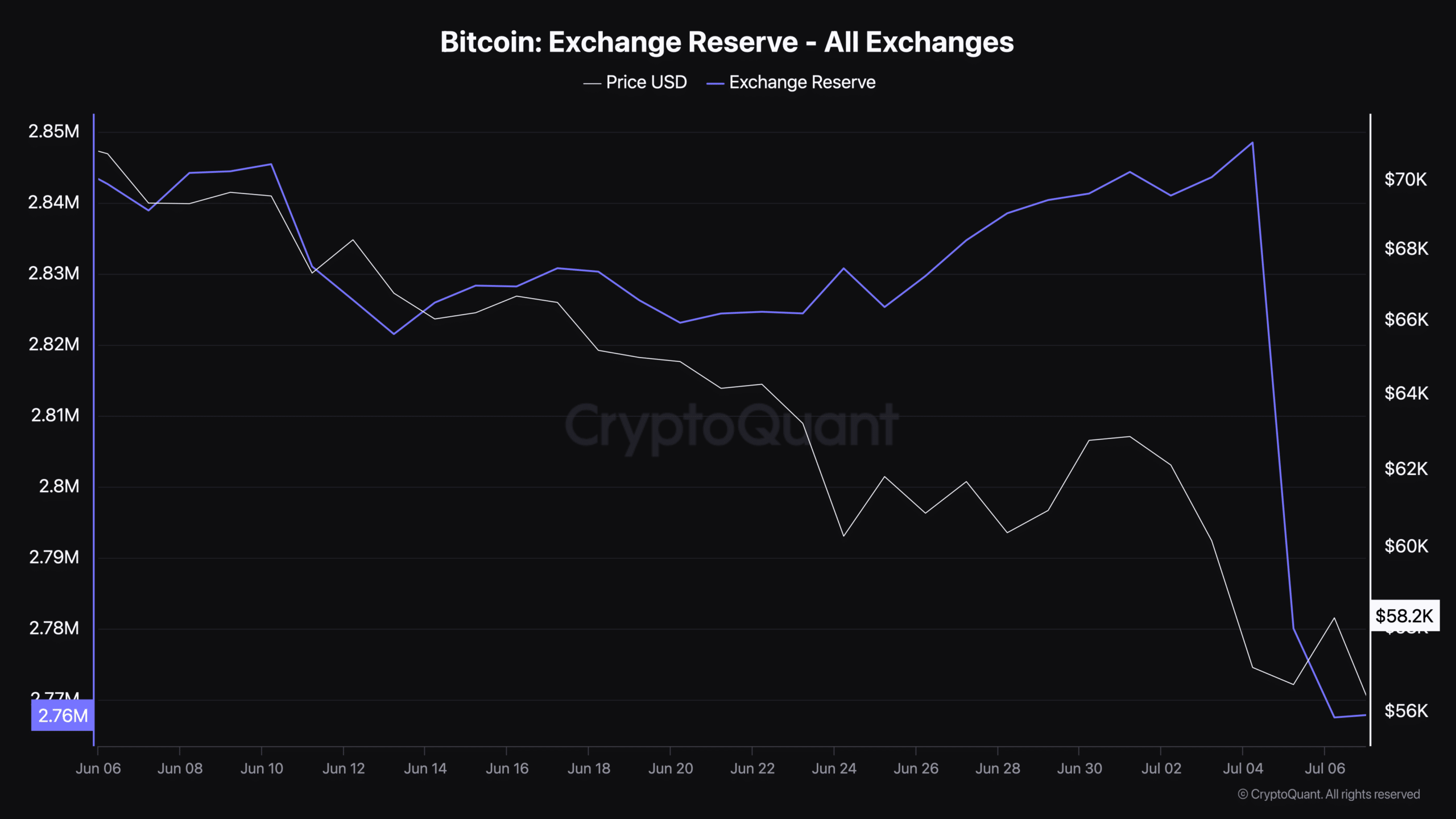

- Bitcoin’s trade reserve dropped to the extent that was seen in 2018.

- Lengthy-term traders had been assured in BTC, however just a few indicators had been bearish.

Bitcoin [BTC] has as soon as once more gained bullish momentum because it was quick approaching the $60k goal. This simply may be the tip of the iceberg, because the coin has the potential to succeed in new highs quickly. Let’s take a look at why that was the case with BTC.

Is an enormous transfer possible?

As per CoinMarketCap’s knowledge, BTC’s value elevated by over 6% up to now seven days. Within the final 24 hours additionally, the bullish development continued because the king of crypto’s value rose by greater than 1%.

On the time of writing, BTC was buying and selling at $59,256.11 with a market capitalization of over $1.17 trillion.

In the meantime, Titan of Crypto, a preferred crypto analyst, posted a tweet highlighting that BTC was following a previous development. As per the tweet, in previous cycles, BTC has all the time reached new highs after starting its third parabolic advance stage.

To be exact, such episodes occurred again in 2013, 2017, and 2021. On the time of writing, BTC had reached the help stage from which it might start its third advance.

Therefore, there have been probabilities of this bull rally pushing BTC to an all-time excessive within the coming months.

