- Bitcoin trade deposits have hit a six-year low, marking the bottom stage of BTC deposits in that point.

- That being mentioned, HODLERS are key in stopping a drop to the $55K assist.

Bitcoin [BTC] bulls confronted one other setback after a short weekend spike that pushed BTC above $60K. With three consecutive pink candles, BTC has retreated to $58K.

Whereas analysts are cut up on whether or not $60K is assist or resistance, a brand new CryptoQuant report reveals Bitcoin trade deposits have hit a six-year low of 132,100, signaling diminished promoting strain.

Might this milestone assist BTC keep away from a drop to $55K?

Drop in BTC trade hints at rising hodler dominance

The chart reveals fewer Bitcoin trade deposits, usually a bullish sign. Economically, diminished provide can inflate every BTC token’s worth.

Whereas for buyers, much less BTC on exchanges suggests confidence in worth restoration.

Supply : CryptoQuant

Furthermore, AMBCrypto’s evaluation reveals that spikes in BTC trade deposits usually align with BTC testing excessive worth ranges, indicating profit-taking methods and infrequently resulting in steep declines, suggesting potential accumulation.

Conversely, fewer deposits level to elevated management by long-term hodlers, as noticed prior to now six years for the reason that final spike.

Put merely, the Bitcoin house is now dominated by hodlers assured in a worth correction.

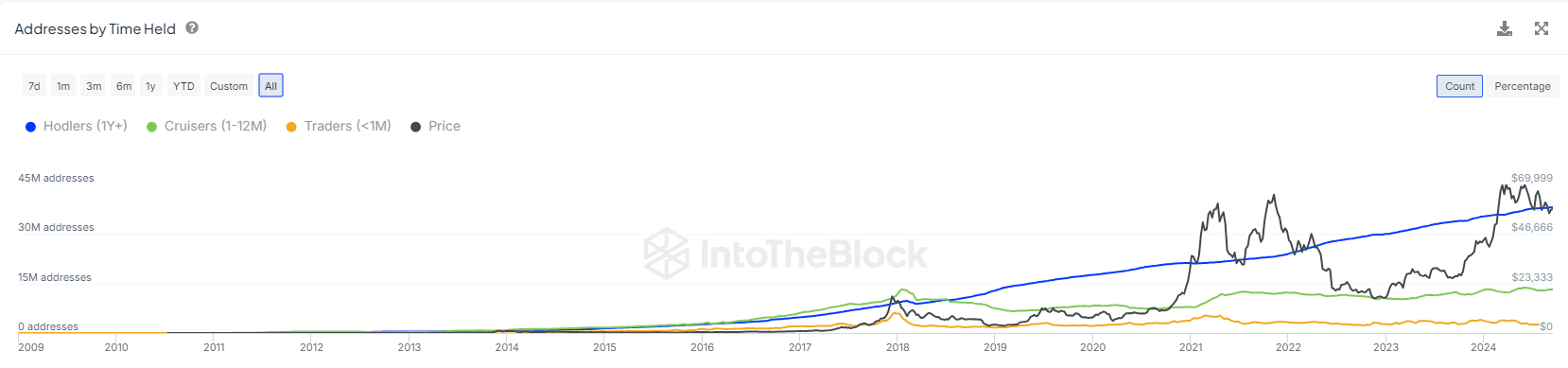

Supply : IntoTheBlock

As anticipated, the hodler rely has surged to 38 million, marking a staggering 375% enhance from 8 million six years in the past. Notably, hodlers holding BTC for over a yr now signify 70.77% of complete addresses.

Surprisingly, this share exceeds the rely noticed through the mid-March rally, when BTC hit its ATH.

Briefly, long-term holders are key to stopping a drop to $55K – however what are the percentages?

