- International m2 cash provide has turned constructive.

- Historic patterns point out BTC may be set to surge on the charts now

Bitcoin [BTC], the world’s main cryptocurrency, continues to flash uncertainty amongst merchants, whales, and establishments. Particularly because the market waits for higher situations within the last quarter of the yr.

Traditionally, Bitcoin has surged each time the worldwide M2 cash provide has elevated. Now, with the worldwide M2 turning constructive, merchants are anticipating a possible bull run. One just like these seen in late October 2023 and early January 2024, following which BTC hit new all-time highs.

On the time of writing, BTC/USDT appeared to be correcting in a bullish flag sample. One other BTC surge may very well be on the horizon, with the anticipated Federal Reserve price lower being key.

Supply: Seth Fin/X

A 25 foundation level lower appears possible. Nonetheless, in monetary markets, massive strikes must settle earlier than turning into obvious.

Bitcoin buying and selling again at mid vary

At press time, BTC was buying and selling close to the center of its worth vary inside a descending development channel.

A breakout to the upside may result in a push in the direction of the highest of the channel and a possible breakout. The decrease boundary sat at $51k, whereas the higher resistance was at $66k.

Now, though BTC appeared to be consolidating, its energy stays evident. Particularly since bears have been unable to interrupt the decrease trendline.

Supply: TradingView

If Bitcoin breaks the higher trendline and stays above it, BTC’s worth may see a big rally, doubtlessly pushing it new highs. This may be supported by the worldwide M2 versus Bitcoin worth chart.

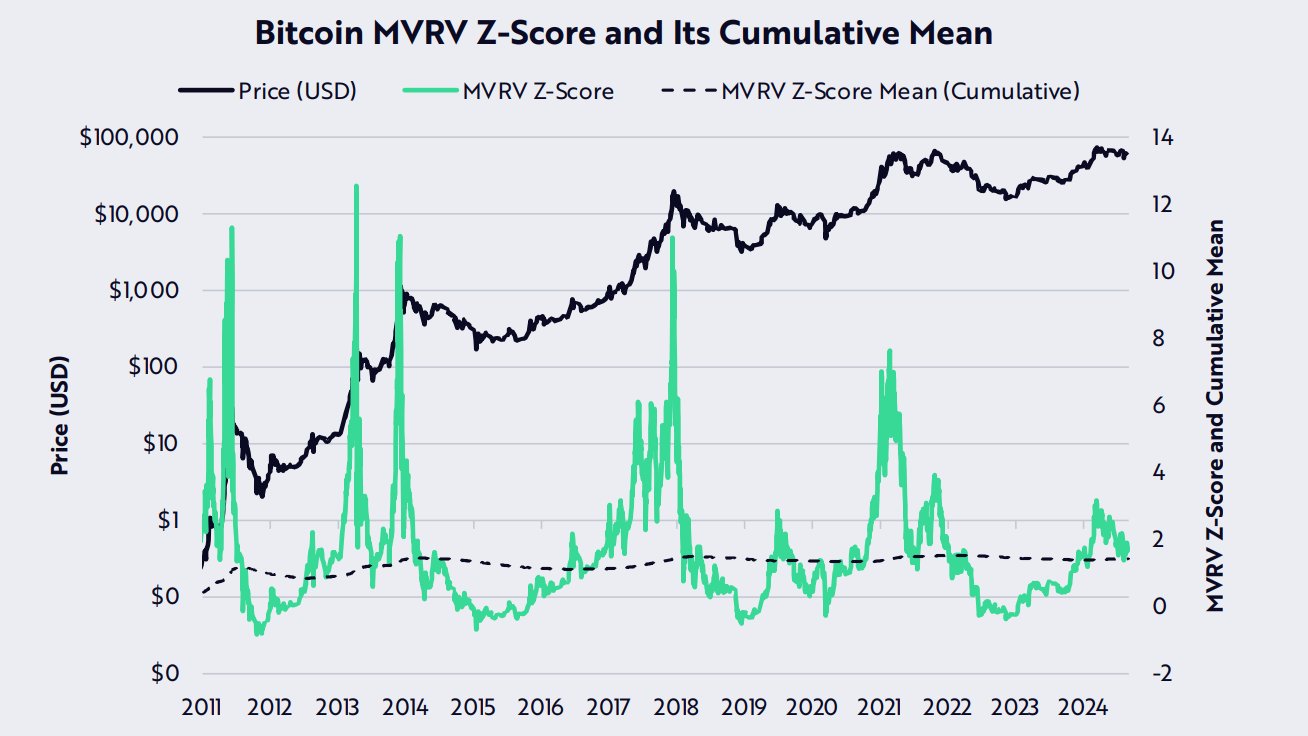

MVRV z-score highlights low unrealized earnings

The MVRV z-score, a key indicator of market sentiment, had a studying of round 1.9 at press time. This instructed that BTC has been regularly declining whereas the community’s common on-chain price foundation has risen.

