- Lengthy-term Bitcoin holders exhibited confidence, promoting much less regardless of market fluctuations and nearing all-time highs.

- Bitcoin’s sturdy help at $63,440-$65,470 and rising liquidity advised potential for upward momentum.

CryptoQuant Founder & CEO Ki Younger Ju lately commented on the conduct of Bitcoin [BTC] traders.

He said that those that held Bitcoin for six months to 2 years have now largely offered their holdings because the crypto neared its earlier all-time excessive.

The founder famous,

“If you’re selling Bitcoin now, you likely haven’t held it for over 3 years, as veteran holders aren’t selling.”

This conduct advised that long-term traders have maintained their confidence in Bitcoin’s long-term worth.

CrypNuevo additionally mentioned Bitcoin’s future trajectory, stating that liquidity on the $68.9k stage was steadily rising.

In keeping with CrypNuevo, it appears inevitable that Bitcoin will attain this stage, though it stays unsure whether or not there shall be a dip earlier than reaching it or if the worth will proceed to rise immediately.

Supply: X

In keeping with analyst Ali Martinez, Bitcoin is at the moment.

“Breaking through multiple trend lines in the hourly chart.”

He additionally recognized a essential help stage for Bitcoin between $63,440 and $65,470, the place 1.89 million addresses acquired 1.23 million BTC.

This help zone is significant because it suggests a robust shopping for curiosity at these ranges, which might assist stabilize the worth throughout any potential dips.

Present market situations

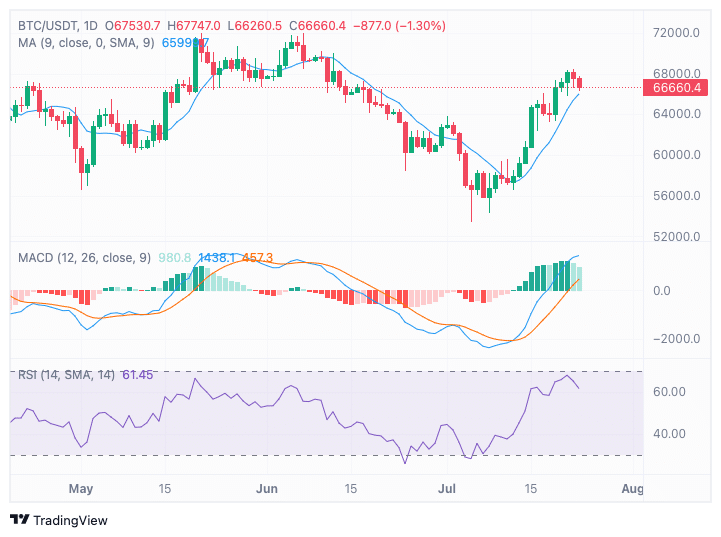

As of press time, Bitcoin was priced at $66,680.44, with a 24-hour buying and selling quantity of $43,180,179,849. Bitcoin’s value has dropped by 0.85% within the final 24 hours.

The 9-day easy shifting common (SMA) was at 6599, indicating that the current value was barely above this stage, suggesting a short-term bullish pattern.

The Shifting Common Convergence Divergence (MACD) indicator confirmed a bullish crossover, with the MACD line crossing above the sign line earlier in July.

This bullish sign was supported by rising inexperienced histogram bars, suggesting rising momentum.

Nonetheless, warning is suggested because the MACD approaches the overbought area, which can point out a possible reversal or correction.

Supply: TradingView

On the time of writing, the Relative Power Index (RSI) was 61.45, suggesting the market is in bullish territory however not but overbought.

The RSI has been rising from oversold ranges seen in late June, reflecting strengthening upward momentum.

Regardless of the bullish sentiment, the RSI nearing the 70 stage might sign rising overbought situations, warranting vigilance for potential bearish divergence or pattern reversal.

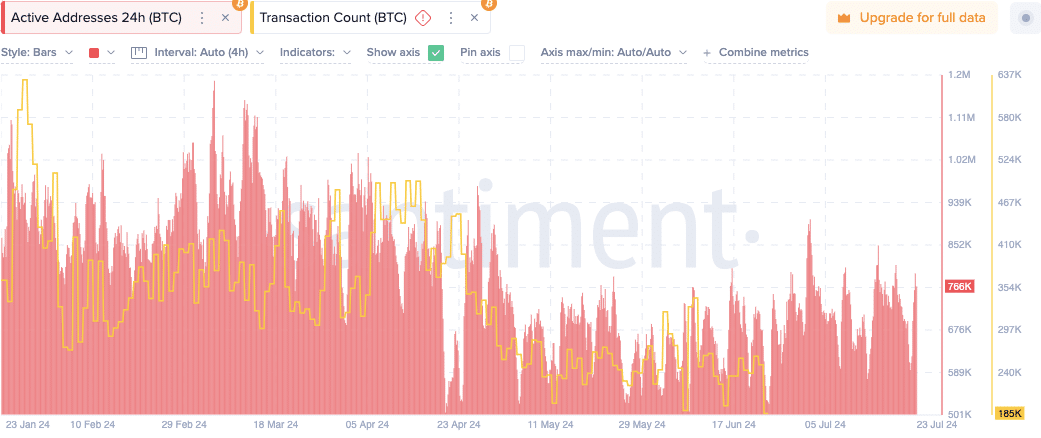

On-chain exercise

On-chain knowledge revealed that energetic addresses have fluctuated, peaking considerably in late February and early April, however usually declining in direction of July, with the most recent depend at 766K.

Supply: Santiment

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Transaction counts have mirrored this pattern, with notable spikes in exercise throughout the identical durations and the most recent transaction depend at 185K.

This decline in on-chain exercise advised diminished engagement and transaction quantity in current months, aligning with the general market tendencies.