- Bitcoin doesn’t have sufficient demand within the quick time period to maintain a rally past $60k.

- Merchants can put together for a bearish reversal on Monday however ought to be careful for volatility.

Bitcoin [BTC] fell by 16.2% between Monday, the first of July, and Friday, the fifth of July. After reaching the bottom level at $53.5k, BTC bounced by 9.33% over the subsequent day and a half. The sharp downward value transfer would possibly see a short-term vary formation established.

AMBCrypto analyzed the liquidation charts and the worth motion to grasp the place the costs may pattern over the subsequent week. Whales had been accumulating BTC, however the sentiment was weak, and the coin motion onto exchanges was a priority.

Plotting the Bitcoin value path for the subsequent week

Supply: BTC/USDT on TradingView

The 4-hour chart confirmed a possible vary formation between $58.8k and $53.5k. The mid-range stage at $56.2k had served as assist on the fifth of July when costs tried to bounce larger.

The H4 RSI was at 44 and confronted rejection at impartial 50. Nevertheless, the RSI would possible go larger over the subsequent day or two as a result of the vary highs beckons BTC costs to it.

The OBV, then again, remained in a downtrend, warning bulls to not take the bait supplied.

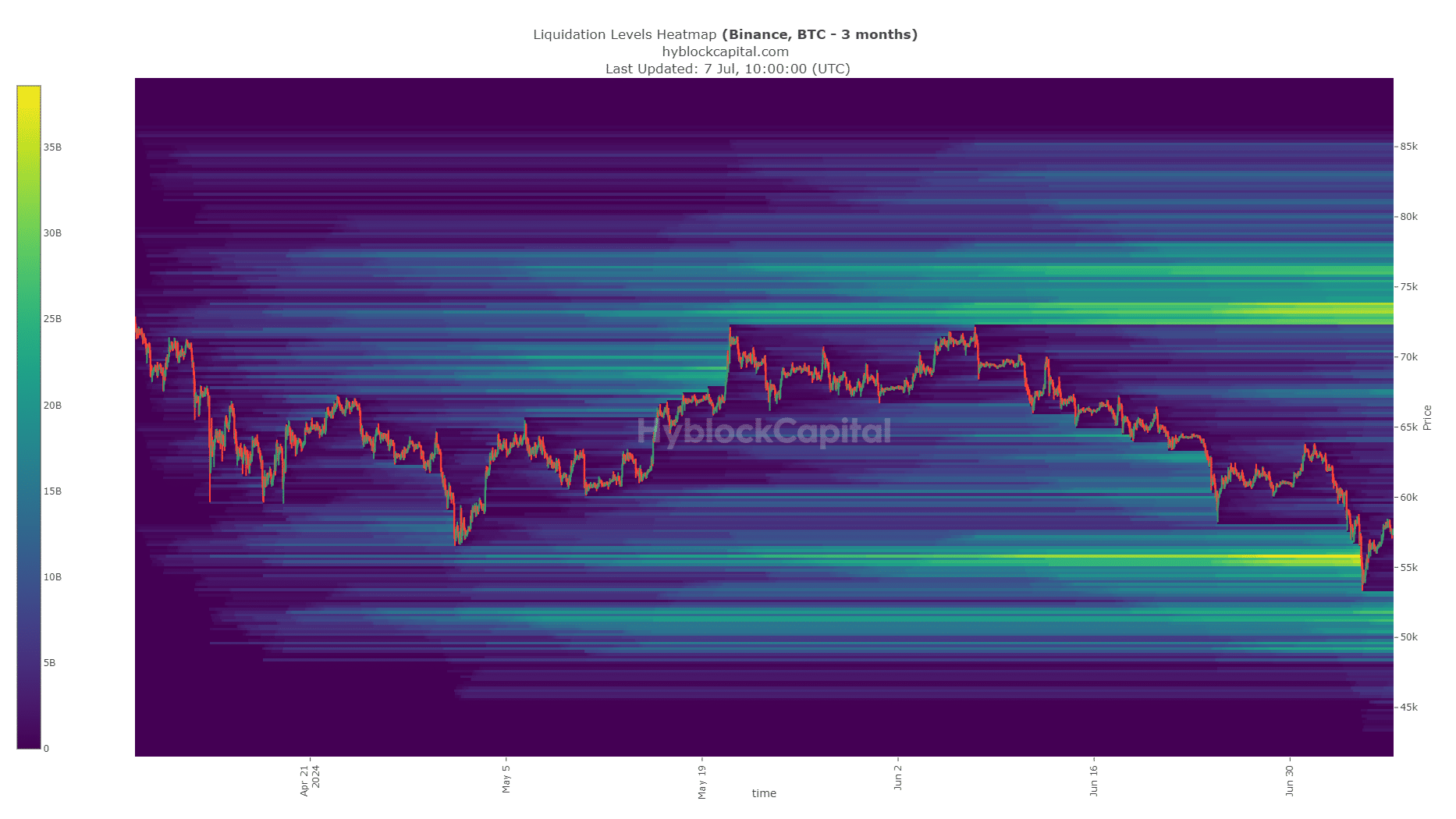

Supply: Hyblock

The liquidation heatmap of the previous three months confirmed that the $55.5k area had a excessive focus of liquidation ranges. This pool of liquidity was swept and within the coming weeks, BTC would possibly search to run it northward to the $73k liquidity zone.