Supply: X

Odds of Bitcoin reaching an ATH in 2024

Since there have been probabilities of an enormous bull rally, AMBCrypto deliberate to have a more in-depth have a look at the king of cryptos’ state.

As per our evaluation of CryptoQuant’s knowledge, Bitcoin’s trade reserve reached as little as it was seen again in 2018. This clearly indicated that purchasing stress on the coin was growing, which is taken into account a bullish sign.

Supply: CryptoQuant

Other than that, BTC’s Binary CDD was inexperienced, that means that long-term holders’ motion within the final seven days was decrease than the common. They’ve a motive to carry their cash.

Nonetheless, the aSORP regarded troublesome because it was crimson. This recommended that extra traders had been promoting at a revenue. In the midst of a bull market, it may possibly point out a market high.

Supply: CryptoQuant

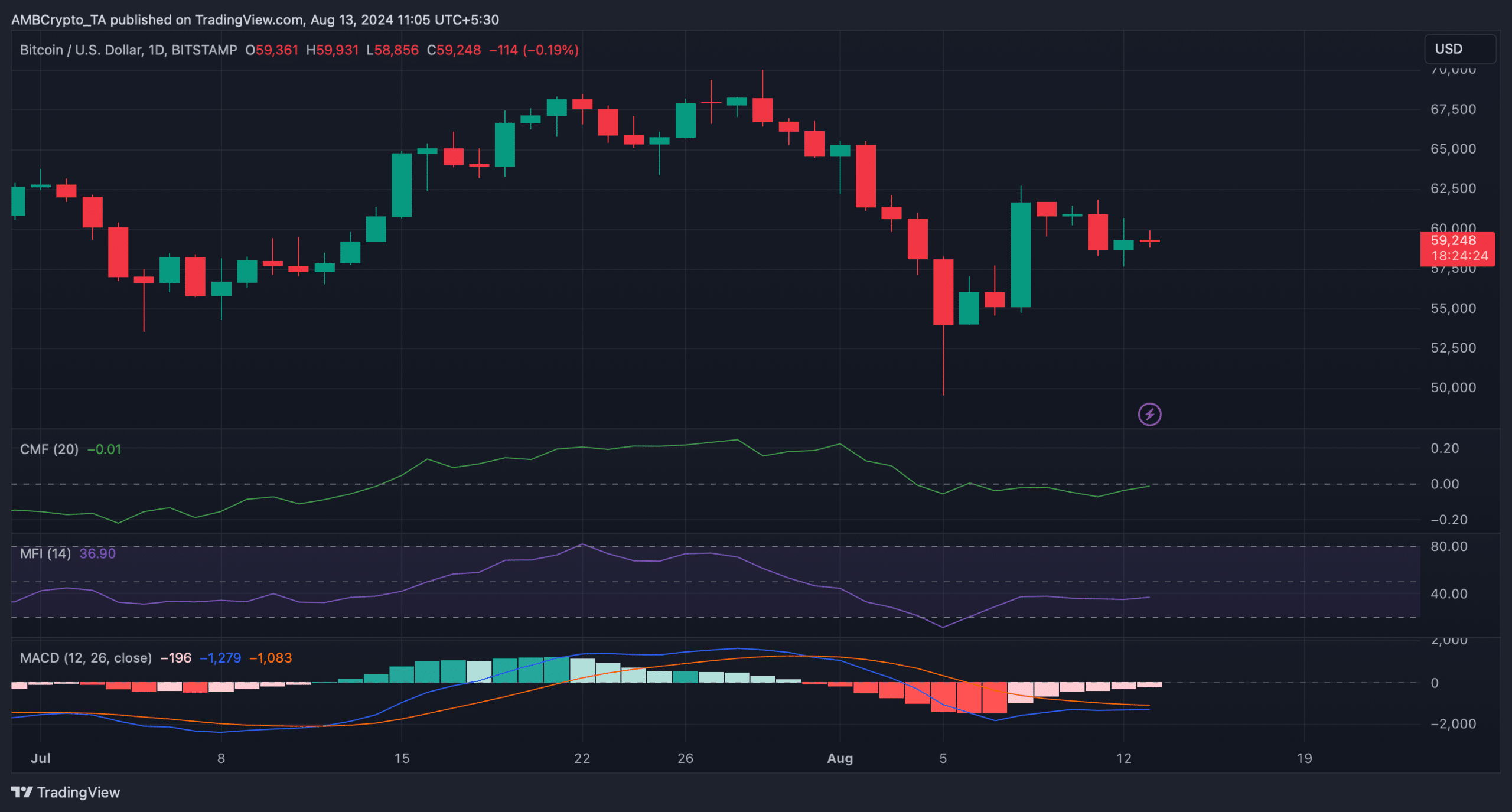

Due to this fact, AMBCrypto deliberate to take a look on the every day chart of Bitcoin to raised perceive whether or not it might maintain this upward trajectory.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

The technical indicator MACD displayed that the bulls had been attempting to meet up with the bears.

BTC’s Chaikin Cash Stream (CMF) gave hope of a bullish takeover because it went northward. Nonetheless, the Cash Stream Index (MFI) moved sideways, indicating just a few slow-moving days forward.

Supply: TradingView