- The Bitcoin Rainbow Chart confirmed that traders should “BUY!” extra BTC.

- The sentiment has been bearish prior to now two weeks, and additional value drops are doable.

Bitcoin [BTC] was buying and selling close to the $60k assist zone as soon as once more. Almost two months in the past, the identical $60k assist zone was retested as assist after a pointy value plunge to $56k.

Again then, the sentiment was fearful and traders had been cautious. Now, too, an identical sentiment prevailed.

Whereas the short-term value motion confirmed bearishness, the upper timeframe value development was strongly bullish. Previously six months, measured from the late January lows at $38.5k, Bitcoin has gained near 55%.

It has set the next low at $56.5k, marking it because the crucial assist degree for consumers to defend within the coming weeks.

The Bitcoin Rainbow Chart confirmed that it’s nonetheless a good time to purchase Bitcoin. This chart represented Bitcoin’s value motion on a logarithmic scale and might be helpful for traders to foretell potential cycle tops.

Gauging the cycle prime from the Bitcoin Rainbow Chart

Supply: Blockchain Centre

The multicolored chart highlights totally different zones from “Bitcoin is dead” to “Maximum bubble territory”. At press time, BTC was within the fairly aggressively “BUY!” marked zone.

At press time, the chart was assured that there’s a great distance but for this cycle’s value discovery to stretch.

AMBCrypto noticed that the previous two cycle maximums occurred 17–18 months after the halving. Extrapolating that to the present cycle, a most may very well be reached in September or October 2025.

In 2021, BTC was unable to ascend previous “Is this a bubble?” territory. AMBCrypto selected to be extra conservative this time and assumed Bitcoin may not cross the “HODL” territory this time.

Even this conservative guess places Bitcoin at a $260k worth, with $373k being the estimate ought to Bitcoin spill into the “Is this a bubble?” territory.

So, there you have got it, one thing to mark in your calendars — promote Bitcoin above $250k in September 2025.

After all, this isn’t an correct prediction and relies solely on the Bitcoin Rainbow Chart and the earlier cycle’s halvings and prime timings.

Investor prudence and a more in-depth research of value motion and on-chain metrics could be essential to extra keenly gauge the cycle prime.

Purchaser weak spot was highlighted

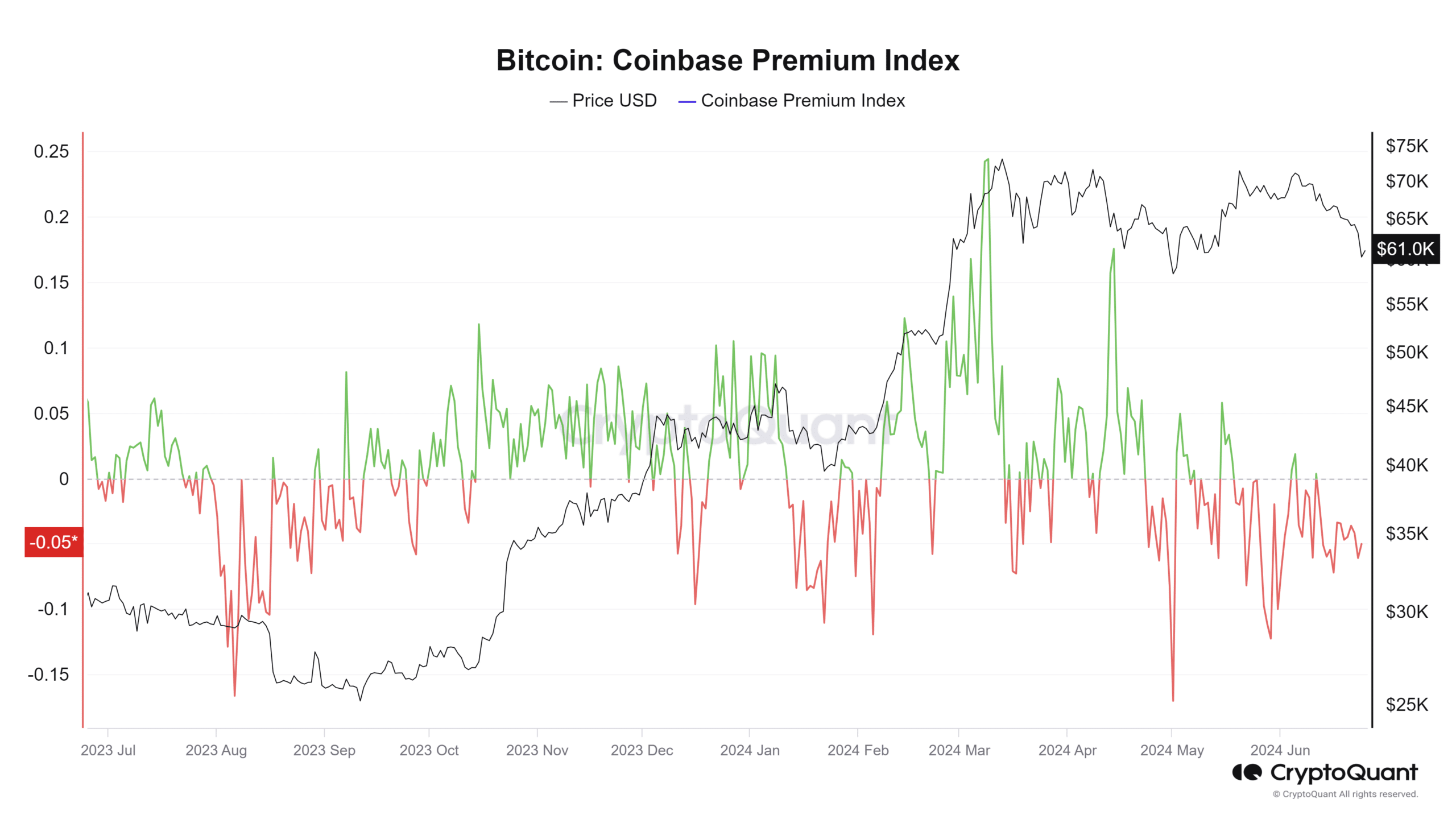

Supply: CryptoQuant

The Coinbase Premium Index has been adverse for the previous month. It signaled that the worth on the Coinbase market was decrease than the Binance USDT Bitcoin pair by slightly below 0.1%.

This implied that the U.S. investor curiosity in Bitcoin has waned significantly over the previous six weeks. In March and April 2024, the Index was largely optimistic, however the sentiment has shifted significantly since then.

