- Bitcoin ETFs face $671.9M outflow, ending a 15-day streak as crypto costs plummet.

- Constancy, Grayscale lead ETF sell-off as $1B is liquidated throughout the crypto market in 24 hours.

Bitcoin’s [BTC]exchange-traded funds (ETFs) in the USA skilled a record-breaking single-day web outflow of $671.9 million on December 19.

This marks the most important outflow since their launch and ended a 15-day streak of inflows for BTC ETFs and an 18-day streak for Ethereum [ETH] ETFs.

Information from Farside Buyers reveals that Constancy’s FBTC led the outflows, shedding $208.5 million. Grayscale’s GBTC and ARK Make investments’s ARKB adopted with outflows of $208.6 million and $108.4 million, respectively.

In distinction, BlackRock’s IBIT ETF remained unchanged, with no reported web outflows or inflows.

Market sell-off accompanies crypto worth drops

The document outflows coincided with sharp declines in Bitcoin and Ethereum costs. Bitcoin dropped 9.2% within the final 24 hours, settling round $93,145.17, whereas Ethereum skilled a steeper 15.6% decline. Over $1 billion was liquidated throughout the crypto market on this interval.

Sosovalue knowledge revealed that the overall web property of Bitcoin ETFs dropped to $109.7 billion as of the nineteenth of December, down from $121.7 billion simply two days earlier. This sharp lower erased a lot of the beneficial properties seen earlier in December.

The sell-off bolstered Bitcoin’s dominance within the crypto market, which stood at 57.4%, sustaining its place because the main asset regardless of the current turbulence.

Federal Reserve coverage and broader financial considerations

The sharp downturn in crypto markets has additionally been linked to broader macroeconomic considerations. Buyers anticipated a 0.25% rate of interest lower from the U.S. Federal Reserve, however feedback from Fed Chair Jerome Powell steered a extra cautious outlook.

Powell indicated that solely two fee cuts could happen in 2025, signaling a slower tempo of financial easing than anticipated.

The hawkish sentiment from the Federal Reserve additionally affected conventional markets, with the S&P 500 seeing a decline. Analysts imagine this uncertainty could have additional pressured the crypto market, as threat sentiment shifted away from progress property.

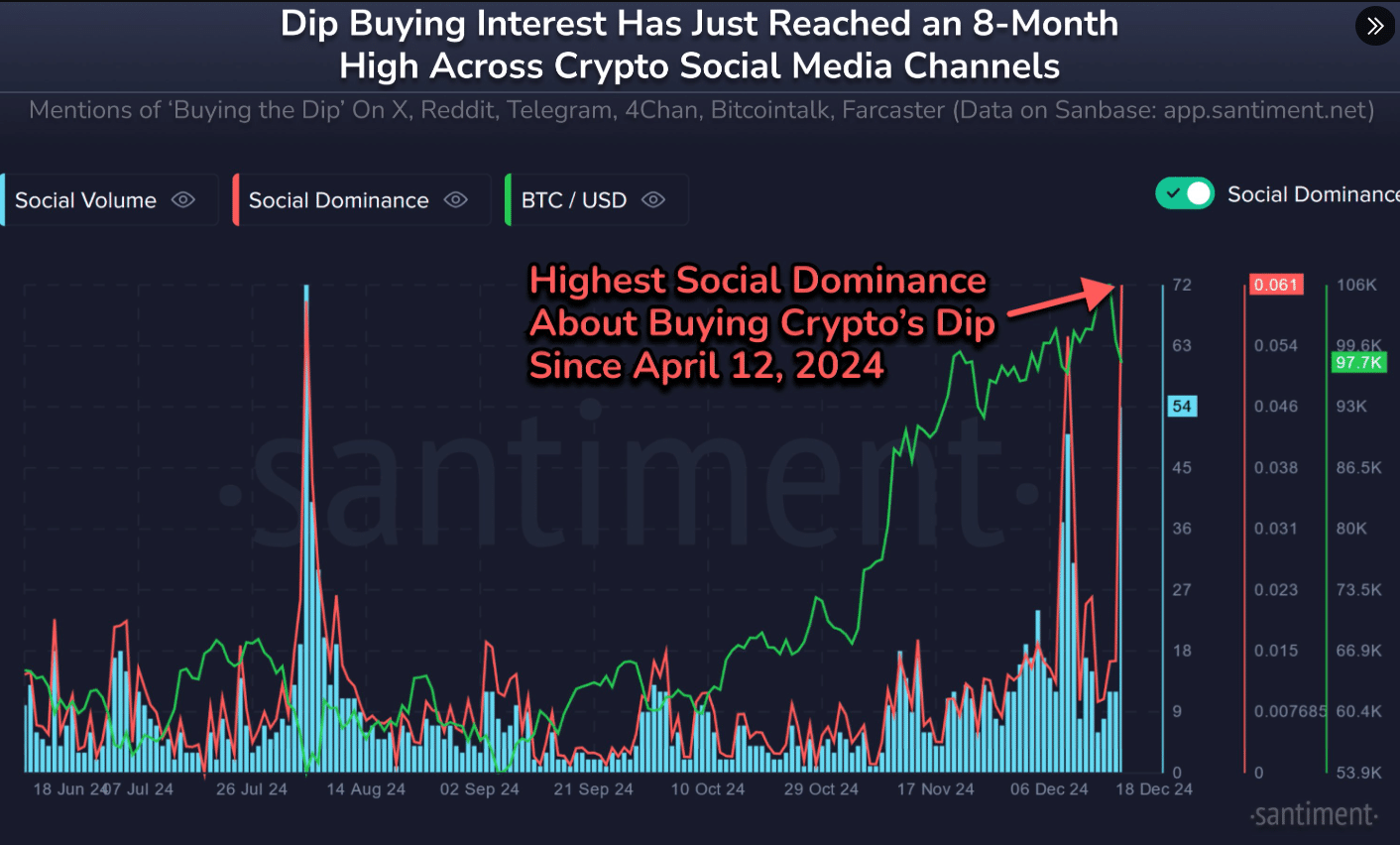

Elevated “buy the dip” sentiment amidst market uncertainty

Regardless of the market downturn, a surge in “buy the dip” discussions was noticed throughout social media platforms. Information from Santiment confirmed that mentions of “buying the dip” reached their highest degree in over eight months.

Supply: X

The final time this sentiment peaked was in April, when Bitcoin’s worth fell from $70,000 to $67,000, earlier than persevering with its decline.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Whereas some merchants stay cautious, the renewed discussions counsel {that a} portion of traders stay optimistic about potential restoration alternatives within the crypto market.