- Bitcoin’s social sentiment metrics present declining commentary round worth targets regardless of stability at $104,250.

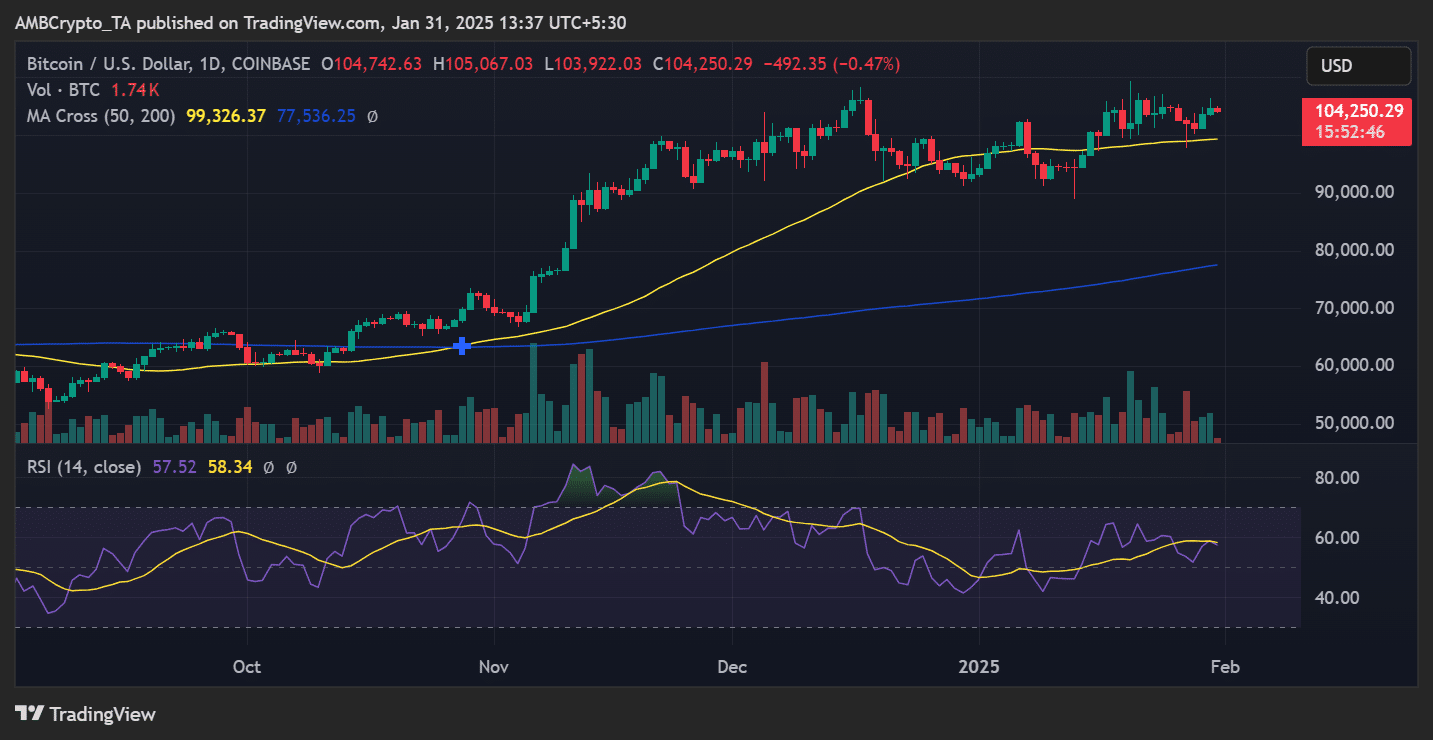

- Value maintains assist above key Transferring Averages at $99,326 and $77,536 regardless of sentiment fluctuations.

Bitcoin’s[BTC] current worth motion across the $104,000 stage has created an intriguing psychological battleground, with social sentiment metrics revealing advanced market dynamics.

Because the main cryptocurrency trades at $104,250.29, at press time, down by 0.47% within the final 24 hours, underlying sentiment indicators counsel a notable shift in investor habits.

Bitcoin’s social sentiment divergence

Essentially the most putting function in current market information is the declining commentary round each greed and worry indicators.

Bitcoin maintained its place above the essential Transferring Averages (MA) Cross ranges of 99,326.37 and 77,536.25. Based on Santiment information, Social Quantity mentions within the $90K-$95K and $110K-$115K ranges have decreased considerably.

This means a possible accumulation section as merchants undertake a wait-and-watch method.

A noteworthy sample emerged on the nineteenth of January, elevated social greed coincided with an instantaneous worth decline.

This inverse correlation between sentiment and worth motion has been constant all through the analyzed interval, with comparable cases recorded on the 4th of December and the sixteenth of December 2024.

MVRV ratio insights

The 30-day Market Worth to Realized Worth (MVRV) ratio has entered a vital zone, suggesting potential worth vulnerability.

The metric at present exhibits a declining development after reaching elevated ranges, traditionally a precursor to native worth tops.

When mixed with the present social sentiment, this technical indicator paints an image of cautious optimism amongst long-term holders.

Supply: Santiment

Bitcoin technical construction and quantity evaluation

The day by day chart reveals a robust underlying technical construction, with Bitcoin sustaining its place above each key Transferring Averages.

On the time of writing, Buying and selling Quantity stood at 1.74K BTC, exhibiting average exercise, whereas the RSI studying of 57.52 indicated balanced momentum, neither overbought nor oversold.

Supply: TradingView

Sentiment Cycles and worth motion

The social sentiment information evaluation reveals 5 distinct cycles since November 2024, the place excessive sentiment readings preceded important worth actions in the other way.

The present cycle exhibits declining social engagement regardless of worth stability, a phenomenon usually related to accumulation phases in earlier market cycles.

What does this imply for Bitcoin?

The convergence of declining social commentary, moderating MVRV ratio, and secure worth motion above key MA counsel Bitcoin’s broader uptrend may proceed.

Nonetheless, elevated volatility is probably going within the close to time period. Decreased social engagement, particularly in worth goal discussions, signifies a maturing market section. Institutional flows might now have higher affect than retail sentiment.

– Learn Bitcoin (BTC) Value Prediction 2025-26

Merchants ought to notice that whereas sentiment metrics present priceless insights, they need to be thought-about alongside conventional technical evaluation and basic elements.

The present market construction stays constructive above the 50-day MA at 99,326.37. Nonetheless, the declining social engagement suggests potential range-bound motion for Bitcoin earlier than the subsequent important directional transfer.