- The rising leverage ratio and Open Curiosity is likely to be holding Bitcoin again.

- The pitchfork and 200 DMA assist failure pointed to a value drop beneath $60k.

Bitcoin [BTC] has fallen beneath the 200-day easy transferring common. It was presently buying and selling inside the $60k-$60.5k assist zone however has a great probability of falling to $56k and doubtlessly decrease.

CoinMarketCap confirmed the Crypto Concern and Greed index was at 48. Bearish sentiment gripped the market and merchants is likely to be tempted to commerce on margin to make again losses, which may backfire spectacularly.

Is the Bitcoin backside close to?

Supply: Axel Adler on X

Crypto analyst Axel Adler identified that the value crashes since 2023 Might have had drawdowns from 17% to 23%. The present determine was at 16.4%. In comparison with the previous twelve months, the underside seemed to be shut.

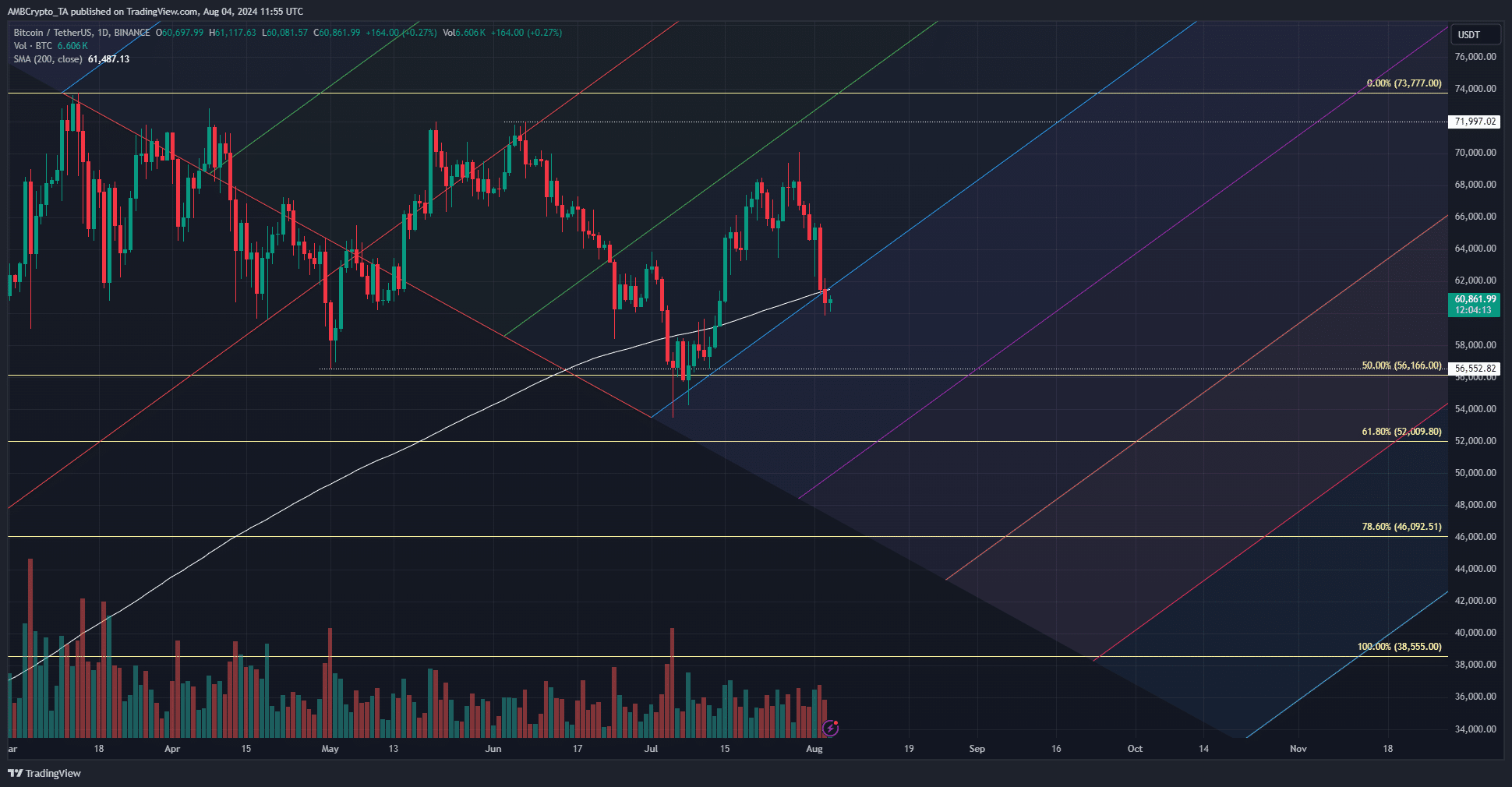

Supply: BTC/USDT on TradingView

