- Bitcoin stabilized above its $60,970-support degree – An indication of market power

- Common analyst Zen is predicting a possible dip to $60,150 or $53,000 although

During the last 24 hours, Bitcoin’s worth appreciated by by 1.34% to commerce at $61,571 on the charts. Its newest uptick highlighted a strengthening market, particularly with the market cap hitting $1.214 trillion and a day by day buying and selling quantity of $22.06 billion.

Bitcoin’s ongoing worth motion additionally revealed its speedy help at $60,970 and resistance ranges at $62,000 and $62,250. In truth, the latest hike above $61,500 meant that the help degree breach is now behind Zen’s forecast, and the value could also be stabilizing above the essential $60,622 – $59,600 vary.

This stabilization aligns with Zen’s earlier evaluation in regards to the potential for a bounce from the vary backside, if the value holds above these ranges.

Right here, it’s additionally value noting that Zen predicted a possible dip to $60,150, citing cleared liquidity beneath $60,630 and a scarcity of quantity in night time buying and selling. He famous the day chart’s downtrend and the month chart’s uptrend, suggesting a blended however doubtlessly bullish outlook within the medium time period.

Lastly, Zen highlighted the opportunity of Bitcoin dipping to $53,000, which aligns with the month-to-month timeframe. This stays a really speculative chance although since it will require BTC to fall by over 10% on the charts.

Supply: X

Zen’s liquidity pool observations revealed that the closest swimming pools are at $61,540 and $62,540, above its press time worth, and at $60,260 and $59,440 under it. Merely put, Bitcoin’s proximity to those liquidity swimming pools, particularly the one close to $61,540, might doubtlessly affect short-term worth motion.

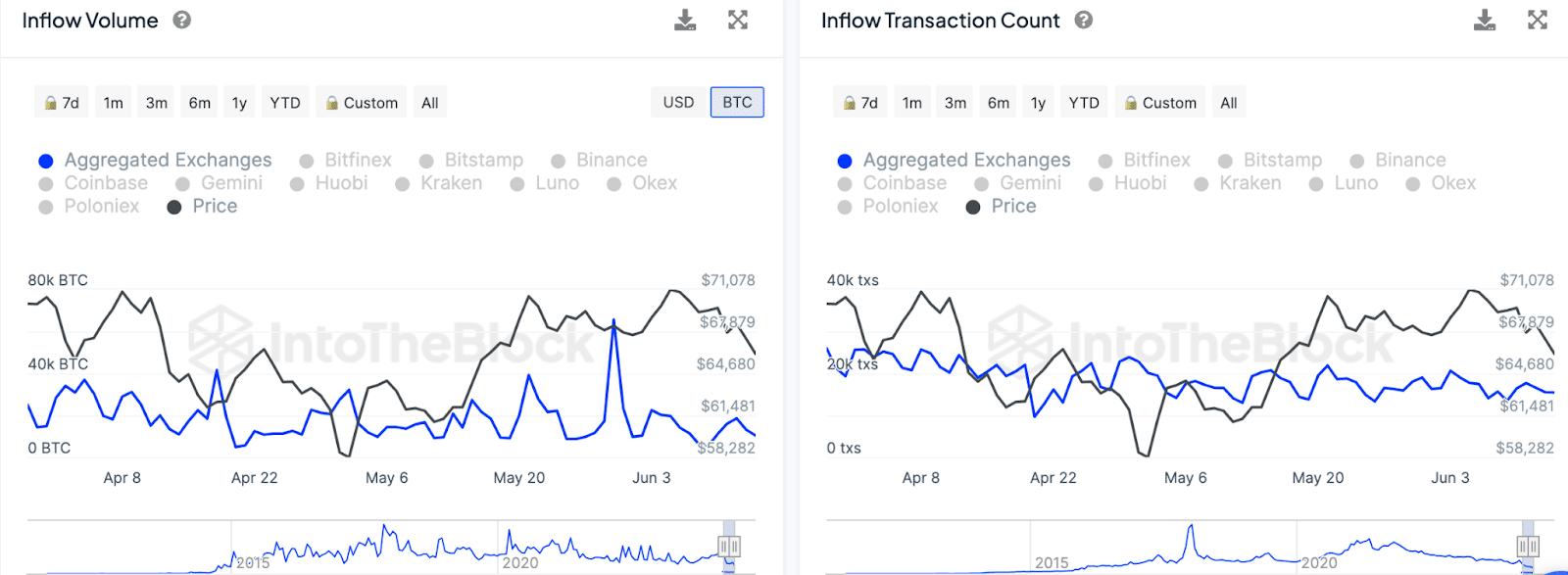

Analyzing Inflows Knowledge

Elsewhere, inflows have fluctuated considerably, with notable spikes in late April and early June. These spikes usually coincide with worth adjustments, indicating that giant volumes of Bitcoin transferring into exchanges can precede worth volatility. The transaction depend knowledge additionally highlighted related patterns, with elevated exercise correlating with worth actions.

Supply: IntoTheBlock

In truth, from 8 April to 22 April, each influx volumes and transaction counts have been excessive, aligning with a worth drop from $71,078 to $58,282.

In late April and early Could, spikes in influx volumes and transaction counts corresponded with worth peaks round $64,680 and $67,879, respectively.

Lastly, early June noticed a number of peaks in these metrics, with the value trending round $61,481, near the present degree on the charts.

Therefore, these are all ranges and metrics value taking a look at for a peek into the cryptocurrency’s future worth motion.