By extension, this implies there are low unrealized earnings out there, leaving extra room for upward motion.

Traditionally, each time the MVRV z-score has been at these ranges, Bitcoin has famous important uptrends. The case research of 2012, 2020, and 2023 are good examples.

Supply: X

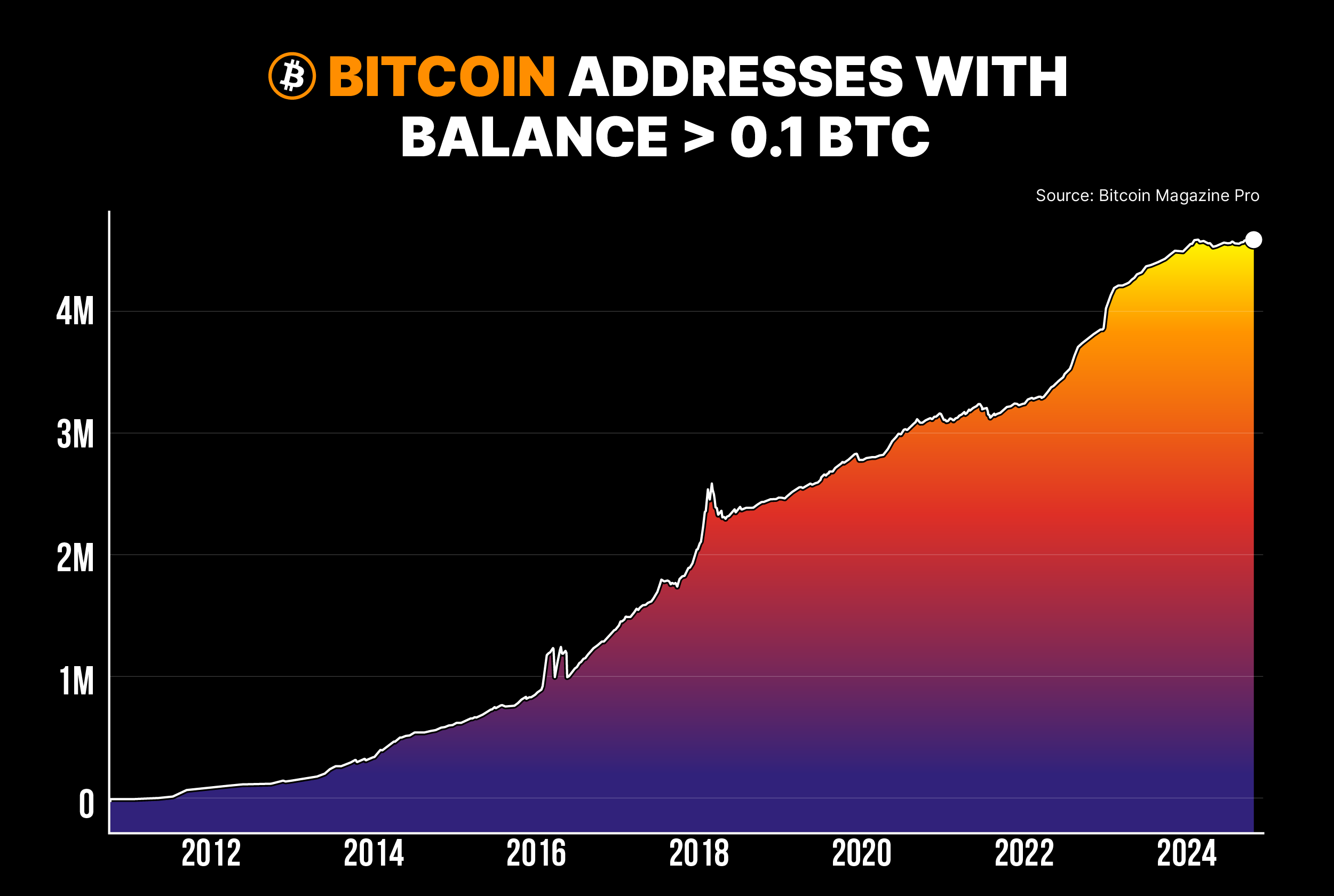

Addresses with greater than 0.1 Bitcoin close to ATH

Moreover, the variety of Bitcoin addresses holding at the least 0.1 BTC is nearing a brand new all-time excessive.

