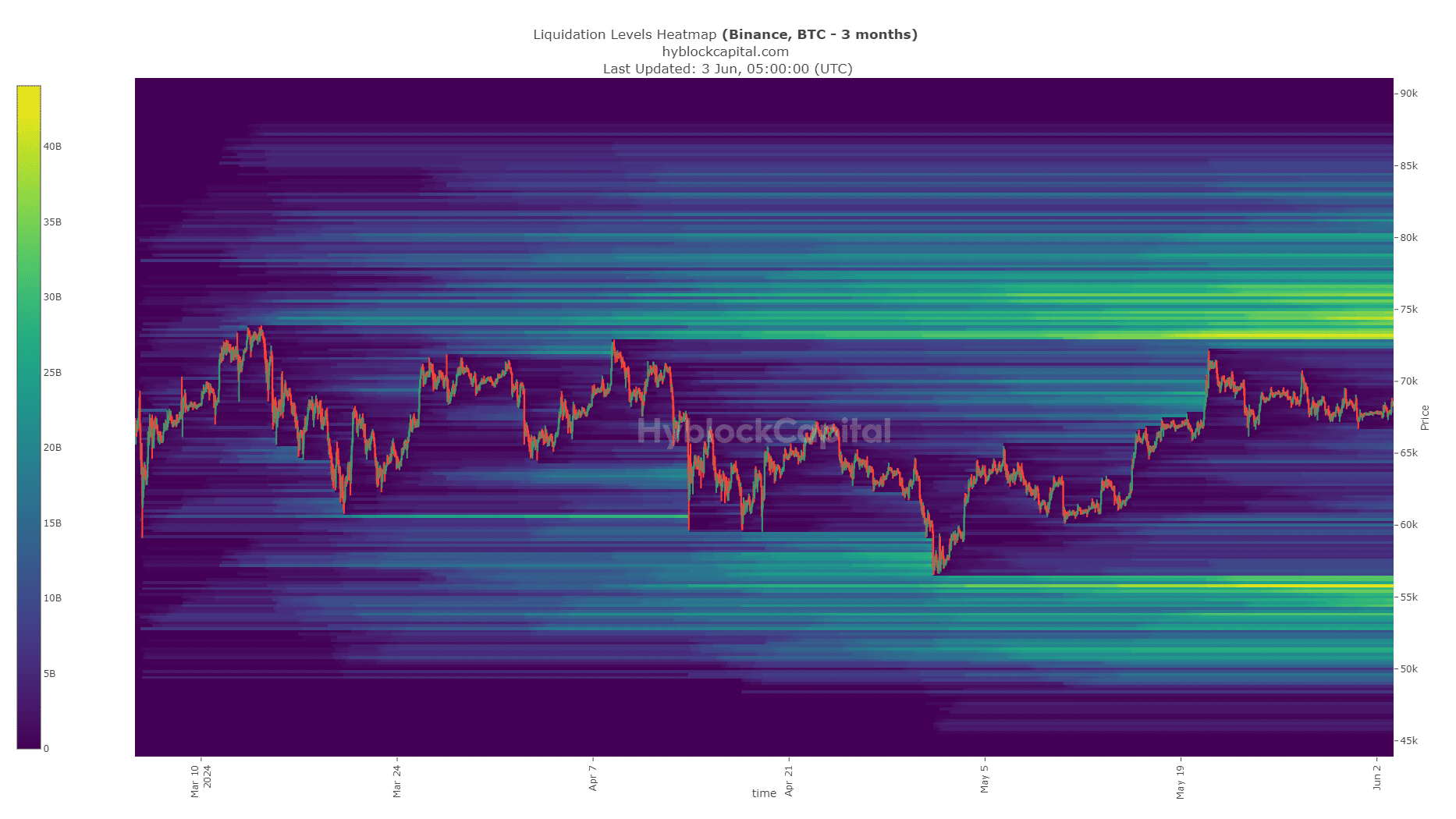

The liquidation cluster might pull BTC towards $75k

Supply: Hyblock

The big cluster of liquidation ranges at $73k-$75.2k is more likely to act as a robust magnetic zone for Bitcoin costs. To the south the $65.6k area was additionally a area of curiosity.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

The shortage of buying and selling quantity meant the Bitcoin worth prediction is consolidation across the $70k area for this week, and even longer.

Till the amount expands and costs can breach the $73.5k area, merchants and buyers can count on a variety formation to take maintain.

Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion.