- There’s a distinct correlation between Bitcoin and the S&P 500

- Bitcoin miner reserves could also be price preserving a watch out for too

Bitcoin is commonly labeled as a risk-on asset, which is a time period bolstered by how folks spend money on it. Essentially the most notable attribute of this classification is that Bitcoin has traditionally demonstrated correlation with the S&P 500.

The correlation between Bitcoin and the S&P 500 normally underscores investor diversification within the risk-on class. Nonetheless, there are cases the place Bitcoin has misplaced its correlation with the inventory market. This was evident in June and July, phases which had been characterised by differing elements comparable to Bitcoin’s involvement in politics.

In keeping with newest knowledge, nevertheless, Bitcoin is as soon as once more transferring in tandem with the inventory market. The correlation coefficient bounced from its lowest level to start with of August and turned constructive in mid-August.

Supply: CryptoQuant

Fee cuts expectations are the widespread denominator for this correlation. The U.S Federal Reserve is slated to carry its subsequent FOMC assembly within the subsequent 4 days. Expectations have been overwhelmingly leaning in the direction of a sizeable charge minimize. Such an consequence could be favorable for the risk-on section, one which encompasses each shares and crypto.

Each Bitcoin and the inventory market are anticipated to reply to the announcement. In reality, most analysts maintain the consensus {that a} bullish consequence is very possible if the Fed decides to embark on aggressive charge cuts. Right here, it’s. price noting that the correlation could also be misplaced additional down the road, particularly if Bitcoin takes off aggressively.

All eyes on Bitcoin miner provide

Talking of bullish expectations, the market is at the moment searching for indicators of a significant rally. In reality, a latest Santiment put up identified that mining pockets balances might supply a robust sign when the subsequent main rally commences.

“Bitcoin and Ethereum mining wallets have seen declining supply held since the first half of 2024. With this latest mild rebound, look for a jump in their combined supplies as a strong signal the next bull run is approaching.”

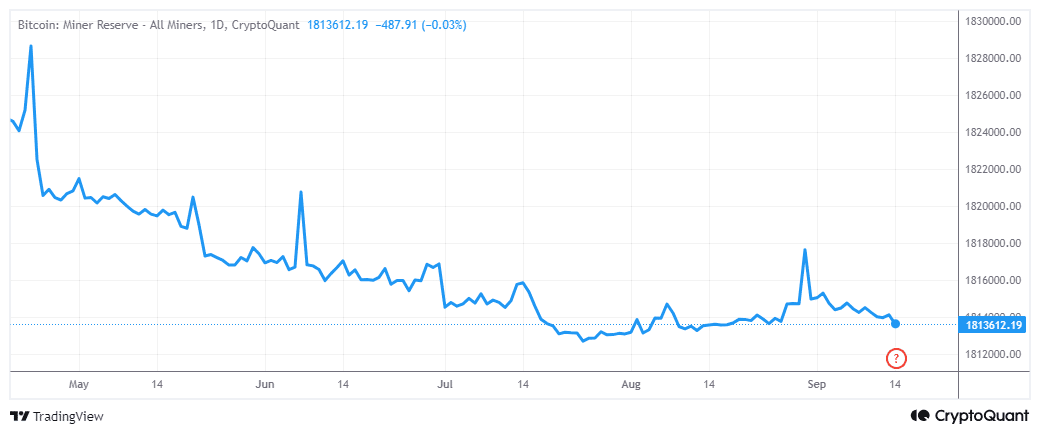

Traders ought to thus maintain an in depth eye on miner reserves primarily based on this evaluation. The miner reserves metric revealed that Bitcoin miner balances have been declining since April. It demonstrated some uptick in July, but it surely quickly retraced in favor of outflows.

Supply: CryptoQuant

We will see primarily based on the aforementioned evaluation that miner flows had been inside their 2024 backside vary. This implies there’s a important probability of a pivot from this stage, particularly now that This fall is simply across the nook.

A mixture of charge cuts and the U.S elections might present the fitting mix of catalysts to set off one other main market transfer. A shift in guard in Bitcoin miner reserves, particularly in favor of a pointy uptick, could also be seen as ample affirmation of when the subsequent bull run kicks off.