- Bitcoin whale exercise noticed an uptick, which often doesn’t happen throughout this a part of the cycle.

- The realized value gradient oscillator confirmed bulls want to take care of their momentum.

Bitcoin [BTC] was gaining bullish momentum as costs approached the all-time excessive. It noticed a 4% pullback up to now two days that retested the $69k help zone. The technical indicators remained bullish.

Accumulation continued apace, whereas costs stagnated in April and the primary half of Might.

In a latest AMBCrypto report, the info highlighted that Bitcoin could be readying to embark on a 300-day bull run. The proof at hand additional strengthened the bullish bias.

This momentum indicator reveals bulls have to take care of the strain or threat a hunch

Supply: AxelAdlerJr on X

Crypto analyst Axel Adler posted on X (previously Twitter) a chunk of on-chain evaluation that highlighted the present momentum of Bitcoin and the values the gradient reached up to now 18 months.

The worth gradient oscillator above measures how rapidly the market cap grows in comparison with the realized cap.

In the course of the 2021 rally, as BTC neared its eventual prime, the oscillator fashioned decrease highs which indicated a fading bull development.

In 2024, the oscillator has fashioned a decrease excessive at 2.96. Therefore, a transfer previous 3 can be fascinating for bulls to keep away from repeating the 2021 sample, which might sign fading bullishness.

On the time of writing, the oscillator studying was at 1.38.

“It’s only a matter of time” for Bitcoin to hit all-time highs

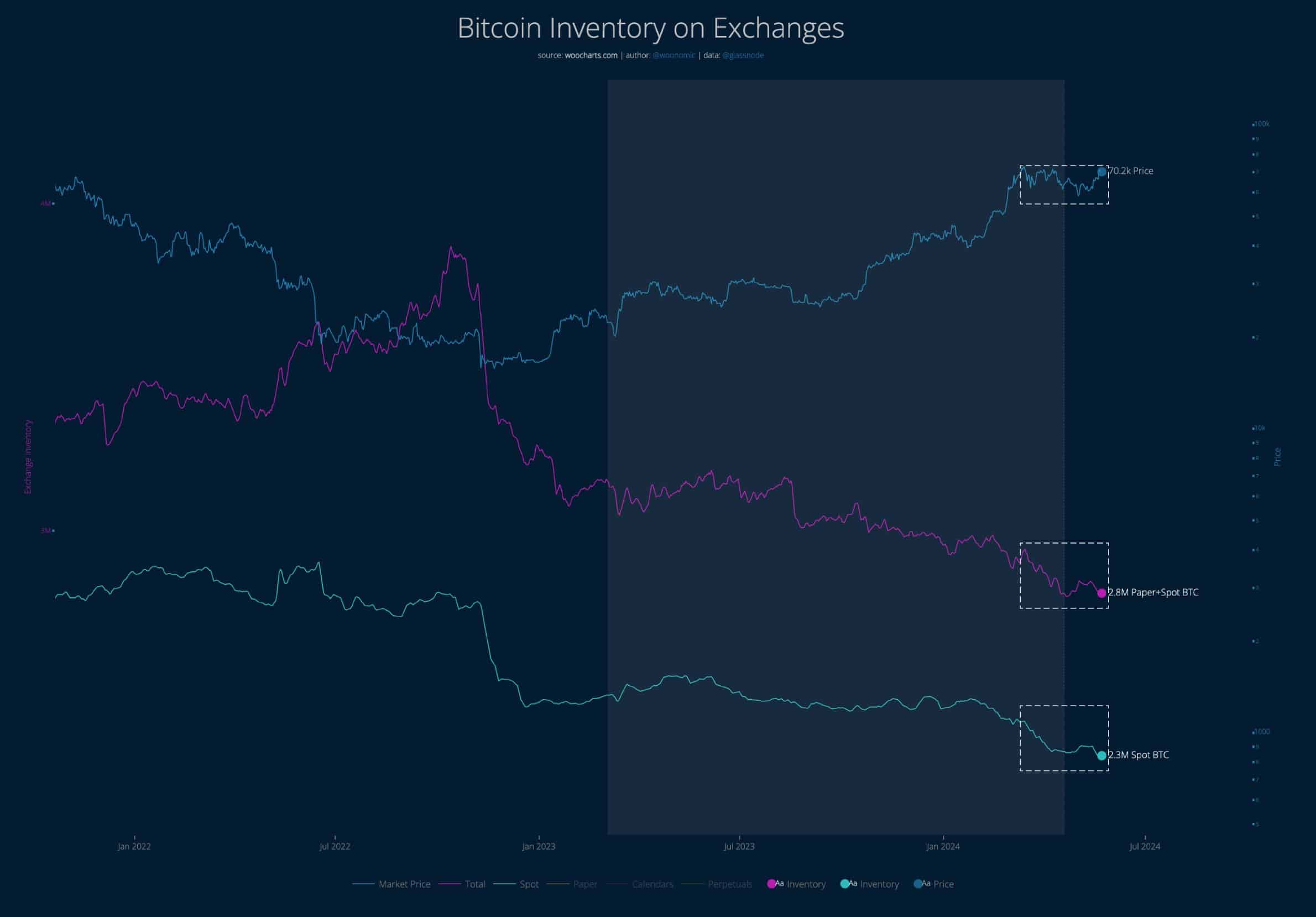

Supply: Woonomic on X

Analyst Willy Woo famous that the accessible Bitcoin was being scooped up in the course of the previous two months when the value lacked a real greater timeframe development.

