- Bitcoin witnessed a big uptick in value, inflicting bears to get liquidated.

- General lengthy positions grew, and curiosity in ETFs surged.

After hovering across the $60,000 mark for fairly a while, Bitcoin [BTC] witnessed some optimistic value motion, injecting hope into optimistic bulls.

Brief sighted

Regardless that the bulls rejoiced, the bears obtained the worst finish of the deal. An enormous variety of quick positions had been liquidated over the past 24 hours. This may end up in a brief squeeze.

As the value goes up, quick sellers face margin calls from exchanges to take care of their positions or are pressured to purchase again BTC to shut their shorts. The shopping for by determined quick sellers to exit their positions pushes the value even greater, attracting new consumers chasing the upswing.

This cycle can result in dramatic value will increase for BTC, exceeding preliminary expectations.

Regardless that quick sellers can expertise important losses, the market can develop into extremely unstable with potential corrections as some buyers take earnings.

Whereas a brief squeeze may be optimistic for bulls positioned accurately, it’s a high-risk state of affairs for everybody concerned as a result of potential for the market to reverse course and liquidate merchants as costs transfer violently.

Supply: X

Nevertheless, these elements haven’t slowed down the bulls one bit.

Bulls march forward

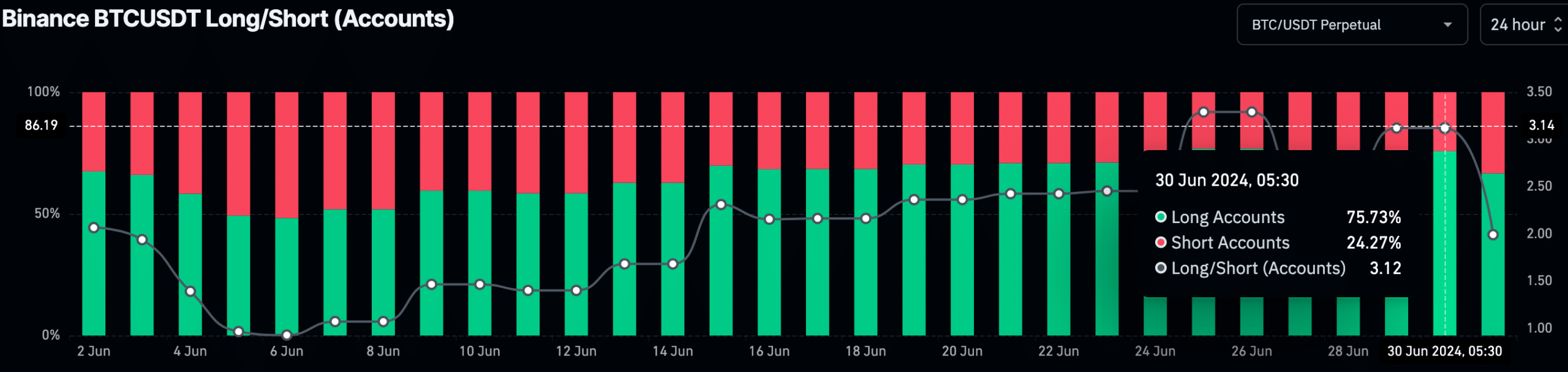

There’s a robust sense of optimism amongst Bitcoin merchants on Binance. AMBcrypto’s latest evaluation of Coinglass’ information confirmed {that a} whopping 75% of open positions on the platform within the final 24 hours had been lengthy bets, indicating a bullish bias.

This sentiment is especially evident for BTC/USDT perpetual contracts, probably the most closely traded crypto pair on Binance.

The development means that many retail merchants on Binance imagine in Bitcoin’s potential for development, even amidst the present market uncertainties.

They’re doubtless wanting previous the short-term volatility, and predict an extra surge in value.

