- There’s growing analysts’ consensus that BTC’s restoration might prolong to $70K.

- Nevertheless, the latest BTC bounce was preceded by over-leverage–a possible worth threat.

Based on Glassnode founders Jan Happel and Yann Allemann, Bitcoin [BTC] was in an ideal place to retest $70K. The duo, who go by Negentropic on X, warned that speculators eyeing to quick the crypto at $68K or $69K might be severely liquidated.

‘Shorts eyeing this long-term #Bitcoin compression range will be liquidated when the $68k to $69k level is surpassed…’

Supply: X/Negentropic

The marked compression channel was a part of the megaphone sample chalked as BTC continued consolidating following the brand new excessive hit in March.

Why BTC might rally to $70K

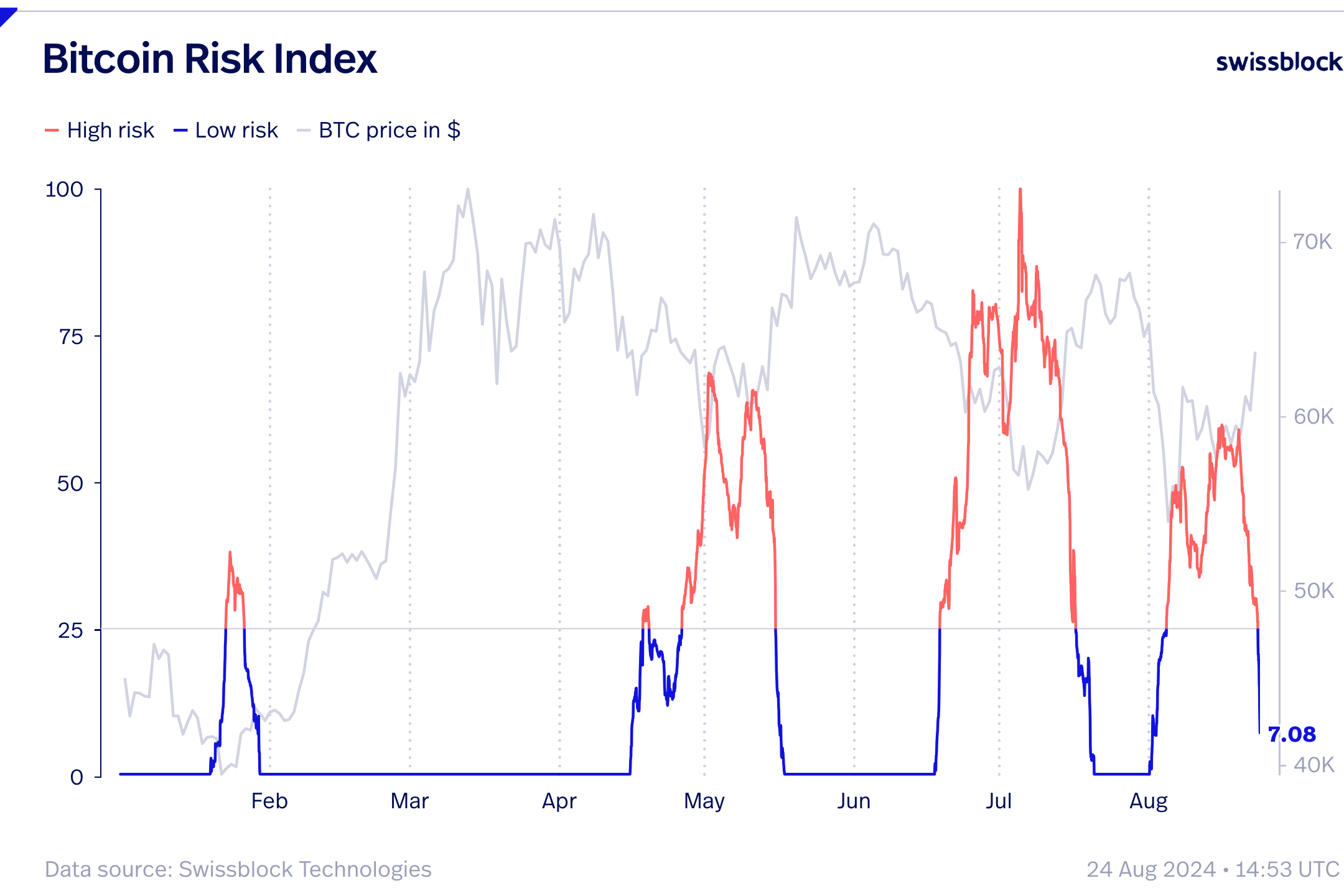

Based on Glassnode founders, by means of their crypto insights platform Swissblock, BTC might hit $70K due to present low-risk ranges and an uptick in community exercise.

