- Because the U.S. Greenback weakens, China appears to strengthen its Yuan forex.

- Investor confidence grows steadily as BTC breaks out of micro channel.

Investor threat publicity resulting from recession fears is reducing, as international liquidity in crypto continues to be on the rise.

Alpha Extract on X (previously Twitter), cited that China is actively stimulating its financial system with out considerably devaluing the Yuan towards the U.S. Greenback.

The U.S. performs an important function in liquidity, particularly with ongoing invoice issuance. So, a weaker greenback can result in elevated liquidity from different central banks.

Supply: Alpha Etract

The Federal Reserve’s reserve financial institution credit score dropped by $10 billion final week, however rising collateral values precipitated a slight uptick within the World Liquidity Index (GLI), now at $125.975 trillion, a 0.165% improve.

The Adjusted Financial Price of Change (AE RoC) remained constructive.

Different metrics, coupled with the interaction between China’s stimulus and U.S. greenback weak spot, might impression Bitcoin [BTC] costs in the long term.

Investor confidence rising considerably Bitcoin noticed a giant Coinbase low cost once more through the unload that occurred throughout earlier week’s market crash.

Nevertheless, it recovered rapidly, closing with greater than 23% acquire from its week’s low.

$BTC now has a Coinbase premium once more, which is usually constructive because it reveals constructive investor sentiment from the U.S. and ETFs.

This additionally signifies that BTC might rally on account of China’s stimulus and a weakening USD.

Supply: CryptoQuant

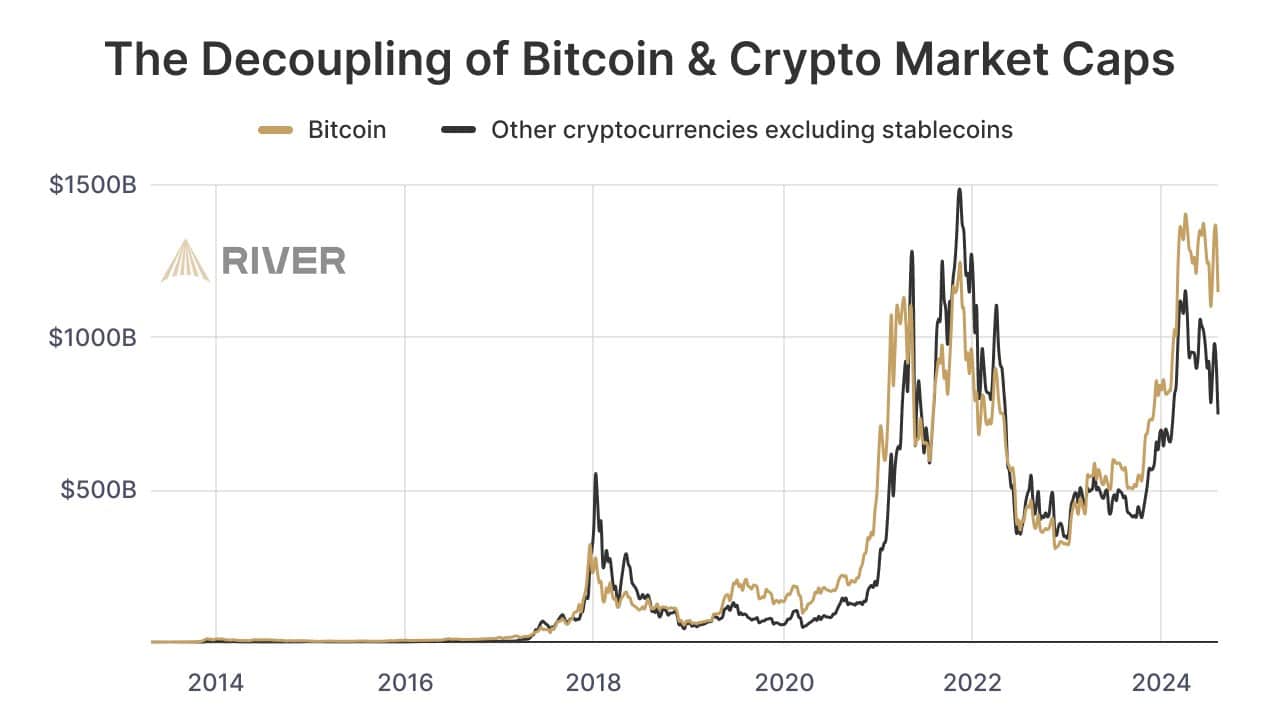

Decoupling of BTC and altcoin market caps

Three years in the past, Bitcoin’s market cap was round $835 billion, whereas different cryptocurrencies, excluding stablecoins, matched that.

As we speak, Bitcoin’s market cap has risen 37% to $1.15 trillion, whereas different cash have dropped 11%.

This shift highlighted Bitcoin’s dominance and questioned the knowledge of these blindly diversifying in crypto.

With China’s stimulus and the U.S. greenback weakening, Bitcoin might probably attain new all-time highs, emphasizing its power out there.

Supply: River

Bitcoin breaks a micro downward pattern

Bitcoin has damaged out of its current downward pattern, and exhibiting potential for a rally.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

If Bitcoin stays above $58,000, it might rise additional to $61,000, triggering brief liquidations. The following key stage to look at is the way it reacts at $61,000.

Coupled with China’s stimulus and the weakening U.S. greenback, Bitcoin might see a big rally within the coming days.

Supply: TradingView