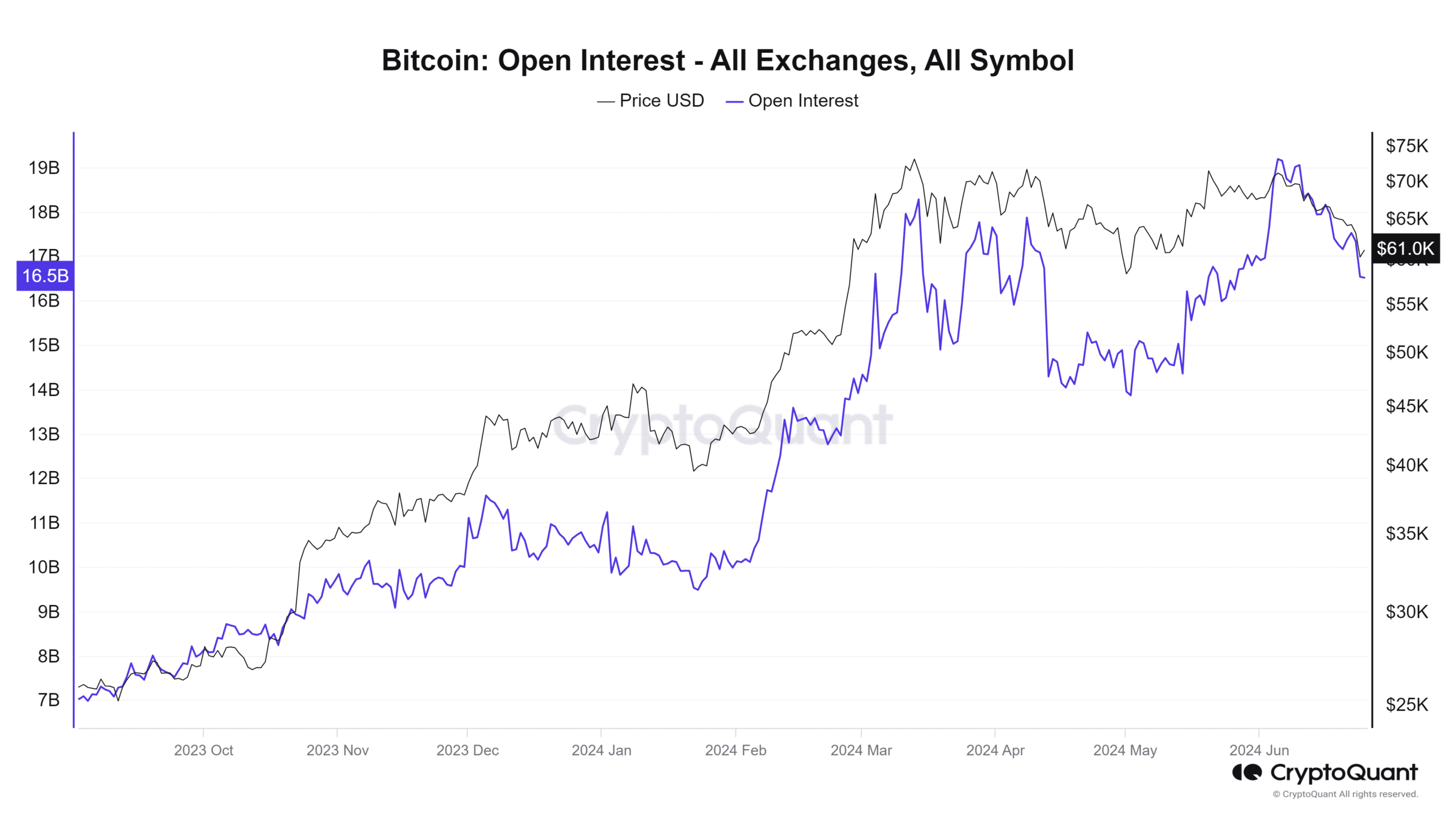

Supply: CryptoQuant

One other signal of bearish market sentiment was the sharp drop in Open Curiosity. On the sixth of June, OI was at $19.1 billion. At press time, with costs down by 14.6%, the OI stood at $16.5 billion.

It indicated that futures market members most popular to stay sidelined and had been unwilling to lengthy BTC because of the constant decline in current weeks.

This generally is a good factor in the long term because it wipes out overleveraged bulls, guiding the worth growth towards a extra secure, spot-driven route.

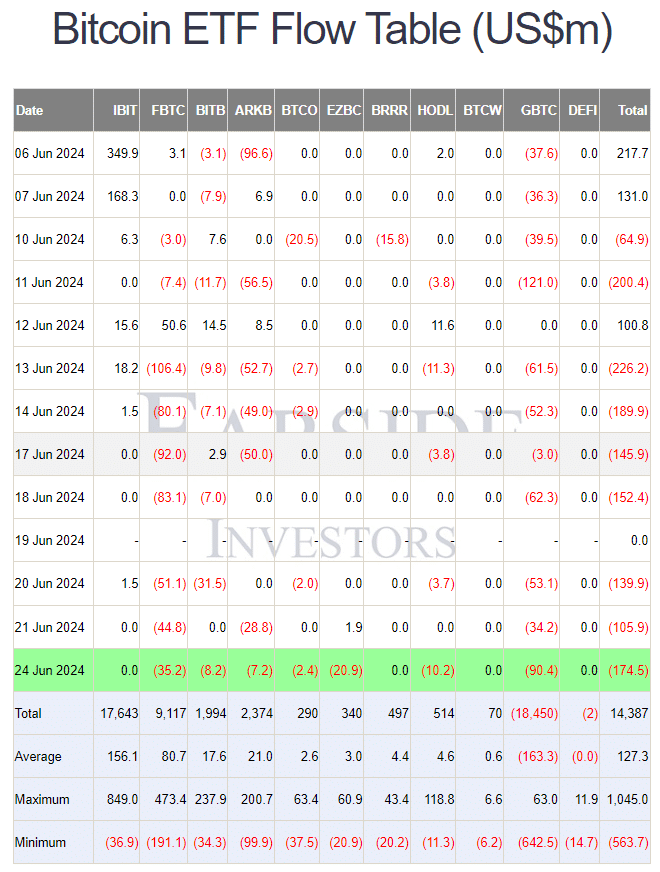

Supply: Farside Buyers

AMBCrypto additionally famous that the info from Farside Buyers on Bitcoin ETF inflows has been adverse over the previous week. This was fairly totally different from the primary week of June, and as soon as once more mirrored the shift in sentiment.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

In a current report, AMBCrypto highlighted that the present value dip would possibly go deeper south.

Information of Mt. Gox and repayments to shoppers whose property had been stolen a decade in the past meant there’s a variety of explanation why the crypto market sentiment is in a troublesome spot.