- Shopping for strain on Bitcoin elevated during the last week.

- BTC efficiently examined a help and may quickly transfer in the direction of $68k.

Bitcoin [BTC] has as soon as once more entered the consolidation part as its value lingered round $67k. In the meantime, the big-pocketed gamers within the sport selected to money in revenue. Will this have a detrimental affect on BTC’s value within the coming days?

Bitcoin whales create buzz

Ali, a well-liked crypto analyst, not too long ago posted a tweet highlighting an fascinating growth. As per the tweet, Bitcoin whales not too long ago cashed in over $1.4 billion in earnings. This was evident from the large rise in BTC’s long-term holders whales’ realized revenue in USD.

Supply X

In reality, AMBCrypto additionally reported earlier the rise in BTC whale exercise. BTC whales’ have elevated as they broaden their holdings in the direction of the 4 million mark. With this, BTC whales reached the 2021 ranges.

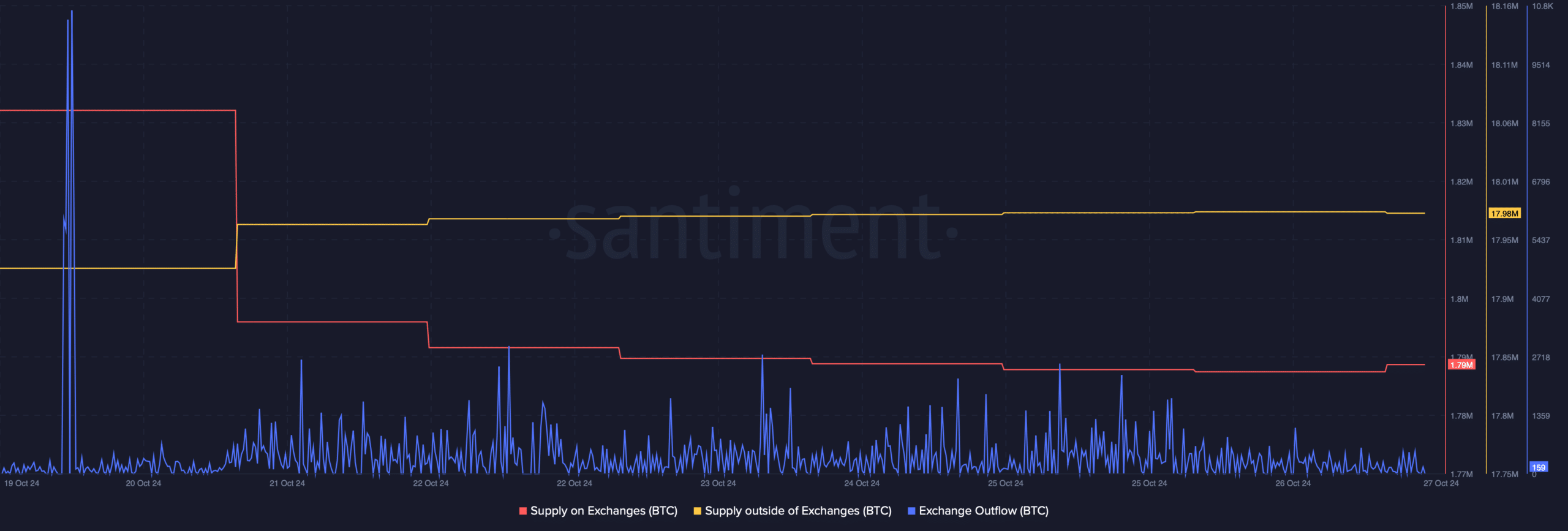

AMBCrypto then deliberate to test market sentiment to search out out whether or not the surge in whale exercise had any affect on shopping for conduct. As per our evaluation of Santiment’s information, BTC’s trade outflow spiked on the twentieth of October 2024.

Because of that, BTC’s provide on exchanges dropped whereas its provide exterior of exchanges elevated. All of those metrics indicated that purchasing strain on the king coin was excessive. A hike within the metric is taken into account a bullish sign as it’s usually adopted by value hikes.

Supply: Santiment

Will BTC lastly flip risky once more?

Whereas all this occurred, BTC’s value began to consolidate. The king coin’s value moved solely marginally during the last week. At press time, it was buying and selling simply above $67k.

To higher perceive whether or not the rise in shopping for strain will permit BTC to register positive aspects, AMBCrypto checked CryptoQuant’s information.

In keeping with our evaluation, BTC’s aSORP turned crimson. This indicated that extra buyers have not too long ago began promoting at a revenue. In the course of a bull market, it may point out a market prime.