The Fibonacci retracement stage is on the $56k stage, which has already been examined as assist in early July. The truth that the bulls had been unable to defend the 200-day easy transferring common was a strongly bearish signal.

Moreover, the pitchfork plotted within the above chart confirmed that the $61.3k stage was a confluence of 200DMA and the pitchfork assist, making its failure extra important.

Was the derivatives market too heated up?

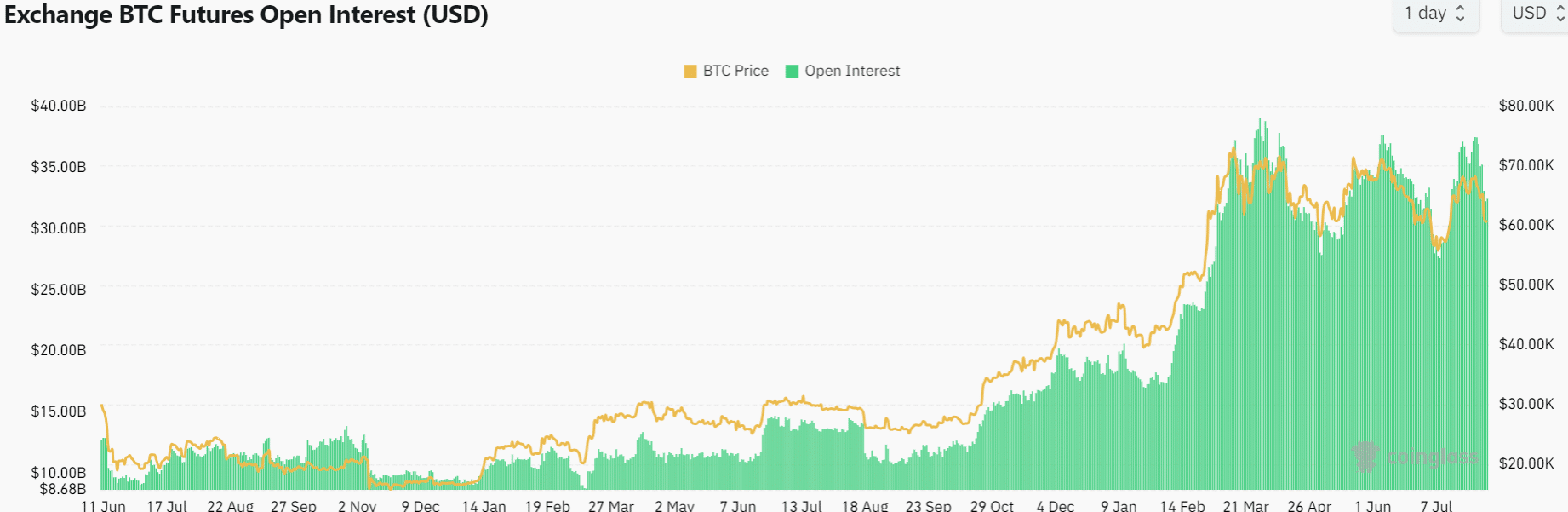

Supply: Coinglass

Since March, the $70k stage, which can be near the all-time excessive, has not been convincingly overwhelmed. Throughout this era the Open Curiosity has hovered within the $30 billion to $35 billion territory.

Over the previous week, it has fallen by $4 billion to replicate bearish short-term sentiment.

A correct bull run requires excessive spot demand, and when the futures market will get too heated up, the overeager bulls and bears typically expertise ache by means of value volatility, which may reset the upward trajectory.

