- Whales have elevated to a 3-year excessive, holding almost 4 million BTC.

- Retail holding has seen a gradual tempo of development, however will the pattern set off a brand new ATH?

Bitcoin [BTC] whales, entities with over 1K cash, have elevated in 2024, hitting ranges final seen in early 2021, simply earlier than the asset exploded to a final cycle excessive of $69K.

In response to Glassnode knowledge, the whale entities have been over 1660 as of the twenty third of October.

Reacting to the hike in massive BTC buyers, Andre Dragosch, Bitwise’s head of analysis, puzzled whether or not it may sign a possible new all-time excessive (ATH).

“Total number of #Bitcoin whales just reached the highest level since Jan 2021! New ATHs incoming?”

Supply: Glassnode

For context, in 2020, whales elevated from 1650 to over 1760. Afterward, BTC pumped to a brand new ATH the next yr. Whether or not the identical pattern will play out in 2024 stays to be seen.

Whales eyes 4 million BTC

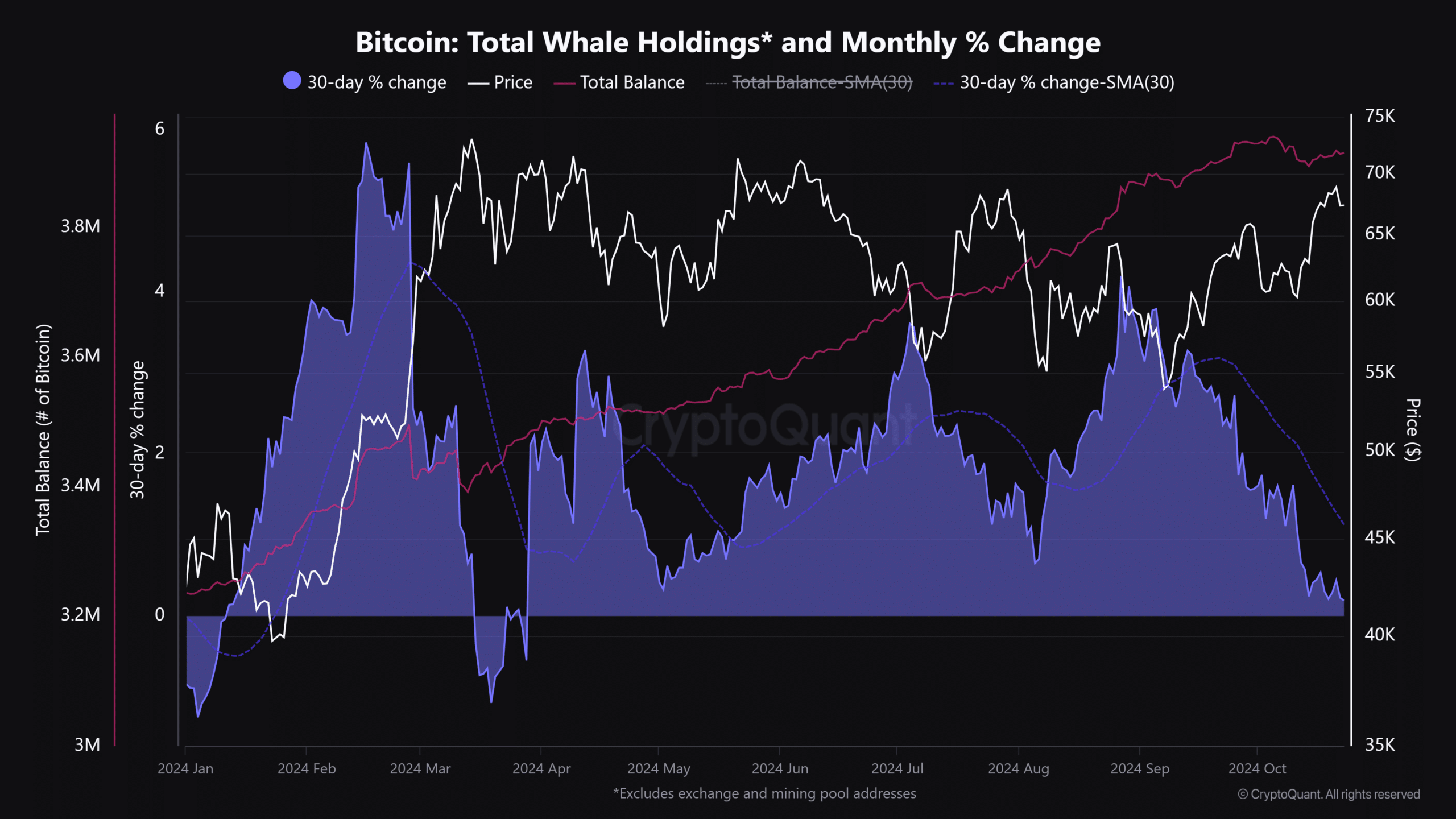

Supply: CryptoQuant

In response to CryptoQuant, whales’ whole holdings stood at 3.9 million BTC as of press time.

That’s a whopping $261 billion, almost 20% of BTC’s market measurement. Since mid-2023, the whale entities have added about 670K BTC.

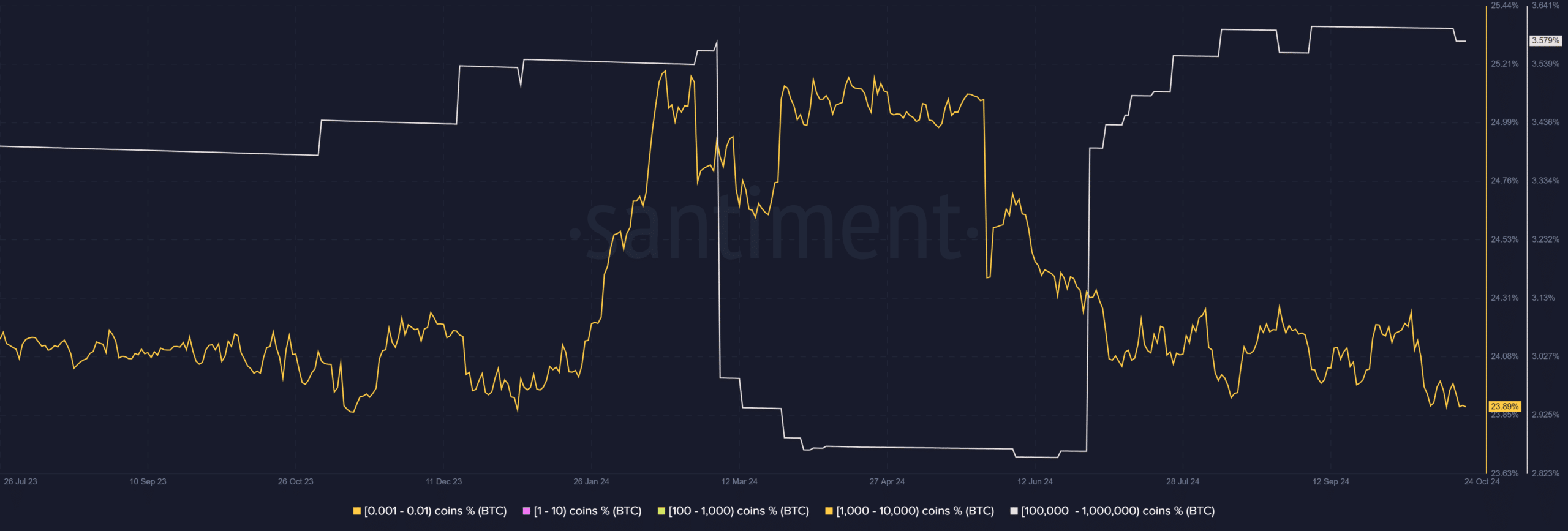

Nonetheless, not all whale cohorts have been closely accumulating. In response to Santiment knowledge, these holding 100K — 1 million BTC fronted aggressive accumulation in 2024. Nonetheless, these with 1K -10K BTC have lowered their publicity.

