- BTC has been closely shorted for the final three days, however the latest value hike has elevated liquidation.

- Bitcoin’s buyers FUD and doubt within the rally will enhance costs, suggesting volatility.

Bitcoin [BTC], the most important cryptocurrency by market cap, has not too long ago skilled a average restoration in its value charts. In reality, at press time, BTC was buying and selling at $57110 after a 4.27% achieve over the previous day.

As the costs recovered, buying and selling quantity spiked over the previous day by 53.38% to $33.57 billion. Additionally, BTC’s market cap has elevated by 4.24% to $1.13 trillion.

Earlier than this enhance, BTC was in a robust downward trajectory, dropping by 6.54% during the last 30 days. Due to this fact, regardless of the latest good points, it remained comparatively low from its latest excessive of $65103 and 22.8% from its ATH.

The present market situations give BTC indicators of life, with analysts exhibiting optimism. For example, Santiment evaluation steered additional value hikes, citing Bitcoin’s market worth.

What market sentiment says

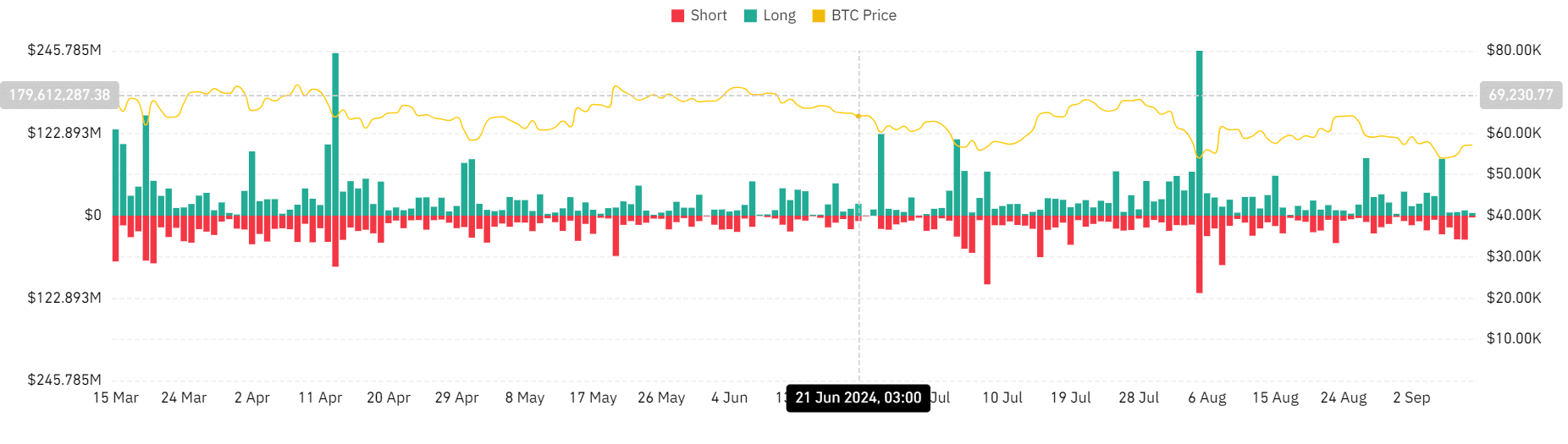

Santiment famous that BTC’s worth has elevated over the previous 24 hours, though it has been shorted during the last 4 days on main exchanges resembling Binance & Bitmex.

Supply: Santiment

In context, many merchants are betting on BTC costs to say no. Largely, shorting happens when merchants borrow BTC and promote it, with the intention of shopping for it once more at decrease costs.

Thus, heavy shorting witnessed since Saturday implies that many merchants count on costs to costs. This market sentiment is normally pushed by FUD, as buyers lack confidence in value path and count on a pullback.

Nevertheless, if the costs fail to say no as quick sellers count on and rise, they arrive beneath strain.

These buyers are pressured to purchase again the property they borrowed to cowl their positions, particularly when there’s a threat of upper losses. As famous by the final 24 hours good points.

Supply: Coinglass

Thus, the value enhance has resulted in elevated liquidation of quick positions, suggesting market volatility. This pressured buy leads to increased demand, which drives costs up, leading to a brief squeeze.