The founders additionally famous that BTC’s rally to $64K flipped the asset’s threat profile from excessive to low.

Supply: Swissblock

Apparently, the Might, June, and July recoveries occurred after the asset flashed a low-risk profile. Therefore, the pattern may repeat and tip the crypto to $70K.

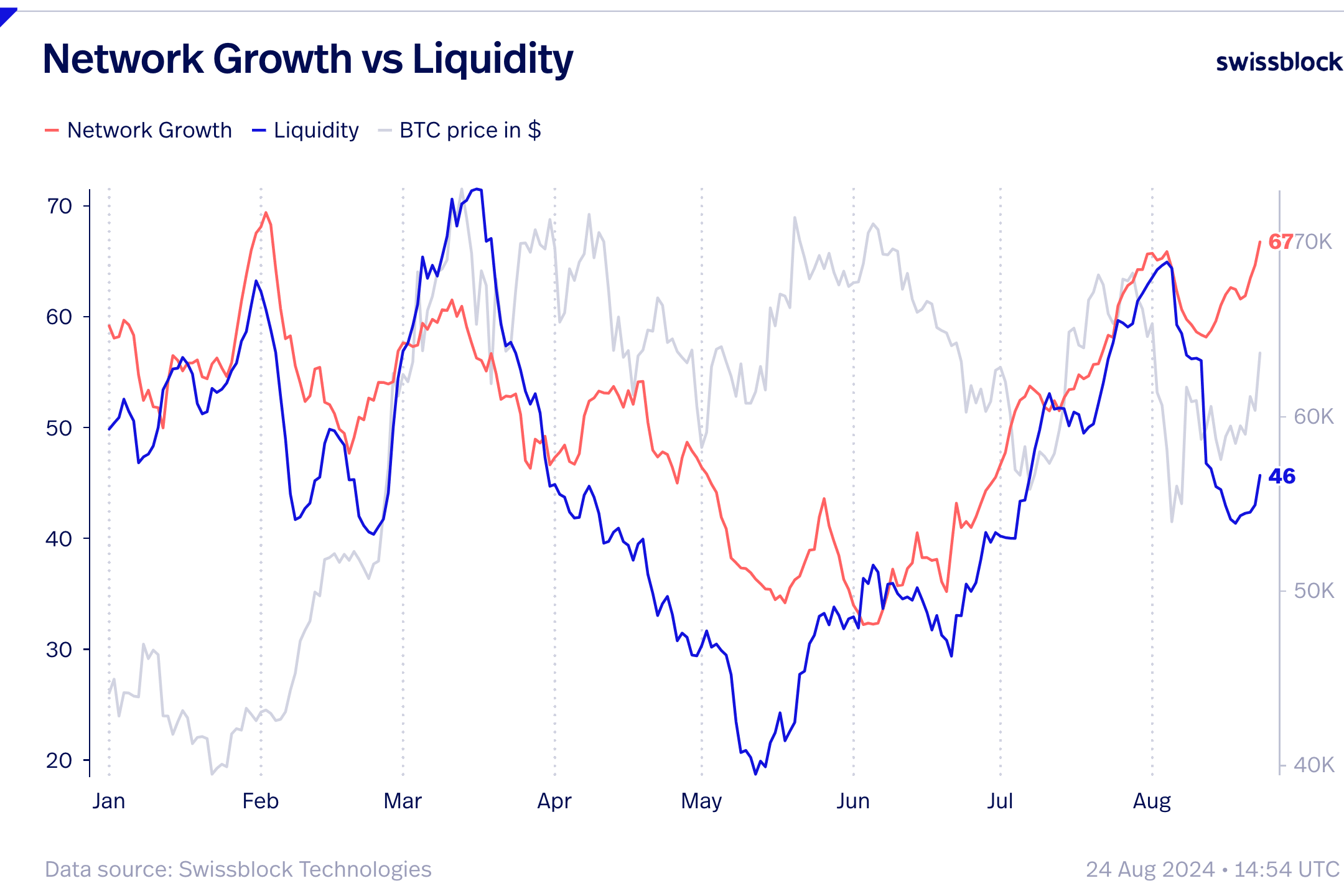

Moreover, Swissblock cited an improved Bitcoin community development that might affirm the sustainability of the uptrend.

‘The network growth is resuming its upward trajectory and even challenged the highs seen in July, where we not only witnessed notable growth but also the breaking of a downward movement that had occurred post-halving.’

Supply: Swissblock

Community liquidity lagged development, however the analytic platform highlighted indicators of sluggish enchancment that might increase BTC.

Moreover, the detrimental funding charges in BTC perpetual markets might speed up the restoration, per Swissblock.