One other bearish metric was the NULP. The metric revealed that buyers have been in a perception part the place they’re presently in a state of excessive unrealized earnings.

Supply: CryptoQuant

Aside from this, Bitcoin’s lengthy/brief ratio additionally witnessed a serious decline. A drop within the metric signifies that there are extra brief positions available in the market than lengthy positions.

Every time that occurs, it signifies that bearish sentiment round an asset is growing.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

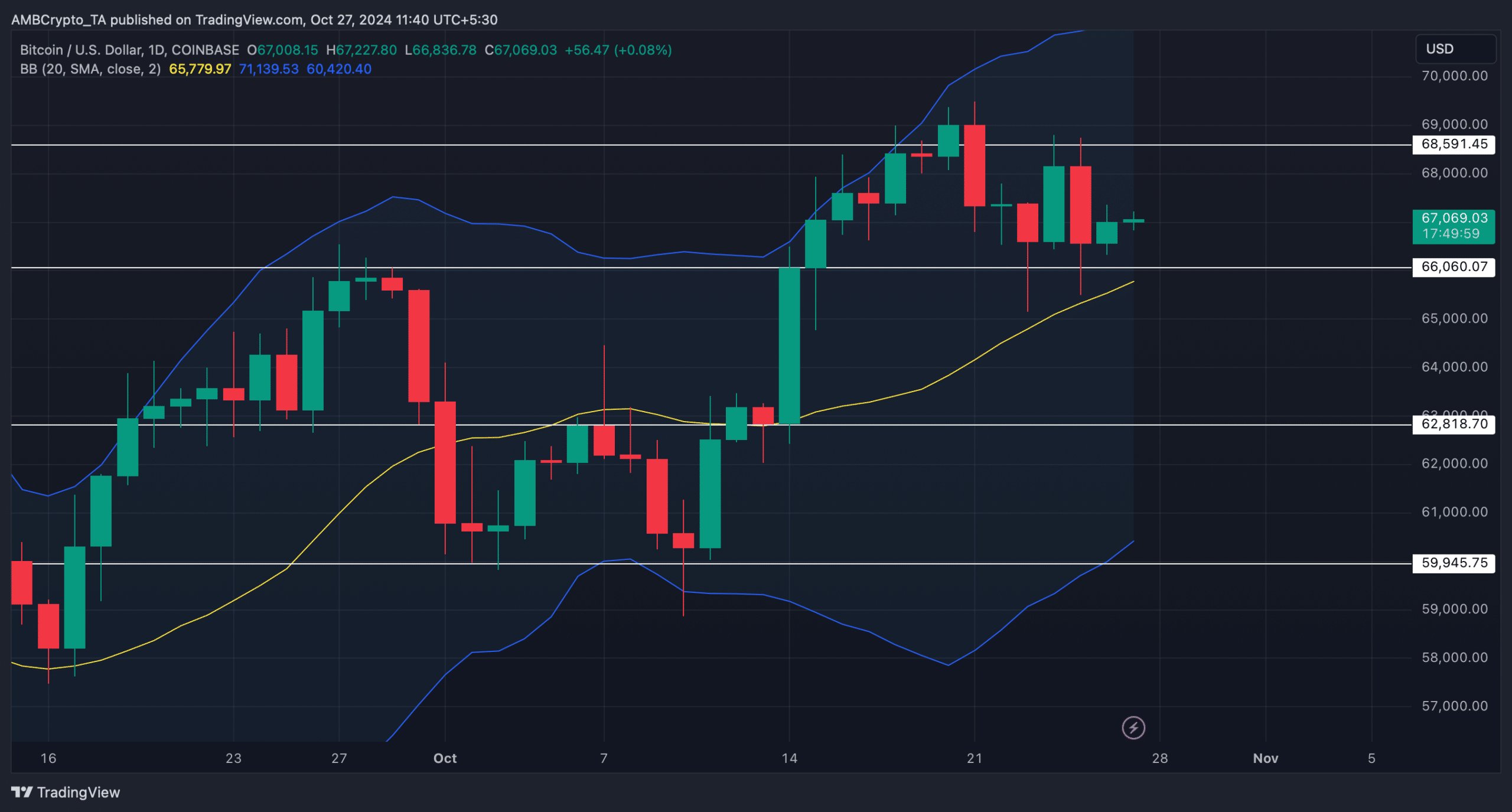

We then took a take a look at the king coin’s every day chart. The Bollinger Bands revealed that BTC has efficiently examined its help on the 20-day SMA.

Furthermore, the technical indicator additionally advised that BTC’s value was in a excessive volatility zone. These indicated that in case of an upward value transfer, BTC may quickly attain its resistance at $68.5k.

Supply: TradingView