Supply: Coinglass

Institutional curiosity rises

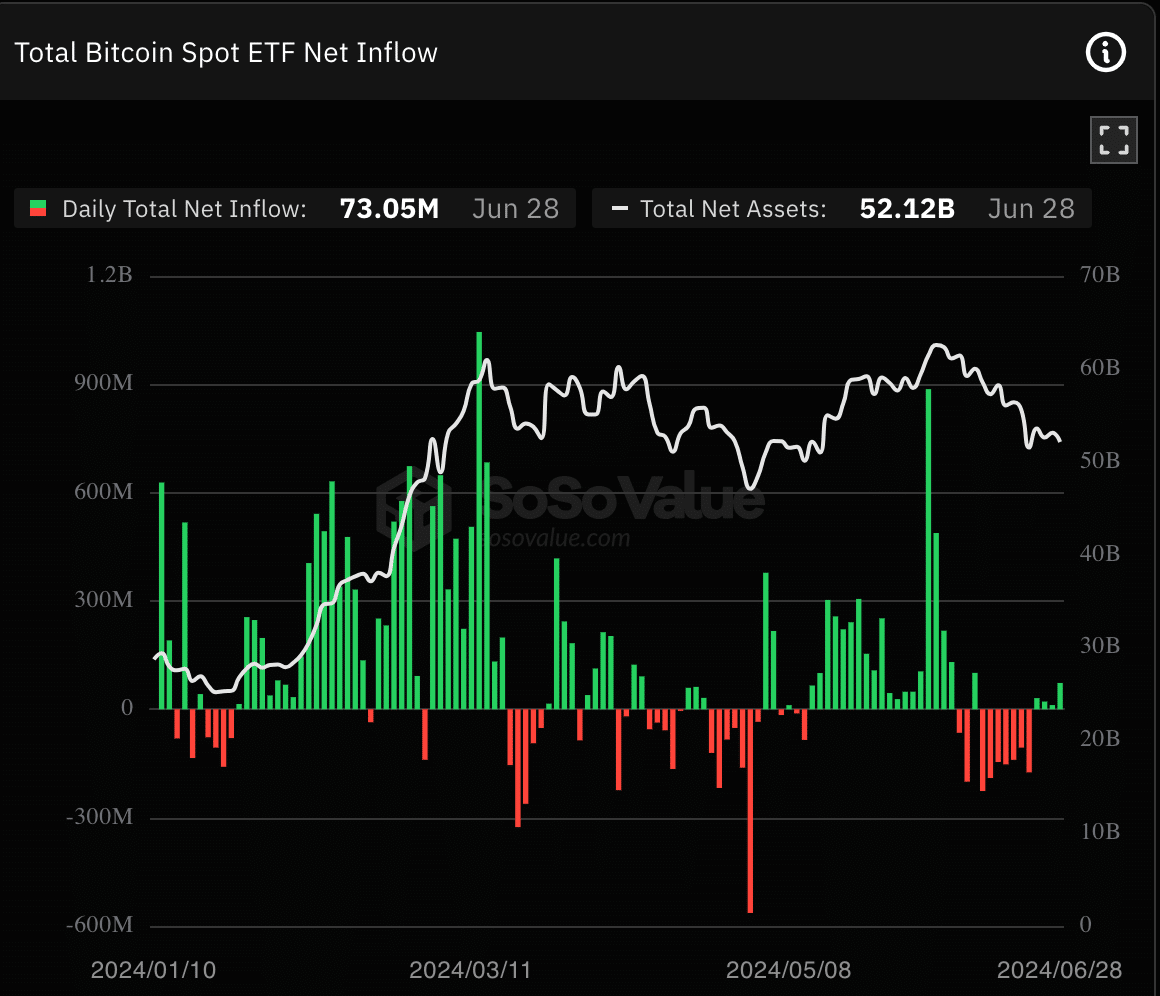

Including to this optimistic sentiment, Wall Road can also be displaying renewed optimism round BTC.

After a number of days of detrimental internet inflows into Bitcoin ETFs, the development has reversed, with general inflows turning optimistic once more.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

A rising quantity of retail curiosity coupled with institutional confidence may also help BTC rally additional.

On the time of writing, BTC was buying and selling at $62,784.09 and its value had grown by 2.17% within the final 24 hours.

Supply: sosovalue