- Bitcoin rose to $70,000 within the earlier buying and selling session.

- Miner reserve has continued to lower, however BTC’s worth has slowed it down.

Not too long ago, there was a slight rise within the outflow from Bitcoin [BTC] miners. Regardless of this enhance, different market indicators advised {that a} important sell-off will not be imminent.

Bitcoin miner reserve declines

A current report by CryptoQuant highlighted a notable enhance in Bitcoin miner outflow. The outflow advised {that a} important quantity of BTC was being transferred from miner wallets.

The pattern is evidenced by a spike within the miner outflow indicator, which reached over 14,000 BTC on the twenty fifth of July. Notably, this was the very best degree noticed in over a month and the primary time in July.

Though there was a lower following this peak, one other substantial rise occurred on the twenty ninth of July, with outflows reaching over 9,800 BTC.

Supply: CryptoQuant

The BTC miner reserve information supported the pattern of accelerating outflows. Initially of July, the miner reserve stood at roughly 1.814 million BTC.

As of the most recent information, this reserve has barely decreased to round 1.813 million BTC.

Promoting spree in verify

Following the Bitcoin halving occasion, there was a noticeable decline in miner revenues. It is because the halving decreased miners’ block reward for his or her computational efforts.

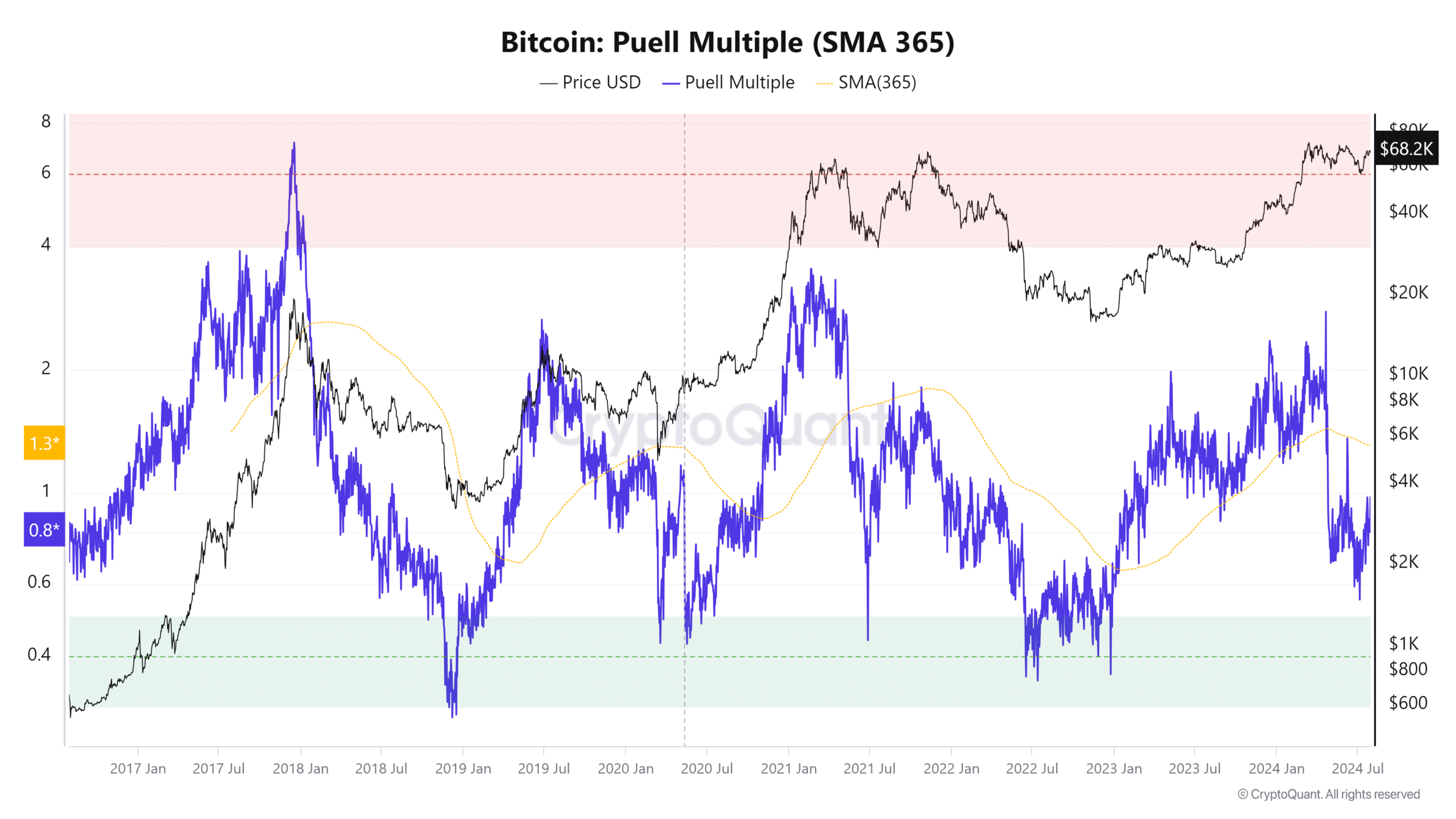

Additionally, there was a shift within the Puell Multiole. The indicator is used to evaluate the mining trade’s well being and potential future conduct.