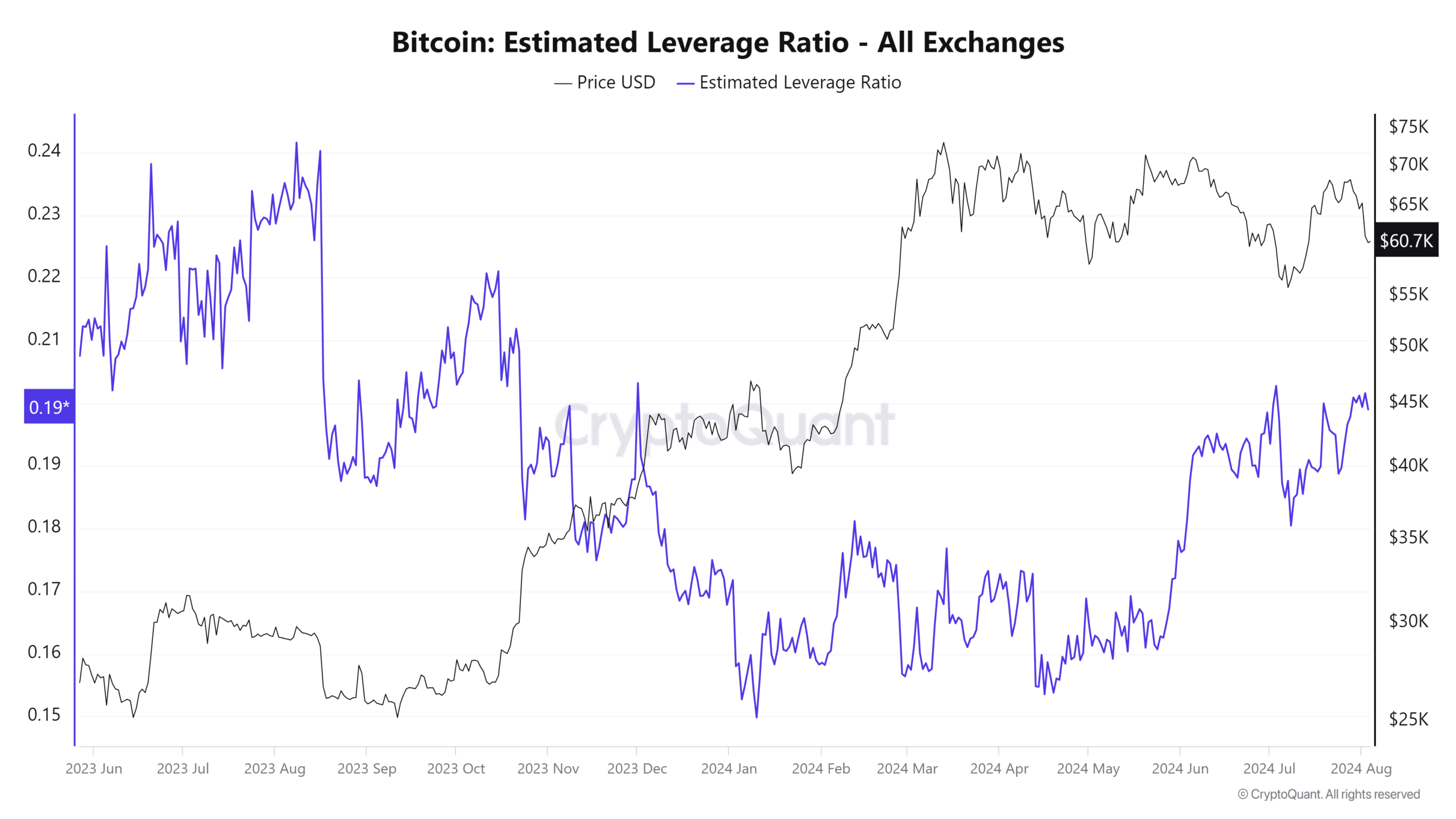

Supply: CryptoQuant

The estimated leverage ratio has been rising since June. A rise on this metric signifies traders are taking elevated dangers with leverage buying and selling. This may very well be as a consequence of hopes of a bullish breakout.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

This could harm the possibilities of a breakout because the value is interested in the lengthy liquidations ranges to the south.

An earlier report famous that the long-term holder promoting strain has fallen in latest weeks. This meant that the $60k is likely to be the native backside, however a deeper retracement because of the macro occasions and market-wide panic cannot be dominated out.