Bitcoin’s value charts

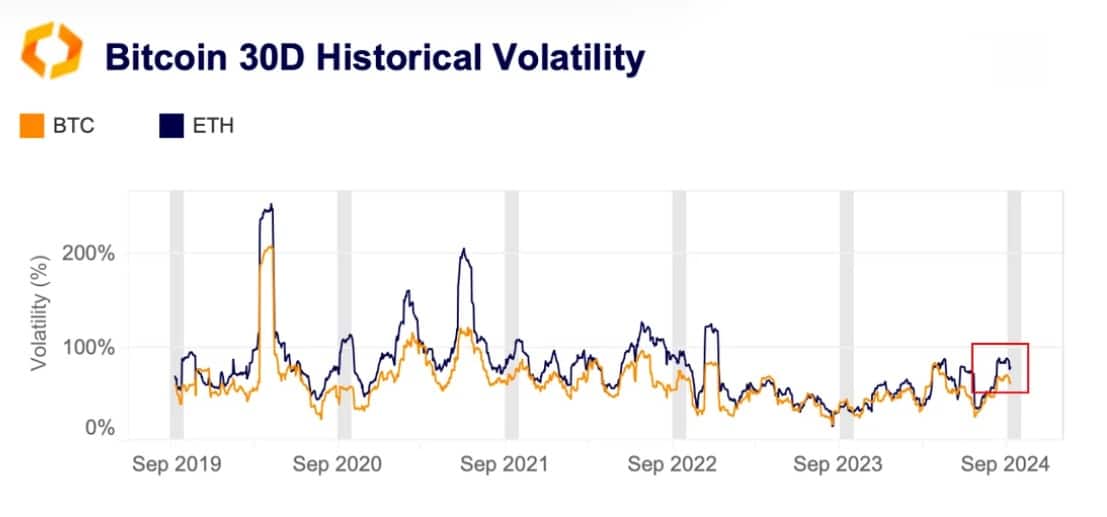

As famous by Santiment, Bitcoin’s market is experiencing increased uncertainty, leading to elevated volatility. Normally, September is traditionally related to volatility, with this yr’s BTC’s 30-day volatility spiking by 70%.

Supply: Kaiko

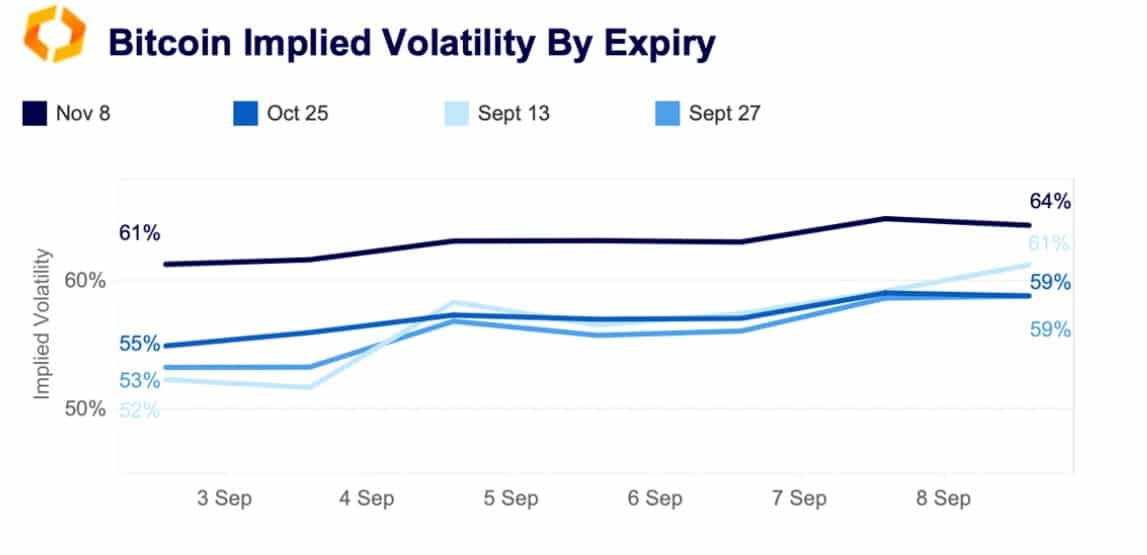

Thus, indicators resembling Implied Volatility have elevated since September began after a drop in August. Particularly, short-term choices have surged by 60% from 52%.

