- Following the consolidation breakdown, there’s a excessive risk that BTC may fall to the $54,600 degree.

- If BTC falls to the $56,850 degree, practically $721 million price of lengthy positions might be liquidated.

Because the cryptocurrency market continues to wrestle, whales have elevated their shopping for exercise.

On the sixteenth of August, a newly created pockets withdrew a major 533.5 Bitcoin [BTC] price $31 million from Binance [BNB], the world’s largest cryptocurrency change on the 58,188 degree, per Spot On Chain.

Whales’ curiosity in Bitcoin

This submit has gathered vital consideration from the crypto group. The market is down, and whales are seeing this worth decline as a possibility.

Moreover, Spot On Chain famous that six whales have collected a major 4,046 BTC and WBTC price $239.5 million from centralized exchanges (CEXes) this week.

Nevertheless, within the final 24 hours and over the previous seven days, BTC’s change reserves have declined by 0.37% and 0.47%, respectively.

However, because of the excessive volatility, the variety of lively addresses has dropped by 27.6% within the final 24 hours, based on the on-chain analytic agency CryptoQuant.

How is BTC faring?

At press time, Bitcoin was buying and selling close to the $58,430 degree, having remained steady over the past 24 hours. Its buying and selling quantity has elevated by 6% throughout the identical interval, indicating larger participation of buyers.

Moreover, BTC’s Open Curiosity rose by 2% within the final 24 hours, signaling elevated curiosity amongst merchants throughout this time.

In accordance with AMBCrypto’s technical evaluation, BTC appeared bearish, because it was buying and selling beneath the 200 Exponential Shifting Common (EMA) on a every day time-frame.

Additionally, the king coin has given a breakdown of the consolidation zone between $61,800 and $58,500. Following this breakdown, there’s a excessive risk that BTC may fall 6.5% to the $54,6000 degree in quickly.

Supply: TradingView

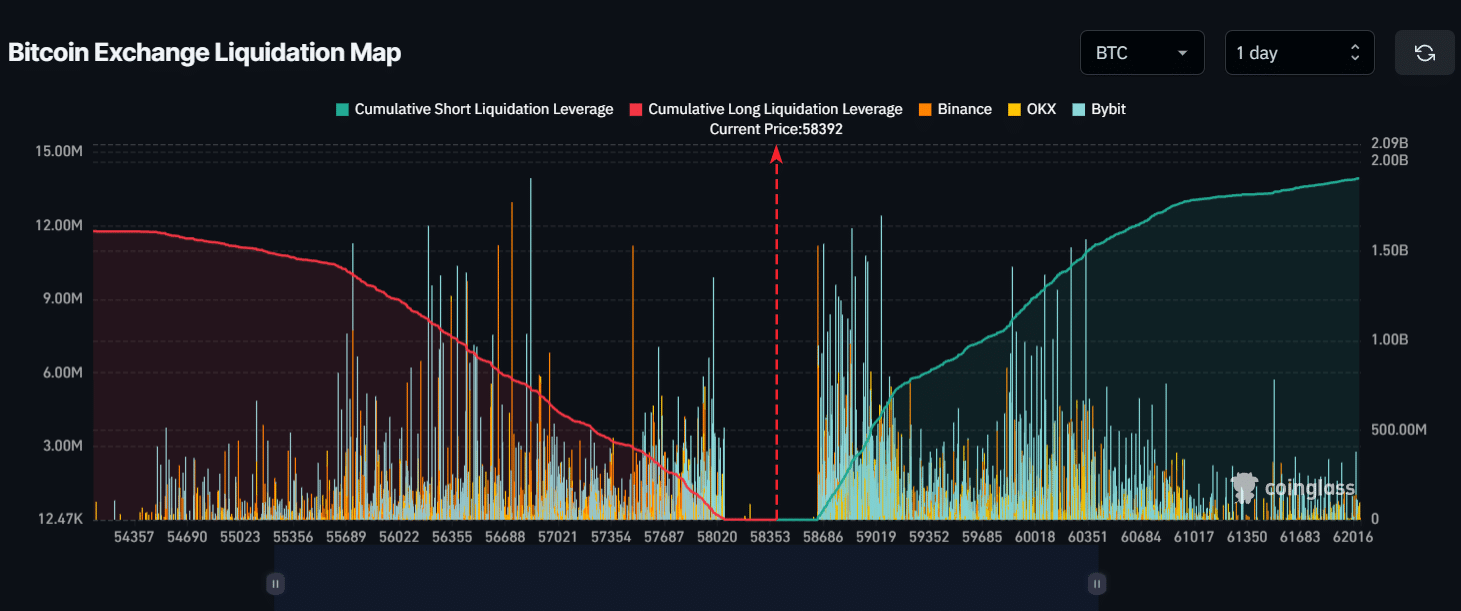

As of press time, the 2 main liquidation ranges have been close to $56,850 on the decrease facet and $59,000 on the higher facet, based on the on-chain analytic agency Coinglass.

Supply: Coinglass

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

If the bearish sentiment continues and the worth falls to the $56,850 degree, practically $721 million price of lengthy positions might be liquidated.

Conversely, if the sentiment modifications and the BTC worth rises to the $59,000 degree, practically $581.3 million price of quick positions might be liquidated.