- Extra Bitcoin holders have remained in revenue regardless of the current decline.

- BTC was buying and selling above $66,000 at press time.

Bitcoin’s [BTC] current value actions have impacted completely different courses of holders, with some experiencing notable beneficial properties.

A research of the time BTC was held, the acquisition value relative to the present value, and different elements confirmed which class of holders has had probably the most optimistic expertise.

Bitcoin trades at over $66,000

Bitcoin’s value pattern evaluation on a each day timeframe highlighted a sequence of current uptrends which have allowed it to regain a major value stage.

Based on an evaluation by AMBCrypto, on the twenty first of July, BTC’s value climbed to over $68,000, marking a rise of greater than 1%.

This rise peaked after a number of days of upward motion, an essential restoration contemplating the sharp drop it skilled initially of the month.

Supply: TradingView

Regardless of this optimistic momentum, some beneficial properties had been subsequently misplaced, but it has maintained its worth above the $60,000 threshold. As of this writing, it was buying and selling at round $66,500, with a slight decline of over 1%.

How the rise affected holders

The evaluation of the World In/Out of Cash Index on IntoTheBlock supplied a compelling overview of the present state of Bitcoin.

Most holders are in a worthwhile place on the press time BTC value. Particularly, practically 49 million addresses, representing over 92% of all holders, had been worthwhile.

This confirmed the general market well being and the beneficial properties most contributors have skilled throughout previous value will increase.

Conversely, about 2.2 million addresses, accounting for roughly 4.14% of holders, confronted losses, indicating that these holders could have bought their property at larger value ranges.

Moreover, round 2 million addresses had been at a break-even level, neither in revenue nor loss, making up about 3.78% of all holders.

These statistics underscored a predominantly bullish sentiment within the Bitcoin market. The Relative Energy Index (RSI), round 60, additional strengthened this sentiment.

An RSI worth above 50 usually signaled bullish momentum, suggesting that the market would possibly proceed to see optimistic developments.

Lengthy-term holders having fun with extra revenue

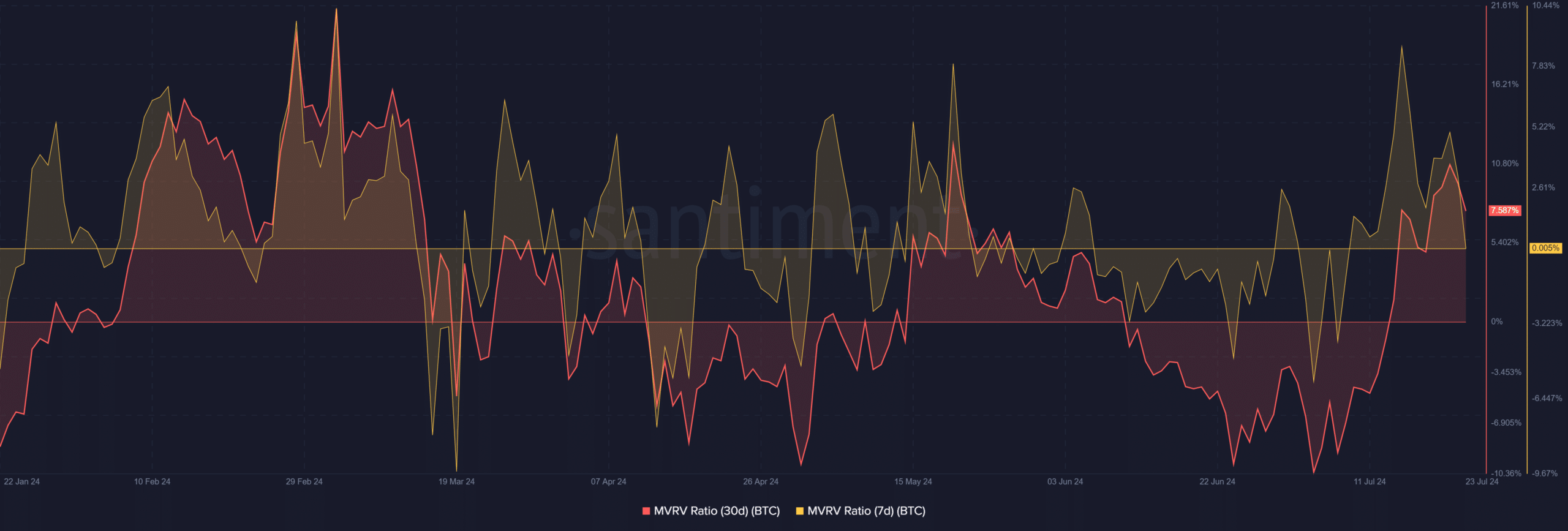

AMBCrypto’s take a look at Bitcoin’s Market Worth to Realized Worth (MVRV) ratios over completely different timeframes supplied precious insights into the efficiency of assorted courses of holders.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

The seven-day MVRV was round 0.6%, indicating a marginal revenue for current patrons. Nevertheless, this worth was declining and signaled that the short-term beneficial properties for these current purchasers had been diminishing.

Supply: Santiment

In distinction, the 30-day MVRV painted a extra favorable image for longer-term holders, standing at over 8%. Thus, those that bought Bitcoin a month in the past have accrued considerably larger earnings than newer patrons.