Within the quick time period, nevertheless, a direct reversal is unlikely. The bulls want time to assemble their power earlier than pushing larger. The vary formation outlined earlier is anticipated to final over the approaching week.

Outlining the important thing Bitcoin value ranges

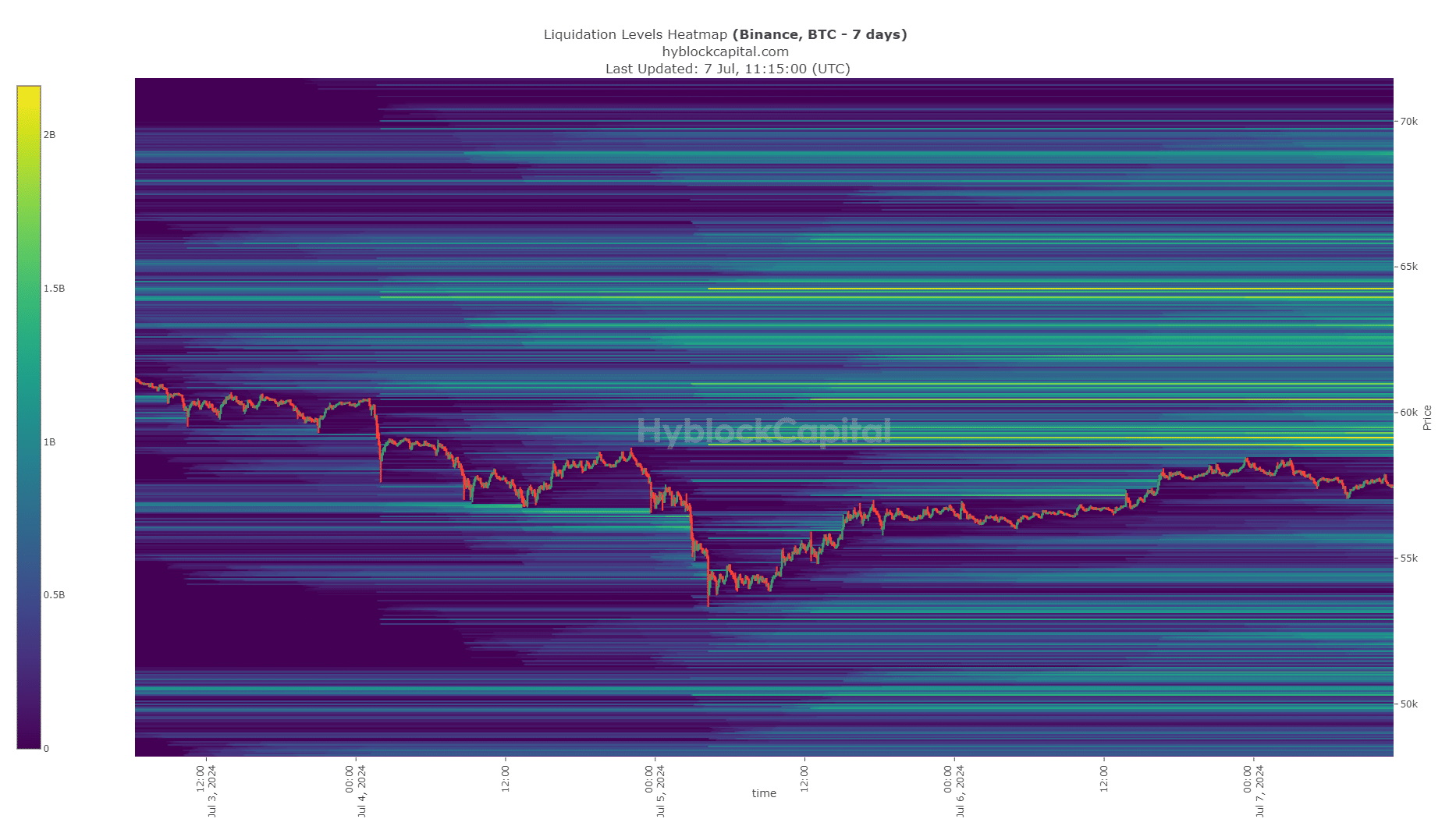

Supply: Hyblock

The 7-day liquidation heatmap confirmed that the $59k-$59.3k zone has bunched up liquidation ranges. This lined up properly with the $58.8k vary highs.

