- STHs have logged $7 billion in realized losses, probably the most on this cycle

- Bitcoin’s worth stays beneath key shifting averages, with short-term holder conduct essential to near-term pattern path

Quick-term Bitcoin [BTC] holders are feeling the warmth as unrealized losses mount, marking a essential inflection level on this market cycle. Nevertheless, regardless of all of the stress build up, historical past means that this can be a pure cooling section inside a broader bull pattern.

Bitcoin losses climb, however keep inside historic vary

The truth is, knowledge from Glassnode revealed that the relative unrealized losses for short-term holders [STHs] could also be nearing the +2 normal deviation stage – A threshold traditionally related to peak misery.

And but, they continue to be inside the higher bounds usually seen throughout bull markets, not but breaching capitulation territory.

Supply: Glassnode

The press time stage of STH ache appeared to be notable too, with over $7 billion in realized losses recorded during the last 30 days.

Whereas this determine is the best realized loss occasion of the present cycle, it’s considerably under the staggering $19.8 billion and $20.7 billion ranges seen throughout the main drawdowns of Could 2021 and June 2022.

Which means that whereas losses have been growing, many buyers are nonetheless exiting earlier than excessive capitulation kicks in. In different phrases, short-term holders could also be locking in modest losses, moderately than enduring deeper drawdowns – A attainable signal of broader market power.

Bitcoin’s worth construction and danger zones

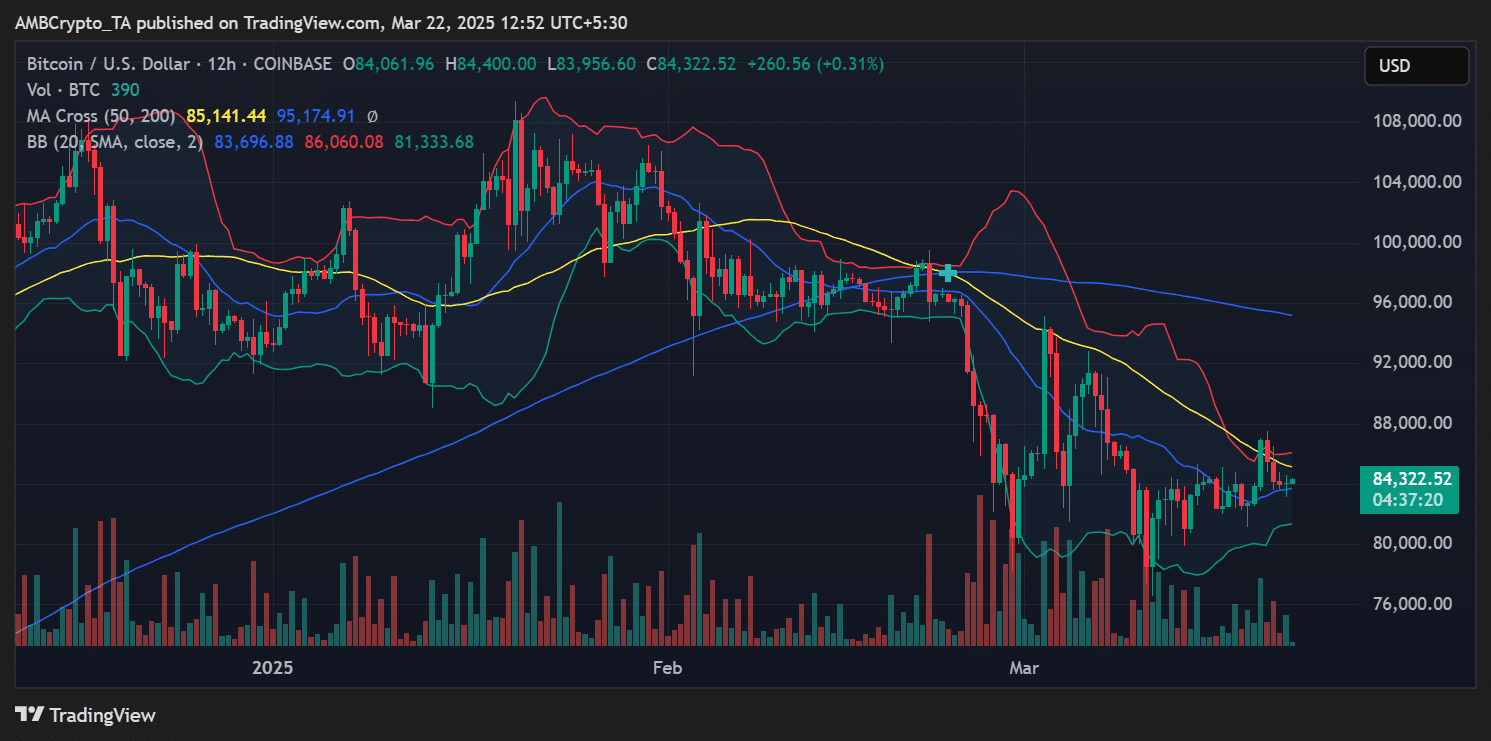

Bitcoin was buying and selling at $84,322 at press time, with the crypto hovering slightly below its 50-day shifting common of $85,141 and effectively beneath the 200-day shifting common at $95,174.

These ranges type key resistance zones and will proceed suppressing upward momentum. Particularly if short-term holder sentiment stays weak.

Supply: TradingView

The Bollinger Bands additionally highlighted a tightening vary, hinting at a possible breakout forward.

Nevertheless, with short-term holders beneath stress, the bias might tilt bearish except new demand enters the market.

What this implies for Bitcoin’s pattern

The mix of rising unrealized and rising realized losses prompt elevated danger, significantly for these holding Bitcoin acquired at latest highs. Nevertheless, the truth that these losses stay inside historic bull market patterns is an indication {that a} macro reversal isn’t but confirmed.

If BTC can reclaim the $85,000-level and flip it into assist, it might renew confidence amongst STHs. Conversely, failure to carry $83,000 might result in extra promoting whereas testing decrease helps close to $80,000.

Total, short-term ache is obvious, however not but excessive. So long as Bitcoin holds above key psychological ranges and macro flows stay intact, this correction could serve extra as a reset than a reversal.