- BTC’s change reserve was at its lowest degree in current months at press time, indicating whale accumulation.

- If BTC’s value falls beneath the $56,500 degree, there’s a excessive risk it may fall to $54,000 or $52,000 ranges.

The present market sentiment seems extraordinarily bearish, whereas crypto whales are capitalizing on this chance and closely accumulating.

On 4th September, the on-chain analytic agency lookonchain made a submit on X (beforehand Twitter) which stated {that a} Bitcoin [BTC] whale purchased 545 BTC price $30.82 million as the value fell notably.

Whale exercise amid value drop

The submit on X additionally famous that this whale has bought practically 862 BTC price $49 million at a mean value of $56,993 degree over the past three days. This isn’t the one time whales have taken benefit of a value dip as a possibility.

Lately, the on-chain analytic agency Santiment shared a submit on X, noting that whales and sharks holding between 10 to 10K BTC have amassed 133.3K BTC from small merchants who’ve been dumping in panic over the previous month.

The numerous accumulation of whales and sharks in the course of the current market downturn suggests a possible long-term shopping for alternative.

Bitcoin technical evaluation and upcoming ranges

In accordance with the skilled technical evaluation, Bitcoin seems bearish because it broke down a powerful consolidation close to the essential help of $57,000.

If BTC value closes a each day candle beneath the $56,500 degree, there’s a excessive risk it may fall to $54,000 or $52,000 ranges within the coming days.

Supply: TradingView

At present, BTC is buying and selling beneath the 200 Exponential Shifting Common (EMA) on a each day timeframe suggesting the asset is within the downtrend.

Nevertheless, the Relative Energy Index (RSI) is within the oversold territory, signaling a possible value reversal.

Main liquidation ranges

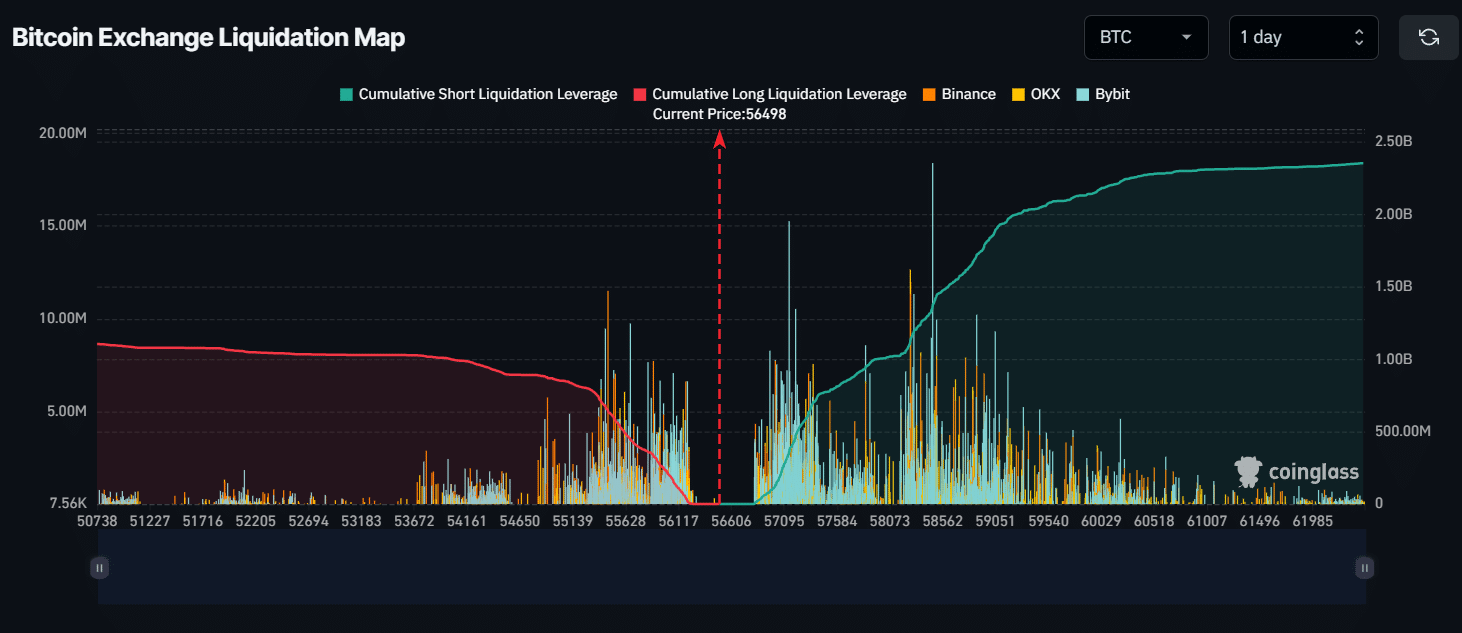

As of press time, the key liquidation ranges had been $55,450 on the decrease facet and $58,450 on the upper facet, as these merchants are over-leveraged at these ranges, in accordance with Coinglass information.

