- Bitcoin could also be affected by the drop in stablecoins’ market cap

- RSI signalled potential reversal, regardless of BTC’s value declining on the charts

Bitcoin (BTC) has recorded vital value fluctuations lately, fueling blended reactions within the crypto market. In gentle of such volatility, it’s value stablecoins. This asset class performs an important function in cryptocurrency buying and selling, offering liquidity and publicity to the market.

Nonetheless, the latest $780 million drop in stablecoins’ market capitalization could also be an indication of lowered shopping for energy. This decline may result in weaker demand for cryptocurrencies, doubtlessly inflicting value stagnation or additional declines.

Supply: Ali/X

Bitcoin, because the market’s main crypto, is predicted to be closely affected, presumably coming into an prolonged accumulation interval or persevering with its ongoing downtrend.

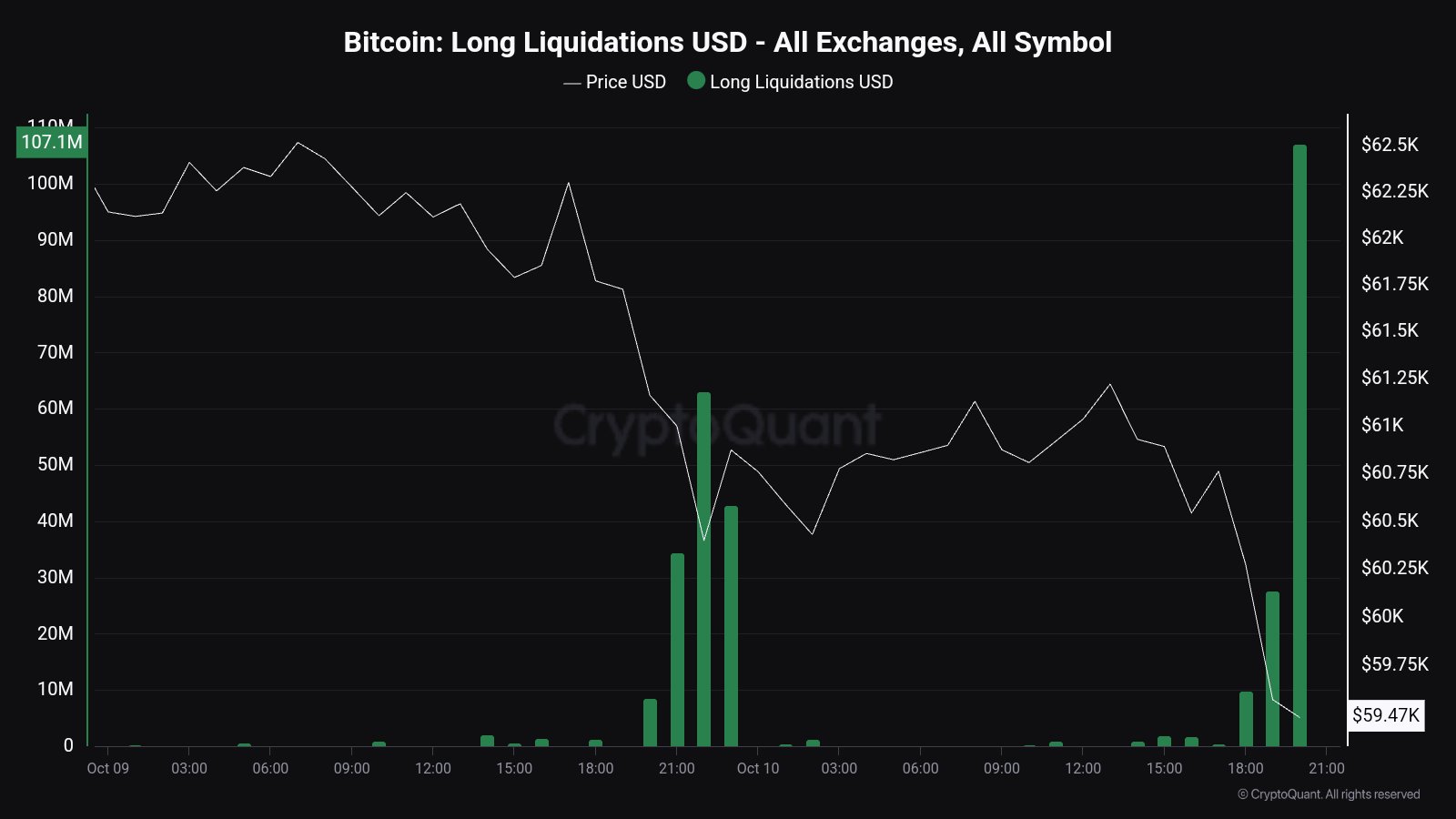

Declining value amidst liquidations

Analyzing the worth motion of BTC/USDT on the 2-hour timeframe revealed that Bitcoin has already tapped into liquidity on the $59.5k–$60k vary, even dropping under $59.5k.

Whereas there’s hope for a reversal, if one doesn’t happen, BTC may drop additional, doubtlessly testing $55k or decrease ranges.

Though this correction won’t be broadly anticipated, the drop in stablecoins’ market cap means that weaker demand may drive Bitcoin decrease earlier than any reversal.

Supply: TradingView

The probability of BTC dropping to $55k is relatively excessive because it has damaged under crucial help ranges, together with the 100 Day Shifting Common (DMA).

This indicator has acted as each help and resistance in latest months when BTC has been in a variety. Breaking under it’s a signal of bearish momentum.

Moreover, Bitcoin additionally dipped below the 200 Exponential Shifting Common (EMA), additional supporting the case for sustained draw back strain. Throughout this decline, over $107 million value of BTC longs have been liquidated when the worth dropped under $59.5k.

Supply: CryptoQuant

BTC’s RSI breaks above trendline

Regardless of these bearish alerts, there should be a glimmer of hope for a BTC restoration earlier than the yr ends.

Bitcoin’s Relative Energy Index (RSI) broke out of a 200-day downtrend. It gave the impression to be retesting this breakout stage at press time.

If BTC manages to carry above this development line, it may sign a reversal and supply some reduction for merchants and traders who’re anticipating a long-term uptrend for Bitcoin.

Supply: TradingView

Staying forward of those market strikes is essential, particularly as Bitcoin’s value stays at a pivotal level.

Whereas additional declines are potential, the potential for a reversal can be current, making this a crucial time for merchants and traders to look at BTC intently.