The magnetic zone beneath $60k is probably going to attract Bitcoin costs to it.

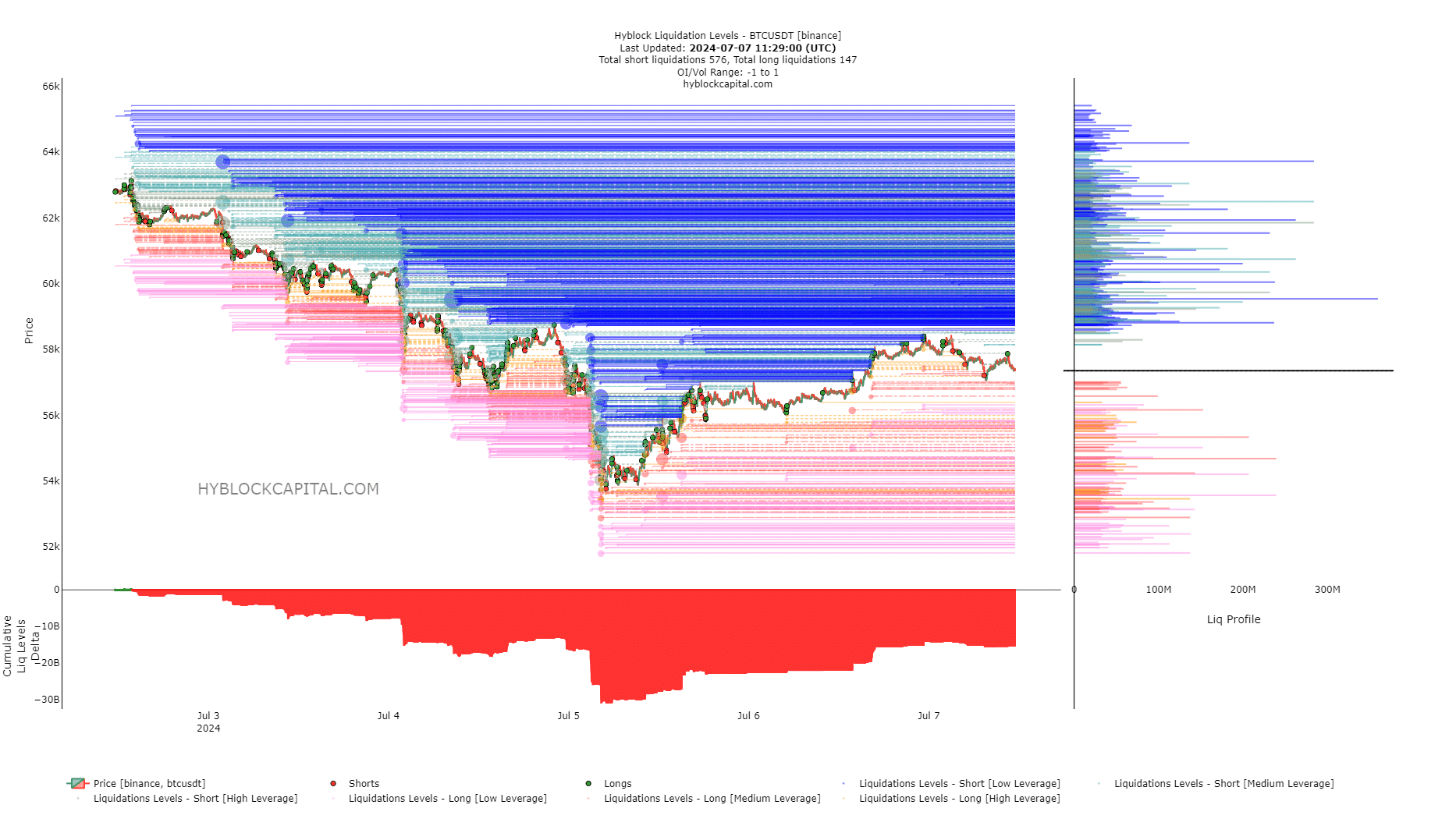

Supply: Hyblock

AMBCrypto additionally analyzed the liquidation ranges. They revealed that the cumulative liq ranges delta was nonetheless largely unfavorable however has withdrawn barely since its most on the fifth of July.

Due to this fact, a transfer upward to hunt the overleveraged quick sellers would possibly begin on Monday, the eighth of July.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Whereas the king of crypto doesn’t have sufficient bullish sentiment or demand to gas a fast rally, merchants mustn’t ignore the potential of a breakout previous $60k.

As issues stand, a bearish reversal from the $59.2k space is anticipated, with volatility across the New York Open at 1 PM UTC on Monday one thing to watch out for.