- Sentiment throughout social media platforms for Bitcoin declined considerably over the previous few days.

- ETF inflows for BTC surged regardless of the damaging sentiment.

Bitcoin’s [BTC] current decline in value has impacted a number of cryptocurrencies throughout the board, as the general market outlook has turned damaging.

Sentiment will get bearish

Based on Santiment’s knowledge, this week, Bitcoin sentiment throughout social media platforms like X (previously Twitter), Reddit, Telegram, 4Chan, and BitcoinTalk has plunged to its most bearish level in a 12 months.

Merchants had been expressing excessive concern, uncertainty, and doubt (FUD) at an unprecedented stage. This negativity might truly sign a shopping for alternative.

Traditionally, when the gang will get this bearish, it could actually create an opportunity for a pointy rebound that catches the bulk off guard.

So, whereas the FUD may be deafening, it is also an indication {that a} value swing is on the horizon.

Supply: X

Inflows on the rise

Bitcoin spot ETFs witnessed their highest each day web influx in over three weeks on the eighth of July. The whole influx reached $295 million, indicating robust investor urge for food for Bitcoin regardless of the current value hunch.

This constructive sentiment got here even because the German authorities bought a record-breaking quantity of BTCs yesterday, amounting to $915.3 million.

Breaking down the ETF inflows, Grayscale’s GBTC attracted $25.08 million, whereas BlackRock’s IBIT noticed a considerably bigger influx of $187 million. Constancy’s FBTC additionally recorded a wholesome influx of $61.54 million.

These figures recommend that traders are more and more turning to identify ETFs as a handy and controlled option to achieve publicity to Bitcoin.

The $295 million web influx represents new capital getting into the Bitcoin market by way of ETFs. This elevated demand might push the worth of BTC upwards, particularly if it’s sustained over time.

It additionally signifies that regardless of declining sentiment throughout social media, establishments and fiat traders are bullish about BTC’s future.

Supply: SoSoValue

How are holders doing?

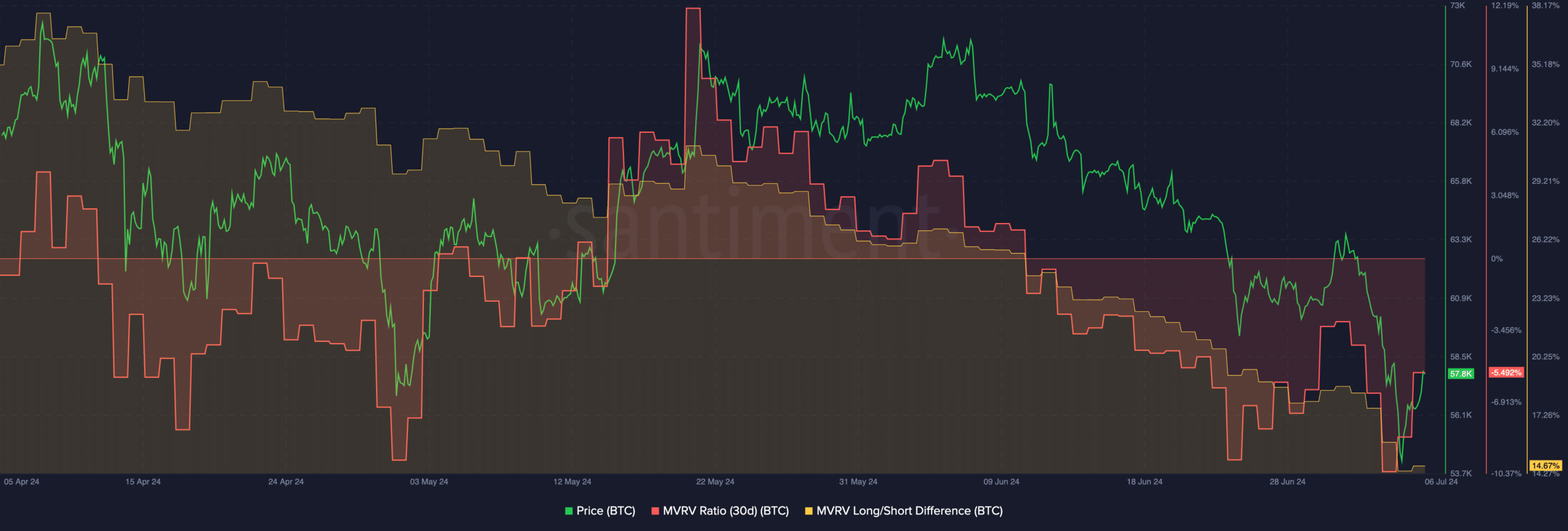

At press time, BTC was buying and selling at $57,404.26. Within the final 24 hours, the worth of BTC grew by 3.87%. Additionally, the MVRV ratio for BTC fell considerably in the previous few days regardless of the current surge in value.

Learn Bitcoin’s [BTC] Value Prediction 2024-2025

This indicated that the profitability of the addresses had declined, and most addresses wouldn’t revenue in the event that they bought their holdings.

Despite the fact that this will influence sentiment negatively, it additionally offers much less of an incentive for BTC addresses to promote their holdings, which ends up in lowered promoting strain on the community.

Supply: Santiment