Which means that long-term holders, sometimes called “strong hands,” are accumulating Bitcoin, supporting the case for increased BTC costs.

As extra sturdy arms purchase BTC, it strengthens the market. This will increase the chance of an upward development on the charts.

Supply; Bitcoin Journal PRO

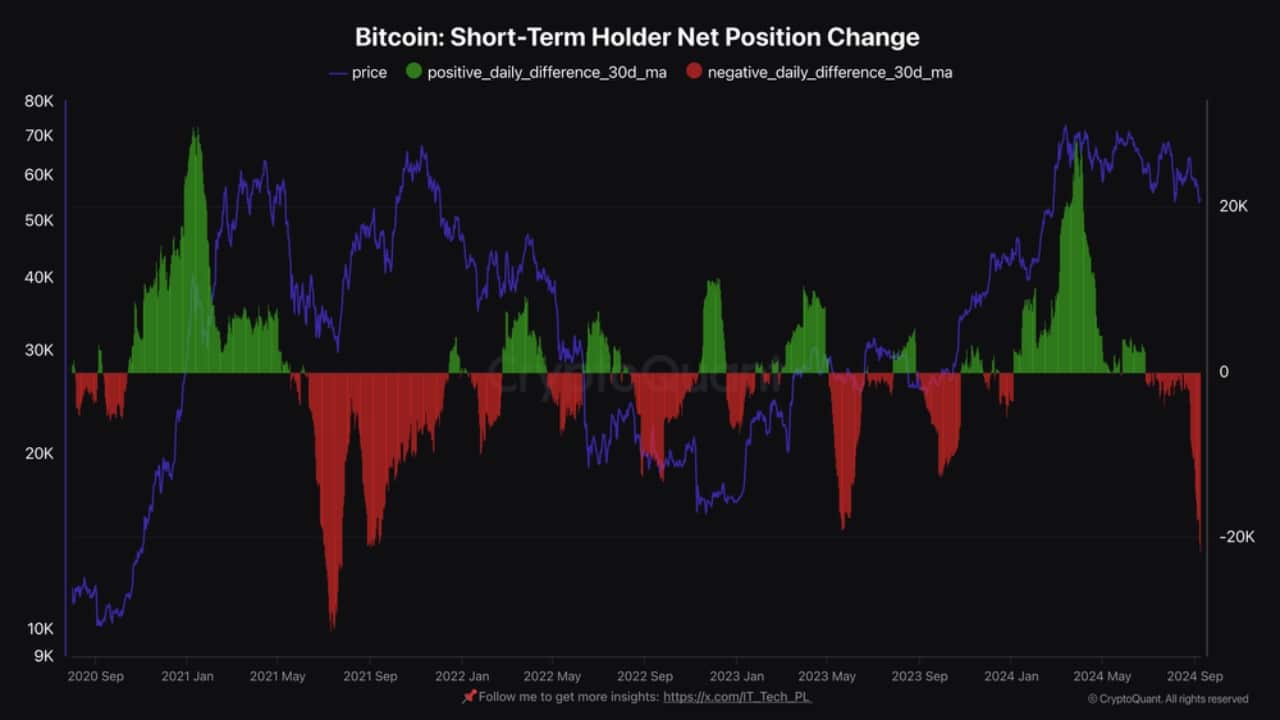

Bitcoin’s short-term holder web place change

Lastly, Bitcoin’s short-term holder web place change revealed that many latest consumers, who entered over the last “fear of missing out” (FOMO) spike, are actually leaving.

That is typically an indication of market capitulation, signaling a possible backside. When short-term holders capitulate, it typically precedes a BTC worth surge.

Supply: CryptoQuant

In conclusion, Bitcoin’s worth is poised for potential progress. With sturdy on-chain metrics and historic tendencies favoring an uptrend, BTC may see a big rally if world market situations enhance and the Federal Reserve implements a price lower.