- Addresses holding 10 to 100 BTC have begun accumulating extra of the coin.

- With rising volatility, Bitcoin would possibly hit $80,000 earlier than the tip of Q3.

Since Bitcoin [BTC] didn’t revisit the all-time excessive it reached in March, there was hypothesis that the bull run is over. Nevertheless, AMBCrypto discovered that to be unfaithful.

As an alternative, it appears Bitcoin is gearing up for the second leg. One factor widespread to a bull cycle is the lively participation of retail traders.

If we take again to the 2017 and 2021 cycles, Bitcoin didn’t hit the highest till there have been a number of small traders out there.

Small traders are displaying energy

However in March, the rise to $73,750 was fueled by institutional capital. Nevertheless, the billions of greenback that drove BTC at the moment has been dwindling for some months. Therefore, the value has been correction and consolidating.

Nevertheless, factor could also be near altering, in line with knowledge proven by the Whale and Realized Cap metric.

Supply: CryptoQuant

This capitalization mannequin appears to be like on the move of funds from smaller whales and retail traders. Lately, AMBCrypto reported that the large fishes out there have been capitalizing on the dip.

Now, it appeared that others have joined as seen by the rise within the stability of the ten to 100 BTC cohort. In previous cycles, a scenario like this acts as the primary stage of one other rally after Bitcoin may need skilled a 20% to 30% correction.

Crypto Dan, an on-chain analyst and creator on CryptoQuant shared an analogous view. In his evaluation, he defined that,

“Since 2024 is the time when the inflow of small whales and general investors began to rapidly increase, and the second half of the bull market has only begun, the possibility of additional capital inflow and a strong rise in Bitcoin can be seen as open in the near future.”

BTC could attain $80,000 quickly

Nonetheless, this doesn’t indicate that BTC wouldn’t hit a decrease worth earlier than one other rally begins. To additional validate this potential re-start of the rally, AMBCrypto examined the volatility round Bitcoin.

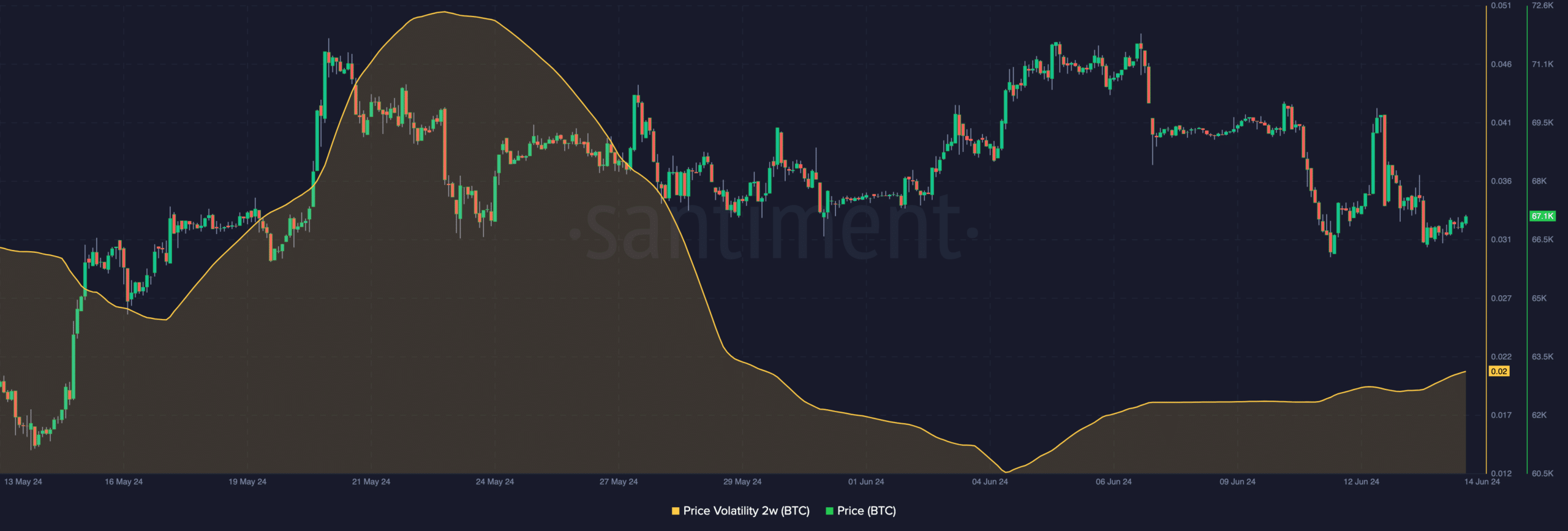

At press time, on-chain knowledge confirmed that the two-week volatility had risen to 0.02. Volatility reveals the potential for upward or downward motion. If the studying is low, it signifies that a cryptocurrency would possibly commerce inside a decent vary.

Alternatively, rising volatility indicate that costs could expertise notable swings. Nevertheless, this will depend on the shopping for or promoting stress out there.

Supply: Santiment

For Bitcoin, its value would possibly see a major upswing quickly. However that may depend upon the consistency retail traders have in accumulating the coin.

Learn Bitcoin’s [BTC] Value Prediction 2024-2025

Ought to shopping for stress improve, Bitcoin’s value would possibly leap towards $80,000 across the starting of the third quarter (Q3).

Nevertheless, this prediction could not see the sunshine of day if promoting stress continues until that second.