- The absence of serious catalysts has left the crypto market delicate to US macro information prints.

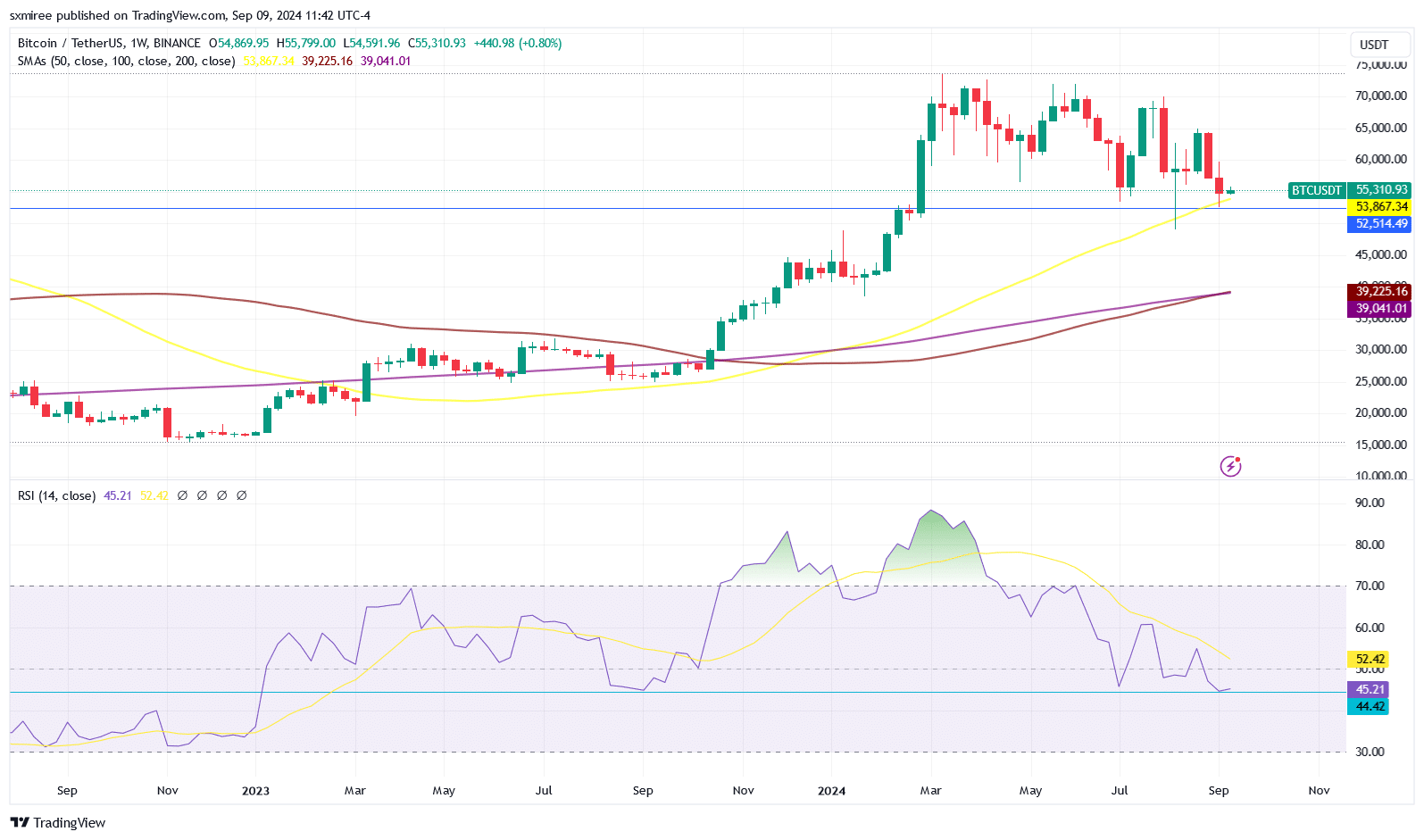

- Bitcoin’s weekly Relative Power Index studying closed at its lowest stage since January 2023.

Bitcoin [BTC] briefly climbed above $55,500 on ninth September after delicate losses heading into the weekend, which cemented detrimental returns of 4.26% for the just-concluded week.

Although not as deep because the 11% slide within the previous week, the marginally underwhelming shut marked consecutive weekly losses for the crypto asset since tenth June, when it tracked declines for 4 straight weeks.

Observers chalked up final week’s dip to the U.S. non-farm payroll information and detrimental flows from Bitcoin ETFs. The newest U.S. jobs report revealed the financial system added 142,000 non-farm payrolls in August, wanting the expectations of 160,000.

In the meantime, information from SoSo Worth confirmed Bitcoin spot ETFs are on an eight-day streak of outflows.

Ultimate week of inflation information earlier than FOMC assembly

This week, market members welcome extra U.S. financial information that might affect the Fed’s 18th September charge choice and influence the general market course.

The Bureau of Labor Statistics will launch August’s U.S. Client Value Index report on Wednesday, eleventh September, adopted by the Producer Value Index information on Thursday.

The releases come after Tuesday’s US Presidential debate between candidates Kamala Harris and Donald Trump. Forward of the talk, analysts at Bernstein have identified that the election’s final result and the character of the regulatory atmosphere usually are not accounted for within the present market.

The analysts led by Gautam Chhugani forecast that Bitcoin may fall to the $30,000 to $40,000 vary if Democrat nominee and VP Harris is elected as President.

A Trump victory within the November elections may, however, propel Bitcoin above $80,000 by the fourth quarter.

Additional decline beneath $50,000 on the playing cards

In his newest evaluation involving Bayesian possibilities, chart dealer Peter Brandt famous that technical indicators have been more and more leaning in favor of his preliminary low $30,000 vary projection.

He stated,

“Currently, my Bayesian Probability for sub-$40,000 is at 65% with a yet-to-be-achieved top at $80,000 at 20% and an advance during this halving cycle to $130,000 by September 2025 at 15%.”

Brandt’s evaluation builds on his preliminary worth forecasts. In April, he noticed that BTC worth had reached a market high after setting an all-time excessive of $73,835, and in Might, he projected a continuation of a bull pattern on the time.

Brandt isn’t alone within the bearish evaluation. 10x Analysis founder Markus Thielen additionally opined that Bitcoin reached a cycle high in April drawing consideration to lowered Bitcoin community exercise after Q1.

Thielen additionally recognized regular Bitcoin ETF outflows and a weak US financial system as different bearish components that might drive BTC down additional.

Halving thesis nonetheless in play

Bitcoin made a brand new all-time excessive this yr earlier than the halving and has been buying and selling sluggishly for the reason that occasion. Nonetheless, some analysts contend that Bitcoin is poised for additional positive factors primarily based on the worth motion in earlier halving years.

Bitcoin persistently tracked positive factors throughout October, November, and December 2016 and 2020.

Supply: Peter Brandt

Value noting, Bitcoin’s worth relative to gold has been making decrease highs this yr regardless of a lift from spot Bitcoin ETFs debut and March’s halving occasion. Brandt believes this continued worth weak spot may drive the BTC/Gold ratio to succeed in 15 to 1.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

BTC/USDT potential rebound

Bitcoin is buying and selling close to $55,400 at writing after posting the bottom weekly shut since late February. The BTC weekly RSI equally closed at its lowest stage for the reason that begin of 2023.

Supply: TradingView

Curiously, Bitcoin order books trace at a possible bullish setup on the horizon as does the Bitcoin CME futures chart. Bitcoin futures opened greater than final week, shifting again right into a descending wedge sample after briefly breaking beneath it.