- The FED anticipated to chop charges from September to December month-to-month.

- Prime belongings to contemplate shopping for in response to delayed fee choices sample.

The Federal Reserve lower rates of interest too late in 2020, raised them too late in 2022, and once more they’re reducing them too late in 2024, as market analyst Patric famous on X (previously Twitter).

This constant delay in choices has impacted monetary markets. It’s now anticipated that the Fed will lower charges from September to December month-to-month as per goal fee chances.

That is difficult for the general public however helpful for cryptocurrencies. The Fed delayed these actions as a result of reducing charges isn’t advisable when inflation is excessive, as it could possibly hurt the financial system.

Now, with fears of a recession, inflation is now not the one concern.

Supply: CME Group

Slicing rates of interest and probably printing more cash is a short-term repair for the financial system.

Nevertheless, it hurts extraordinary individuals who solely have money as a result of it causes inflation, making their cash much less beneficial. This occurred in 2020 as effectively.

This sample of delayed fee choices can create alternatives to purchase sure belongings. Folks want to concentrate on how these adjustments affect their financial savings and contemplate investing in belongings that may defend their wealth in opposition to inflation.

Listed below are the three belongings to contemplate shopping for in response to this sample:

BTC: Covid crash vs. recession crash

Earlier than a giant bull market, we regularly see a giant crash or an extended consolidation section. Bitcoin’s worth motion in 2020 is much like 2024.

After breaking out of a descending wedge in 2020, BTC rallied to a brand new ATH following the COVID-19 crash.

This raises the query: Will historical past repeat for Bitcoin? At present, Bitcoin remains to be in a big consolidation section, and the large breakout has but to occur, however it’ll, certainly.

Supply: TradingView

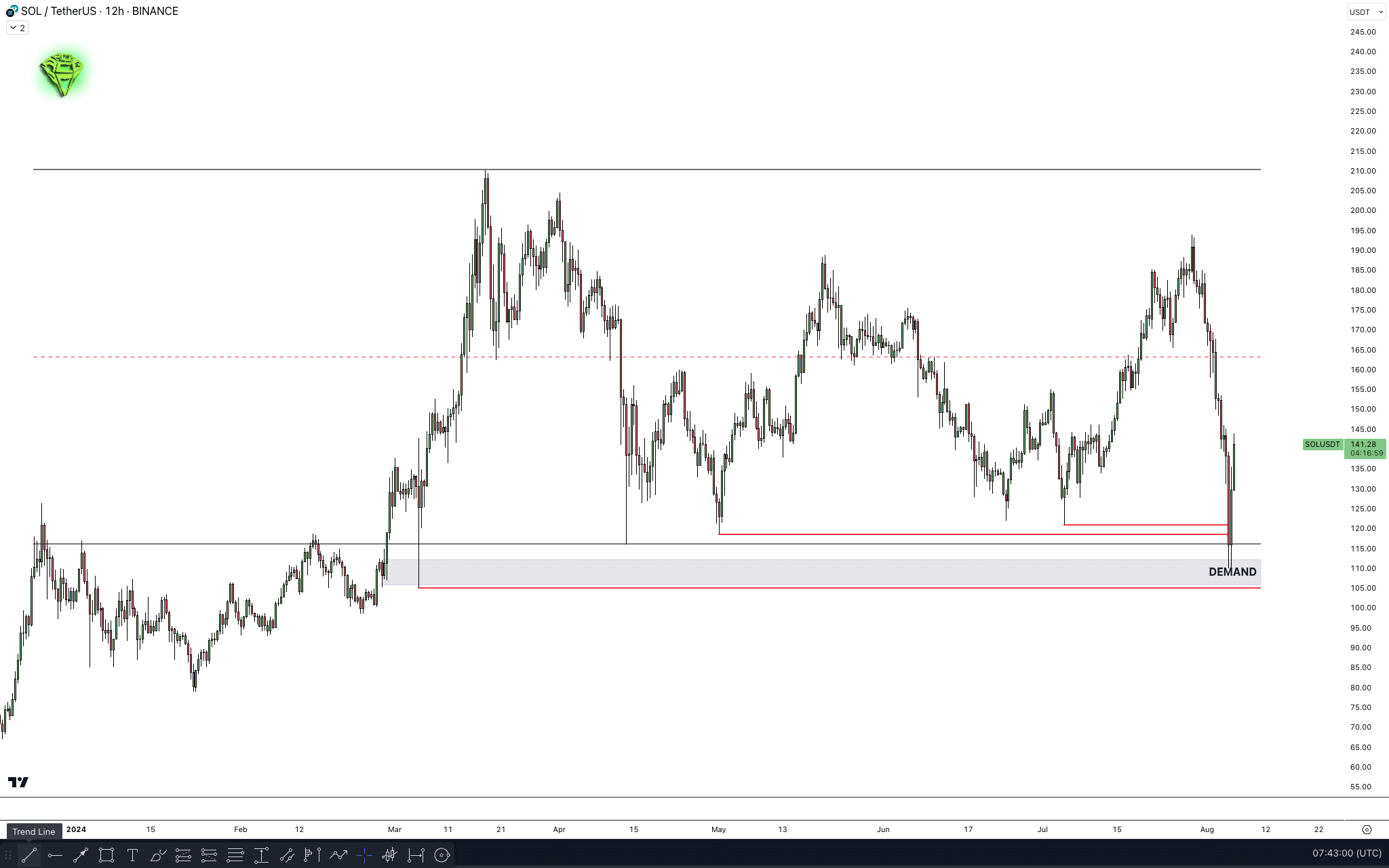

Solana rejected at $110 help

The SOL chart is wanting promising. It examined the necessary $110 help and resistance degree after which bounced again inside the vary.

This motion touched a key demand degree and cleared many decrease costs. There’s no want to purchase instantly throughout a worth surge, but when the worth dips, Solana is an effective choice to contemplate.

Supply: TradingView

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

DOGE assessments resistance-turned help degree

Dogecoin is bouncing again from a key help degree, making it an excellent choice for long-term good points regardless of the present market crash.

The value has proven a powerful restoration at this degree, and with the formation of a double backside, it signifies potential for important returns within the coming months.

Supply: TradingView