‘The funding rates of perpetual futures have not only remained negative since our last reading but have also increased in magnitude: Highly unusual for times of bullishness. This positioning is such that it may fuel an even stronger rise in case of their liquidations.’

The low BTC funding charges have been linked to the dominance of US spot BTC ETFs, which have a higher worth influence than spinoff markets.

Moreover, Swissblock speculated that latest BTC staking within the Babylon staking platform might have led to the detrimental funding charges.

VanEck lately shared the identical restoration outlook, citing an analogous threat urge for food for BTC seen in earlier market recoveries.

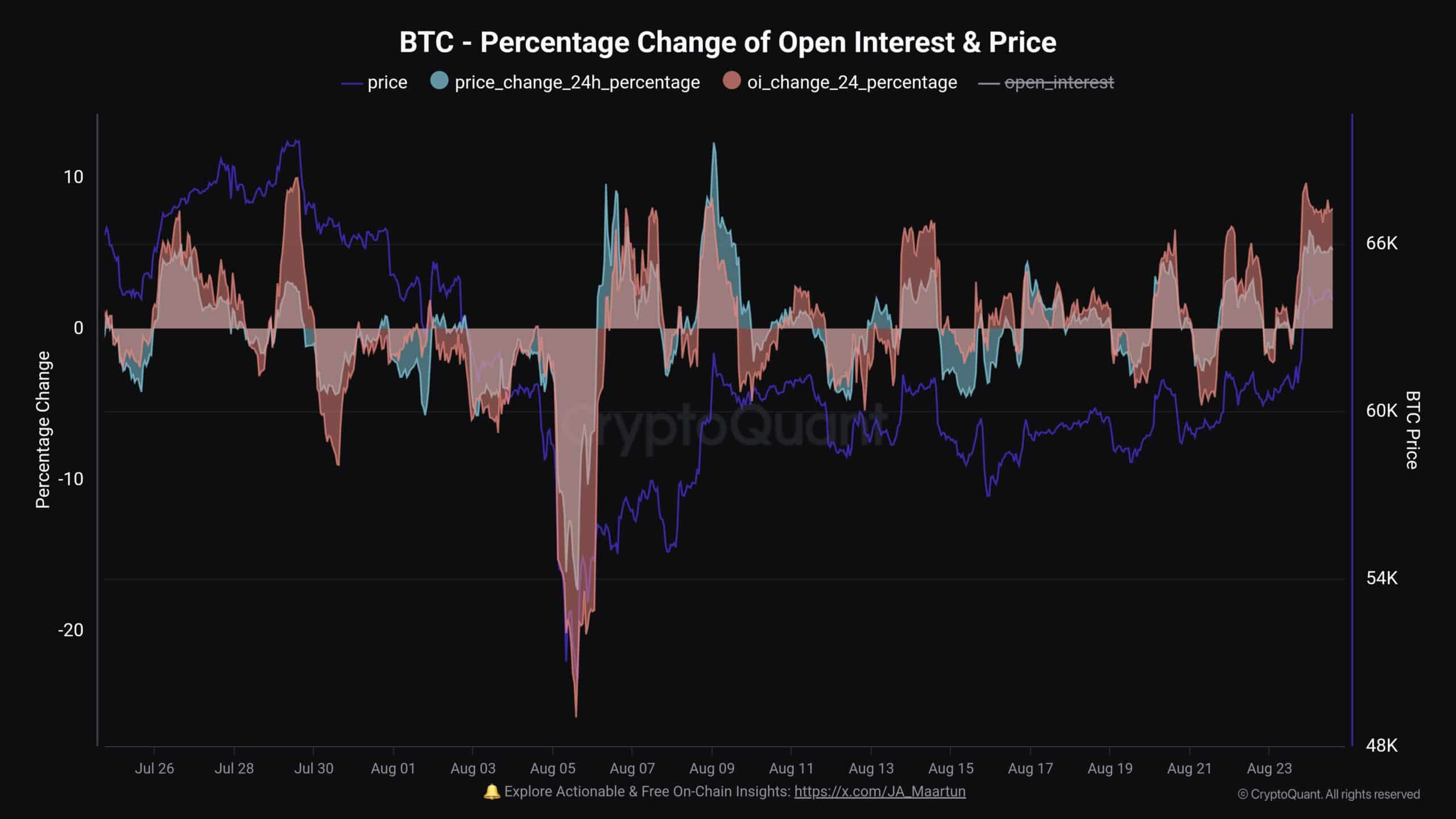

Nevertheless, a CryptoQuant analyst cautioned that over-leverage (Open Rates of interest) was driving BTC’s worth, which might set off a worth reversal as seen in previous tendencies.

‘Same setup again? Open Interest increased harder than the Bitcoin price. Last two time, it was a quick win.’

Supply: CryptoQuant