Supply: Santiment

However general, whales have added extra BTC than their retail counterparts, famous CryptoQuant analysts. They said,

“Since the start of 2024, the holdings of other larger investors (1-10K BTC holders) have grown faster than the holdings of retail investors on a yearly basis. As of today, retail holdings have grown by 30K Bitcoin, compared to 173K Bitcoin of other larger investors.”

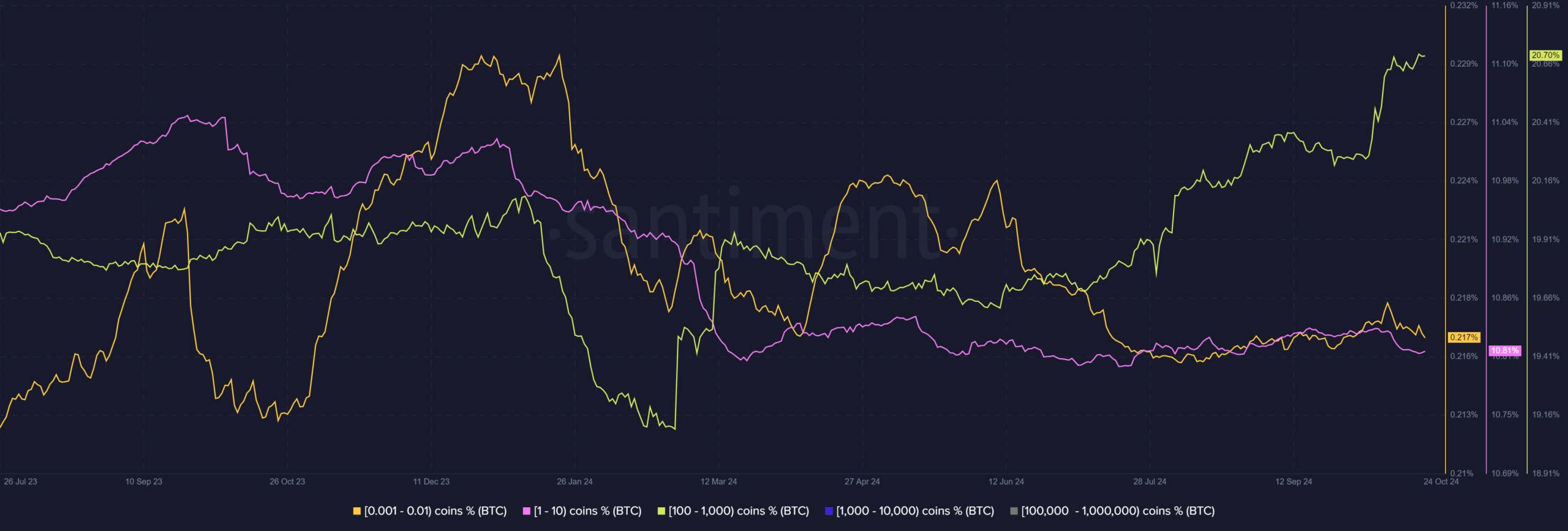

Santiment knowledge revealed that those that held lower than 10 BTC had seen a gradual tempo of development previously few months.

Nonetheless, these with 100 to 1000 BTC have elevated their positions and market dominance from 19% to twenty%.

Supply: Santiment

Regardless of the gradual tempo of development of the BTC retail stash, the general pattern has been skewed towards a holding technique, as seen by the surge in BTC accumulation balances.

Analysts have seen the above traits as optimistic catalysts for BTC’s seemingly new ATH try, however that is still to be seen.