The chances are intriguing

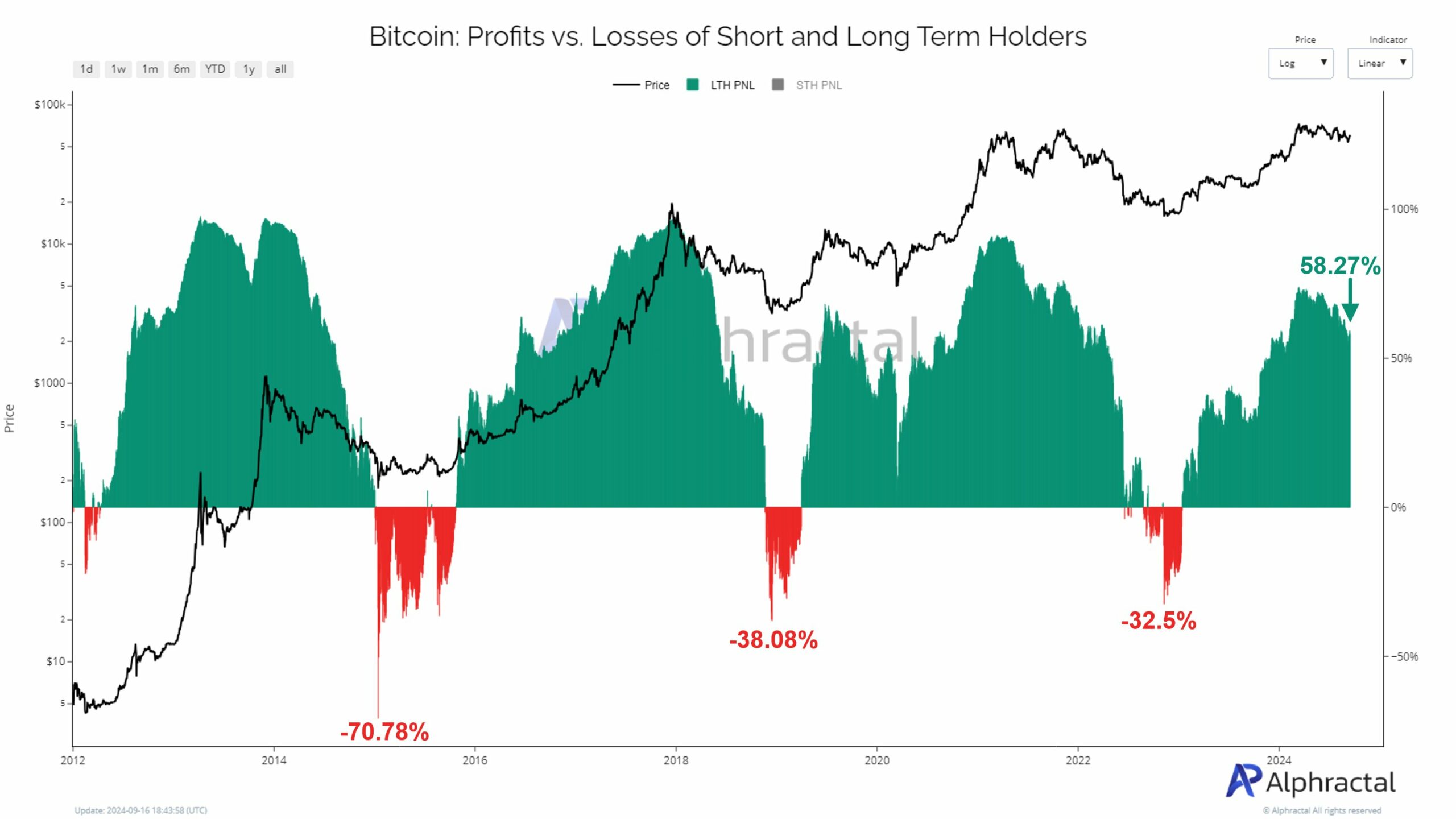

At present, 58.27% of LTH are in revenue, down from a peak of 74% on March 13—a 16% decline. Traditionally, a drop within the revenue margin after hitting highs can sign a possible bear market months later.

Supply : X

Briefly, whereas most LTH stay worthwhile, the weakening margin might counsel a slowdown or bearish development forward.

Nonetheless, regardless of growing losses for the reason that March peak when BTC examined $70K, LTHs continued assist signifies perception in a possible worth correction.

If this development continues, LTH would possibly maintain off on promoting, as evidenced by diminished BTC trade deposits.

Moreover, a possible Fed rate of interest minimize might drive BTC to a brand new ATH, assuming BTC deposits on exchanges proceed their downward development – Will they?

