- Bitcoin whales amassed vital quantities of BTC amidst market volatility

- Miner income fell, leading to vital promoting stress on the crypto

Bitcoin [BTC]‘s latest price crash shocked the crypto markets as a whole. However, even though many market bulls suffered major losses, some addresses gained from the cryptocurrency’s latest correction.

Whales purchase the dip

Wallets holding greater than 10,000 Bitcoin have been main beneficiaries of the latest market volatility. These massive addresses, believed to be primarily owned by trade liquidity suppliers, considerably bolstered their holdings over the previous six weeks. By some estimates, these addresses amassed an extra 212,450 BTC, representing a 1.05% hike of their share of the full Bitcoin provide.

The actions of those massive wallets will be seen as an indication of confidence in Bitcoin’s long-term potential. This constructive sentiment may appeal to different traders to the market, additional boosting the worth. This may occasionally additionally assist BTC regain beforehand achieved ranges and should assist it hit the $60,000-level, if there isn’t a further promoting stress.

Nonetheless, this can be a double-edged sword. If whales proceed to gather massive quantities of BTC, it’d influence the centralization of BTC. These whale addresses may have lots of energy and will manipulate BTC costs, relying on their conduct. This might depart retail traders weak, particularly when these whales resolve to promote their holdings.

Supply: X

One other regarding issue is the truth that retail traders haven’t been displaying the identical degree of enthusiasm as whales.

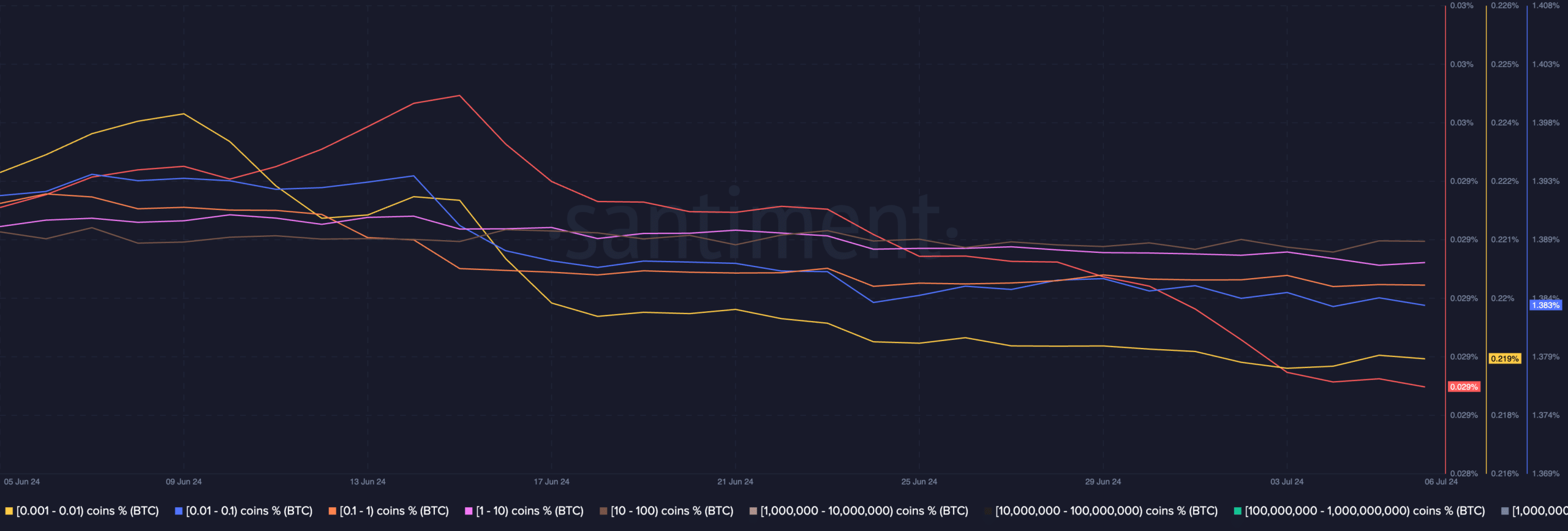

AMBCrypto’s evaluation of Santiment’s information revealed that the variety of retail addresses within the 0.1 BTC to 1 BTC cohort didn’t present any curiosity in shopping for BTC. If sustained over the long run, this may gas centralization and depart retail traders on the mercy of whale addresses.

Supply: Santiment

How are miners holding up?

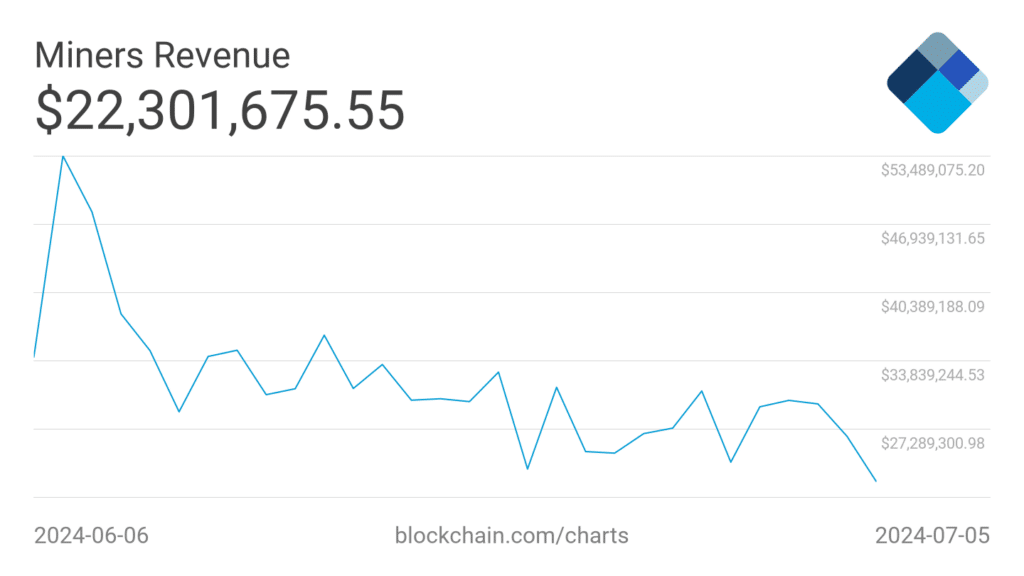

Whereas whale curiosity may briefly buoy Bitcoin’s value, struggling miners might exacerbate promoting stress. Each day miner income has fallen significantly in latest days, highlighting their monetary pressure. This decline in income might incentivize miners to promote their BTC holdings to cowl operational prices, placing downward stress on the worth.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

At press time, BTC was buying and selling at $56,741.70, with its value up by 2.8% within the final 24 hours. Regardless of its lukewarm restoration although, the crypto’s quantity fell by over 37% within the aforementioned interval.

If this stays constant over the following week or so, will probably be tough for BTC to interrupt previous $60,000 on the charts.

Supply: Blockchain