Supply:

If the market sentiment stays bearish and the value falls to the $55,450 degree, practically $650 million price of lengthy positions will likely be liquidated.

Conversely, if the emotions shift and the value rises to the $58,450 degree, roughly $1.32 billion price of quick positions will likely be liquidated.

Information exhibits quick sellers are at present dominating the asset and have the potential to liquidate extra lengthy positions. This thesis will solely work if BTC closes a each day candle beneath the $56,550 degree.

On-chain metrics present bullish indicators

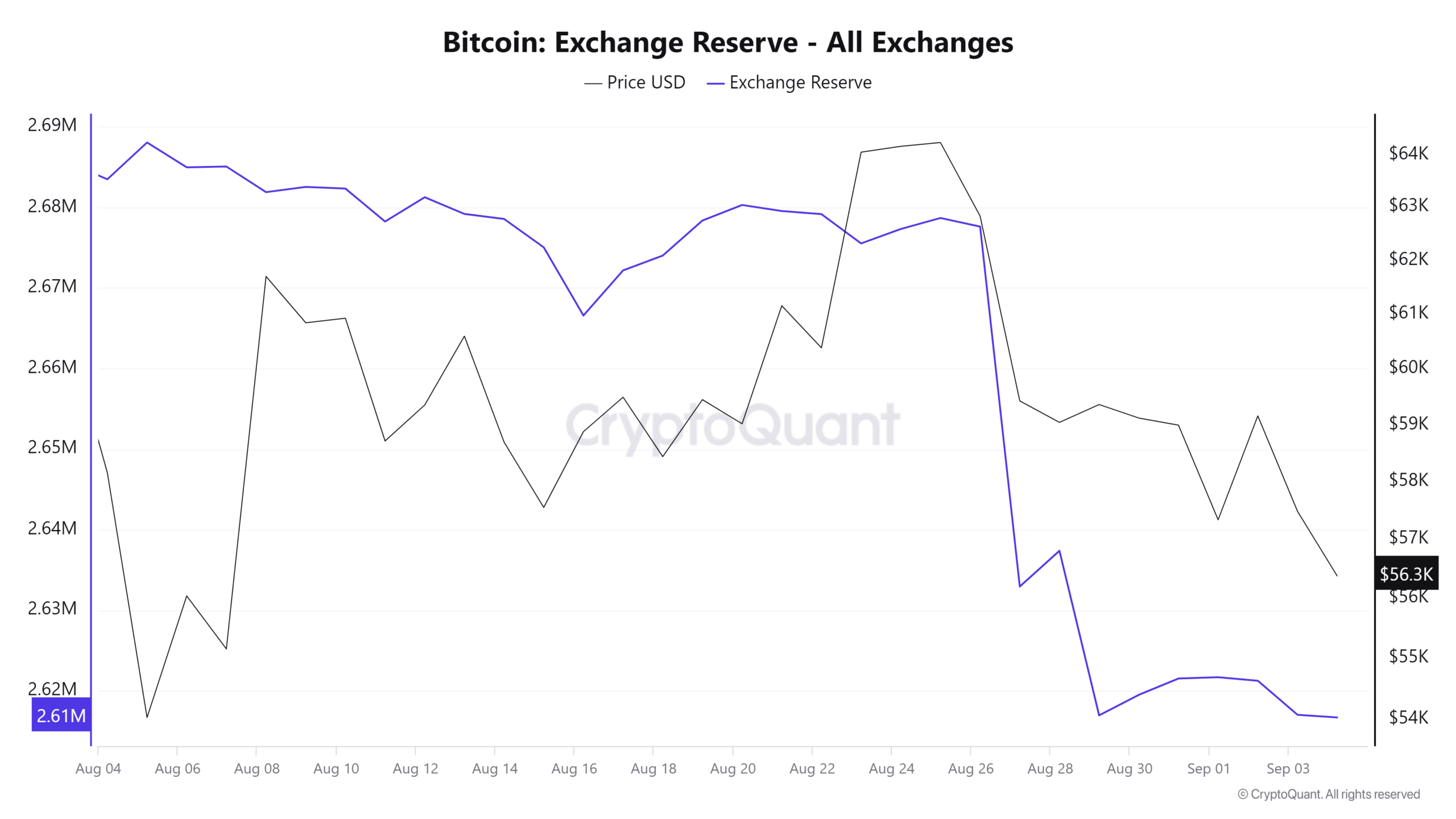

CryptoQuant’s on-chain metrics reminiscent of BTC change reserve and change influx are flashing a bullish outlook for BTC.

In accordance with the on-chain information, BTC’s change reserve is at present at its lowest degree in current months, indicating whale and institutional accumulation. Moreover, it indicators a possible shopping for alternative.

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Whereas, BTC’s change influx has been constantly falling in current months, reflecting shopping for strain from traders and establishments.

At press time, BTC is at present buying and selling close to $56,550 and has skilled a value decline of over 4.5% within the final 24 hours. In the meantime, its open curiosity dropped by 4.65% throughout the identical interval, indicating a reducing in investor and dealer curiosity.