Time will inform

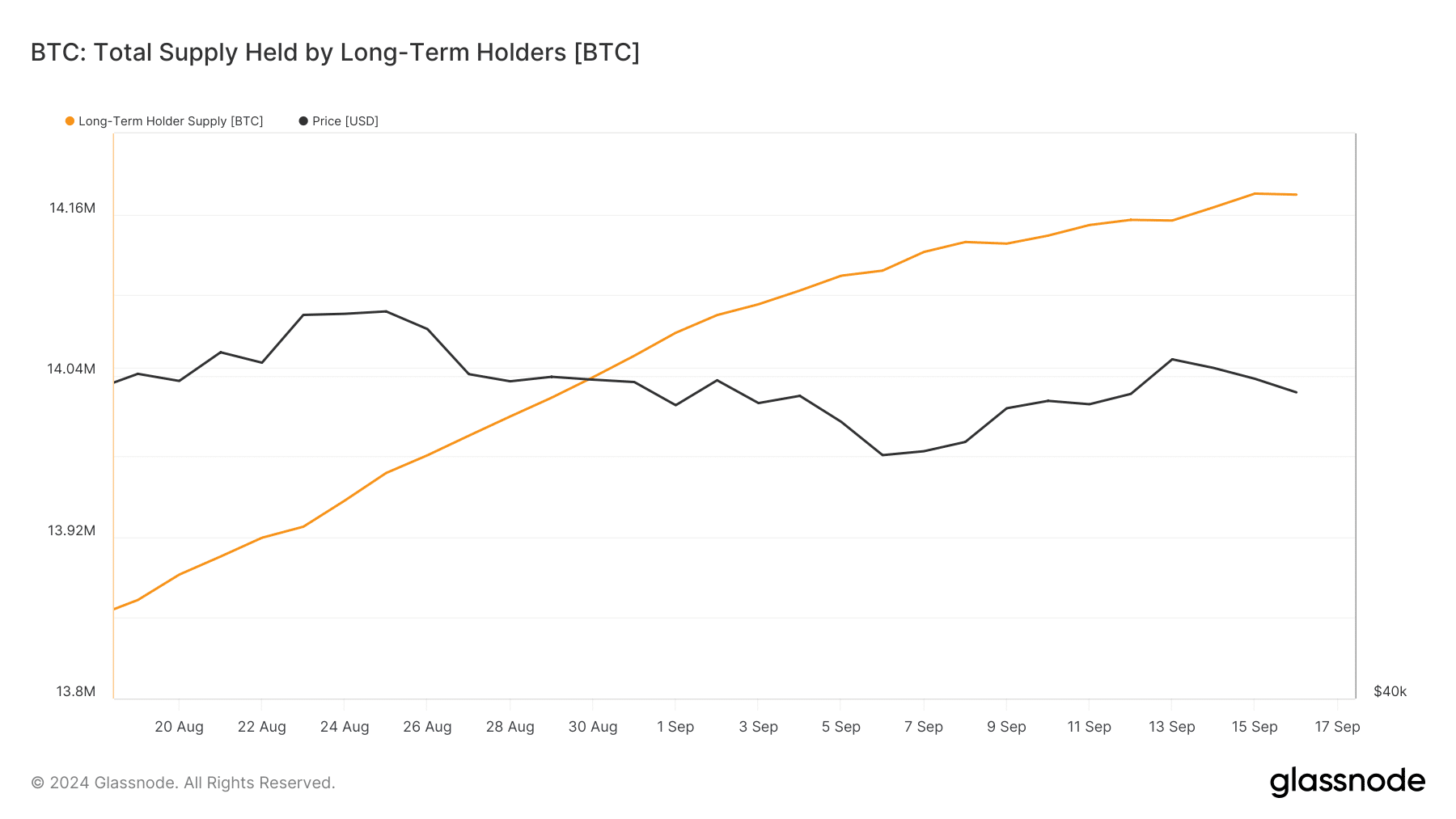

On the 30-day lookback interval, LTHs offered a good portion of their holdings for the primary time on September sixteenth, coinciding with BTC’s retracement to $58K.

Supply : Glassnode

As talked about earlier, for a restoration, LTHs must assist their positions by avoiding additional gross sales. Nonetheless, this downtick was a uncommon incidence, nonetheless aligning with AMBCrypto’s earlier projections.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

If LTHs can show this occasion to be an anomaly, and Bitcoin trade deposits stay low, the door to a brand new ATH might nonetheless be huge open.

Conversely, if LTHs proceed to promote, the $55K assist could also be in danger, and the trail ahead might turn into rather more unsure.