- The Rainbow Chart confirmed the underside is nearer than the highest for BTC

- Falling NUPL famous lowered promoting strain from profit-takers

13 months in the past, Bitcoin [BTC] was buying and selling at $25.7k. Final September, the market was in despair and the halving occasion was at the very least seven months away. This sentiment shifted in October amid rumors of a possible spot ETF approval from the SEC. Inflation additionally appeared to have peaked.

These components contributed to Bitcoin’s attractiveness to potential consumers, and the costs trended greater to succeed in an all-time excessive of $73.7k in March 2024. Can this October additionally provoke a rally that breaks the yearly highs?

Bitcoin Rainbow Chart encourages buyers

Supply: Blockchain Middle

Bitcoin’s Rainbow Chart is a enjoyable means of wanting on the long-term worth tendencies of Bitcoin. It makes use of a logarithmic scale to plot Bitcoin’s worth, and shade codes them to point out buyers whether or not they need to be shopping for, promoting, or HODLing.

It isn’t an actual instrument, nevertheless it does surprisingly effectively by way of predictions and timing the cycle prime and backside, particularly the latter. Whereas in latest months it has fallen in direction of the “Bitcoin is dead” territory, has not fairly reached the perfect purchase zone but.

BTC continues to be inside an excellent purchase zone although, with the Bitcoin Rainbow Chart describing it as “a fire sale.” Evaluating this cycle’s efficiency with the earlier one, the latter half of October may very well be when Bitcoin embarks on a robust rally.

This rally may very well be the bull run that follows a halving occasion.

Downtrend since April has impacted holder profitability

Supply: CryptoQuant

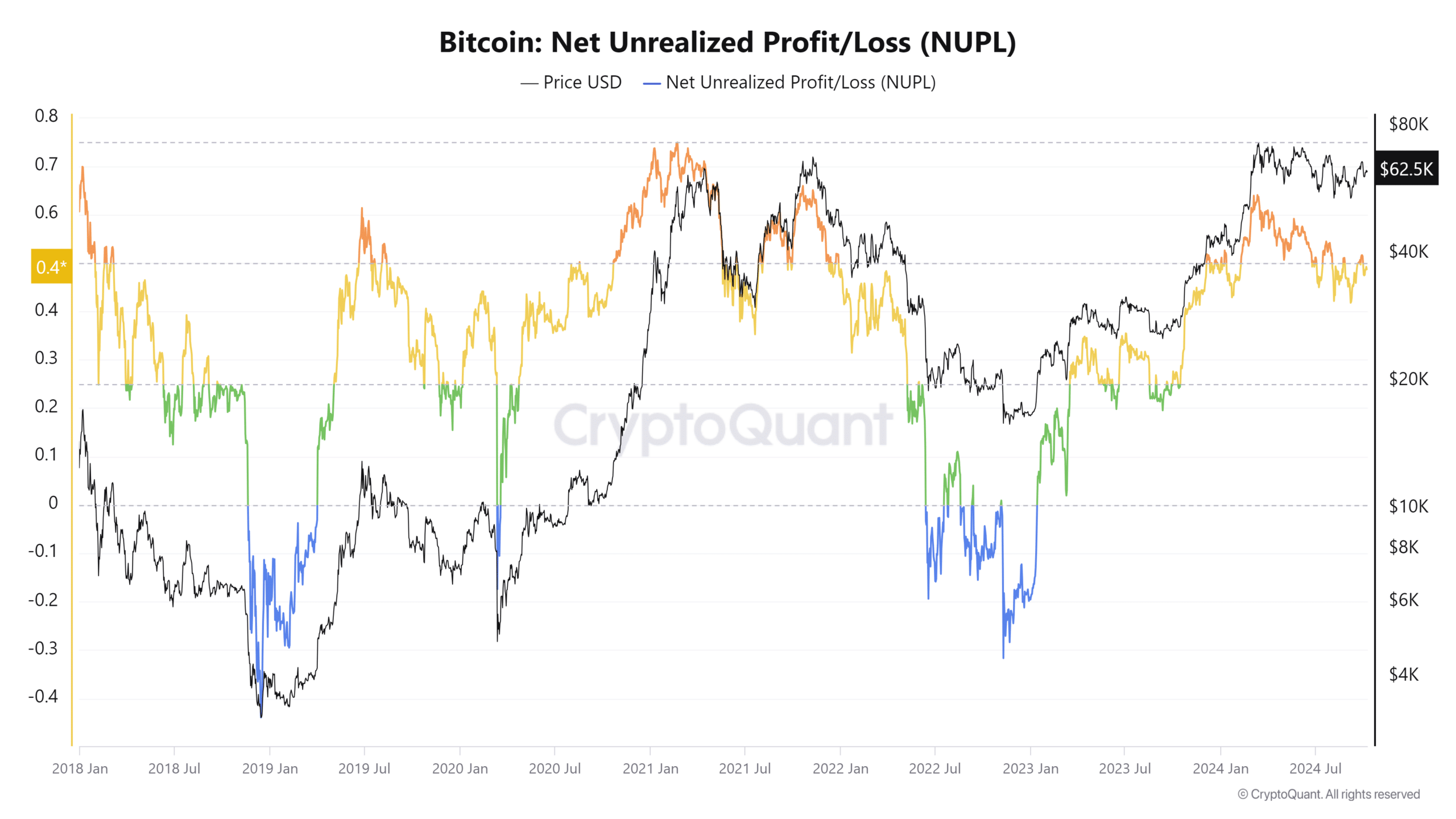

At press time, the Web Unrealized Revenue/Loss metric was at 0.47 – An indication that the market cap was higher than the realized cap. Due to this fact, an excellent portion of holders should still be in revenue, regardless that the worth has been trending south over the previous six months.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

The NUPL fell alongside the worth too, displaying that the intention to promote from holders in revenue is probably going in a decline. This implies there may be room for worth appreciation within the coming months. A NUPL studying above 0.7 typically marks the cycle prime.