It does this by evaluating the day by day issuance worth of BTC (in USD) to the 365-day shifting common of the day by day issuance worth.

A decrease Puell A number of means that miners earn lower than the historic common. When the Puell worth is round 0.5, it sometimes signifies that miner revenues are considerably decreased, pointing to a possible market backside.

Supply: CryptoQuant

At press time, the Puell A number of was 0.9. Whereas this was a rise, it nonetheless indicated comparatively low earnings for miners in comparison with the common.

In such conditions, miners would possibly hesitate to promote their Bitcoin holdings as a result of the costs will not be sufficiently compensatory, given their manufacturing prices.

BTC fails to hit $69K

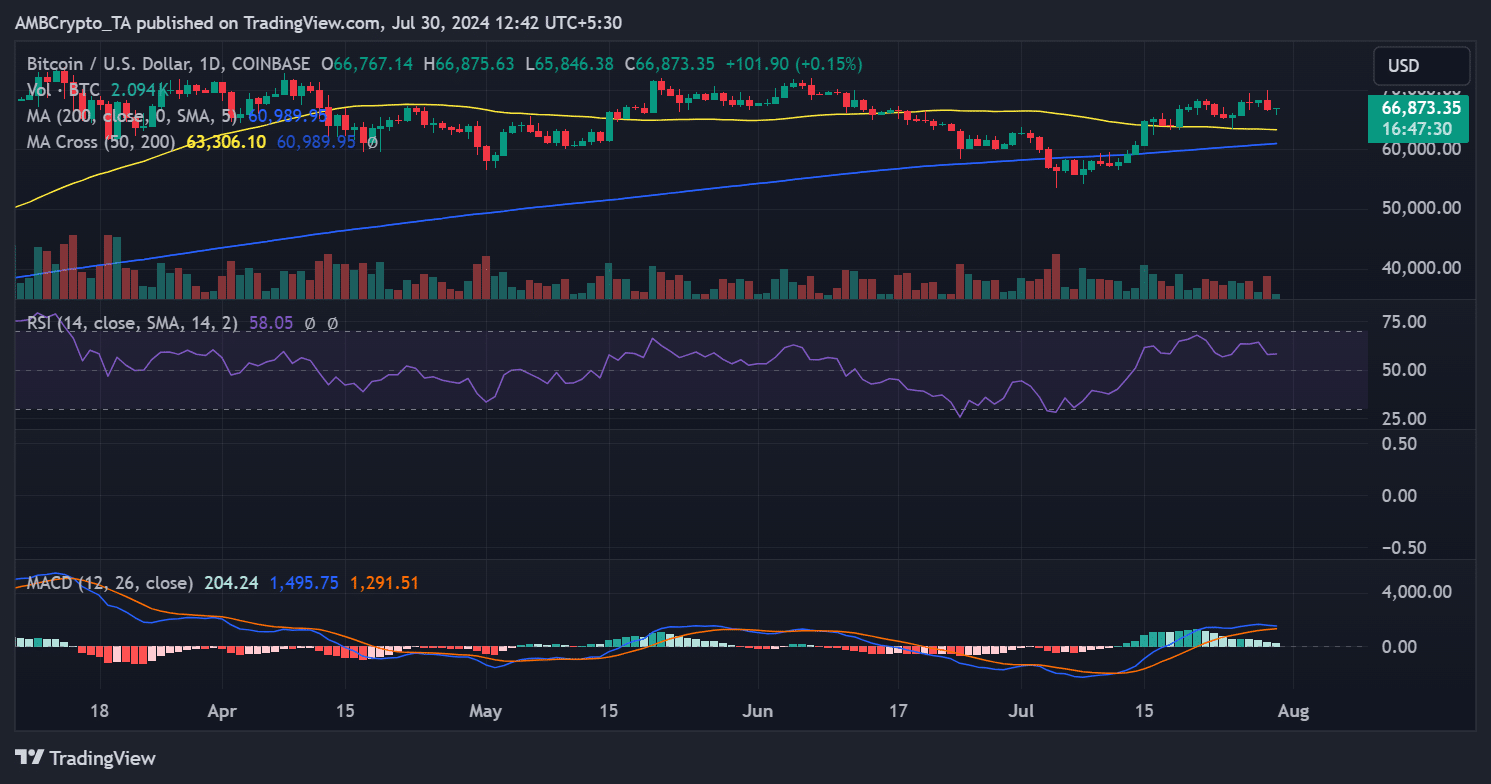

Bitcoin started the buying and selling session on the twenty ninth of July strongly, briefly reaching the $70,000 worth vary. Nevertheless, by the top of the day, it had declined, dropping over 2% to shut at round $66,771.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

This downturn would have affected the worth of miner holdings, doubtlessly influencing their selections on whether or not to extend outflows.

Supply: TradingView

In line with AMBCrypto’s evaluation, Bitcoin traded at roughly $66,800 at press time, exhibiting a modest restoration with a lower than 1% enhance.