This led to panic amongst retail holders, however the spot BTC demand was sizeable.

The analyst believed that it’s solely a matter of time earlier than the costs climb previous their all-time excessive towards the US Greenback.

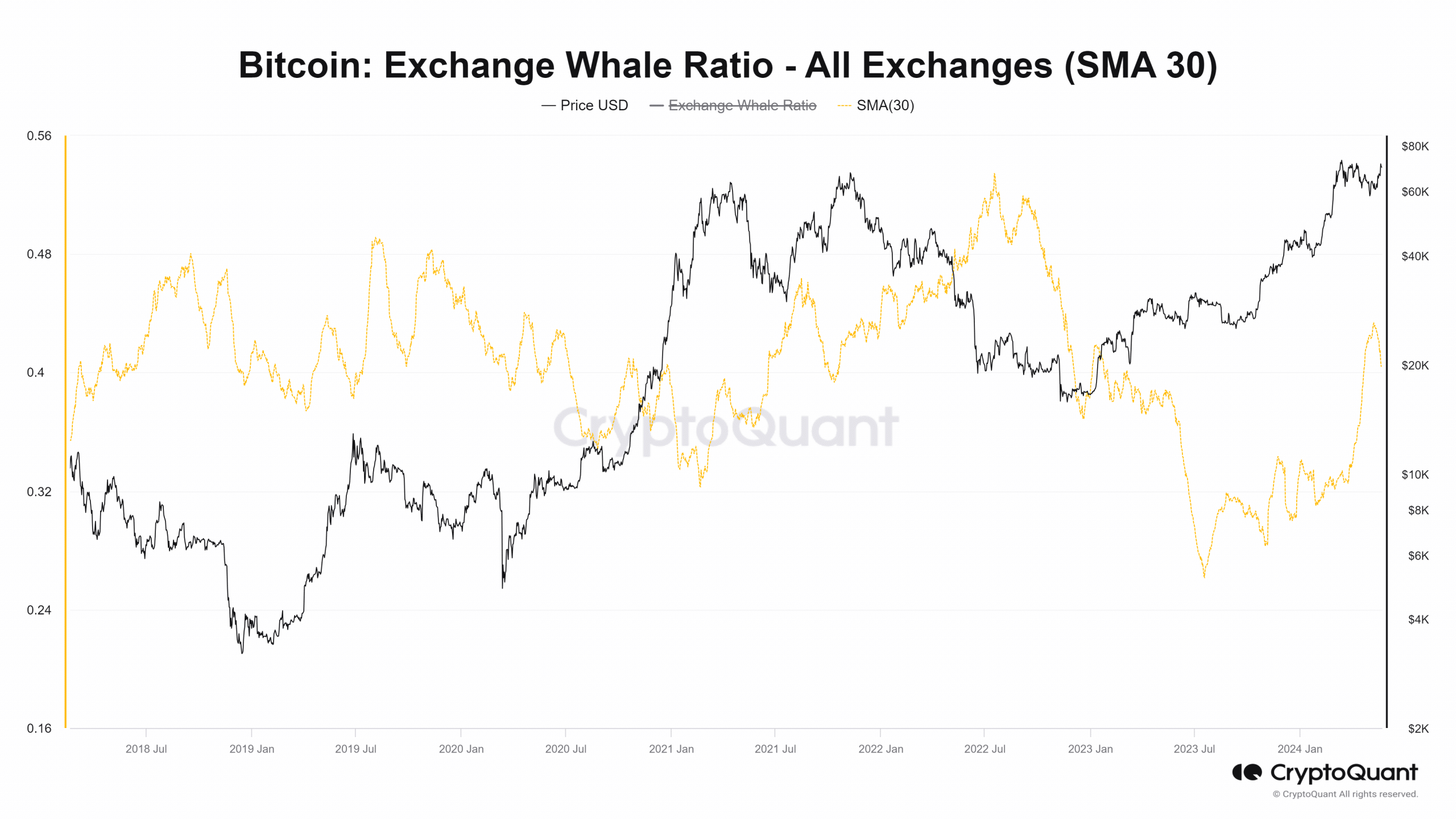

Supply: CryptoQuant

The trade whale ratio noticed a rising development in April and Might. This indicated elevated whale exercise, which is irregular throughout a bull run. Often, in the course of the bullish long-term development, whale exercise quietens down.

It picked up as soon as the highest was in and costs began sliding decrease.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

The outflow from exchanges that Willy Woo highlighted earlier was a superb argument towards the highest being in, however the rising whale exercise may give buyers pause.

Nonetheless, the trade whale ratio shouldn’t be definitive, and the proof at hand reveals this bull run has additional to go.