Supply: Kaiko

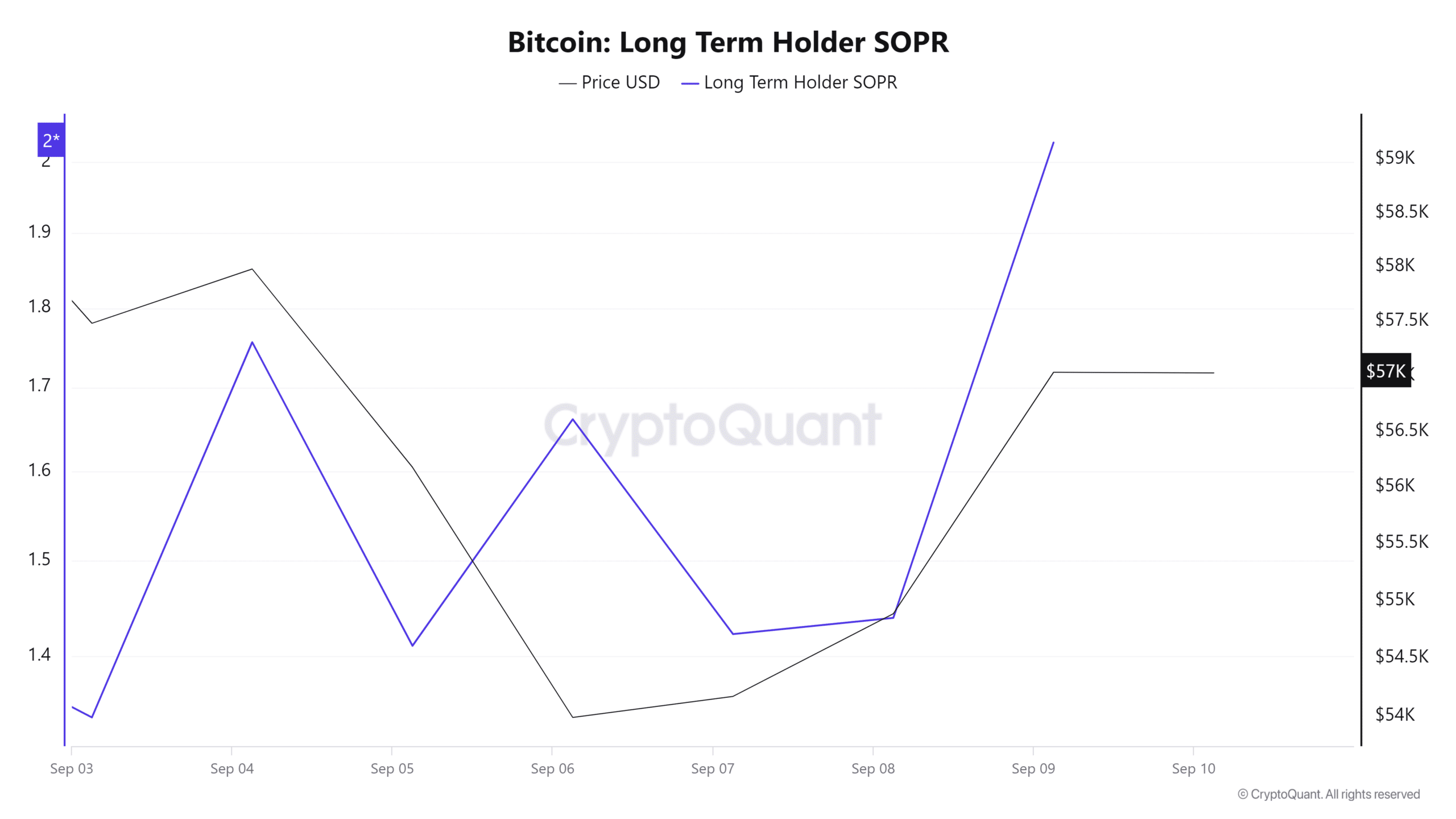

Moreover, the upcoming U.S. presidential elections are contributing to present market uncertainty. This FUD is additional supported by a sudden rise in Lengthy Time period Holder SOPR from 1.4 to 2.0.

So, though costs are in rising, they might expertise a pullback this promote to shut the realized good points.

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Due to this fact, demand for shorts positions signifies that buyers count on the costs to say no. Nevertheless, the demand for brief positions might result in elevated demand, which additional leads to additional value will increase.

If FUD drives costs up, BTC will problem the $59363 resistance and strengthen it to cross the $60k mark.