- Institutional adoption and ETF inflows fueled Bitcoin’s rise towards a possible supercycle.

- Favorable macro developments and community development aligned to assist Bitcoin’s prolonged trajectory.

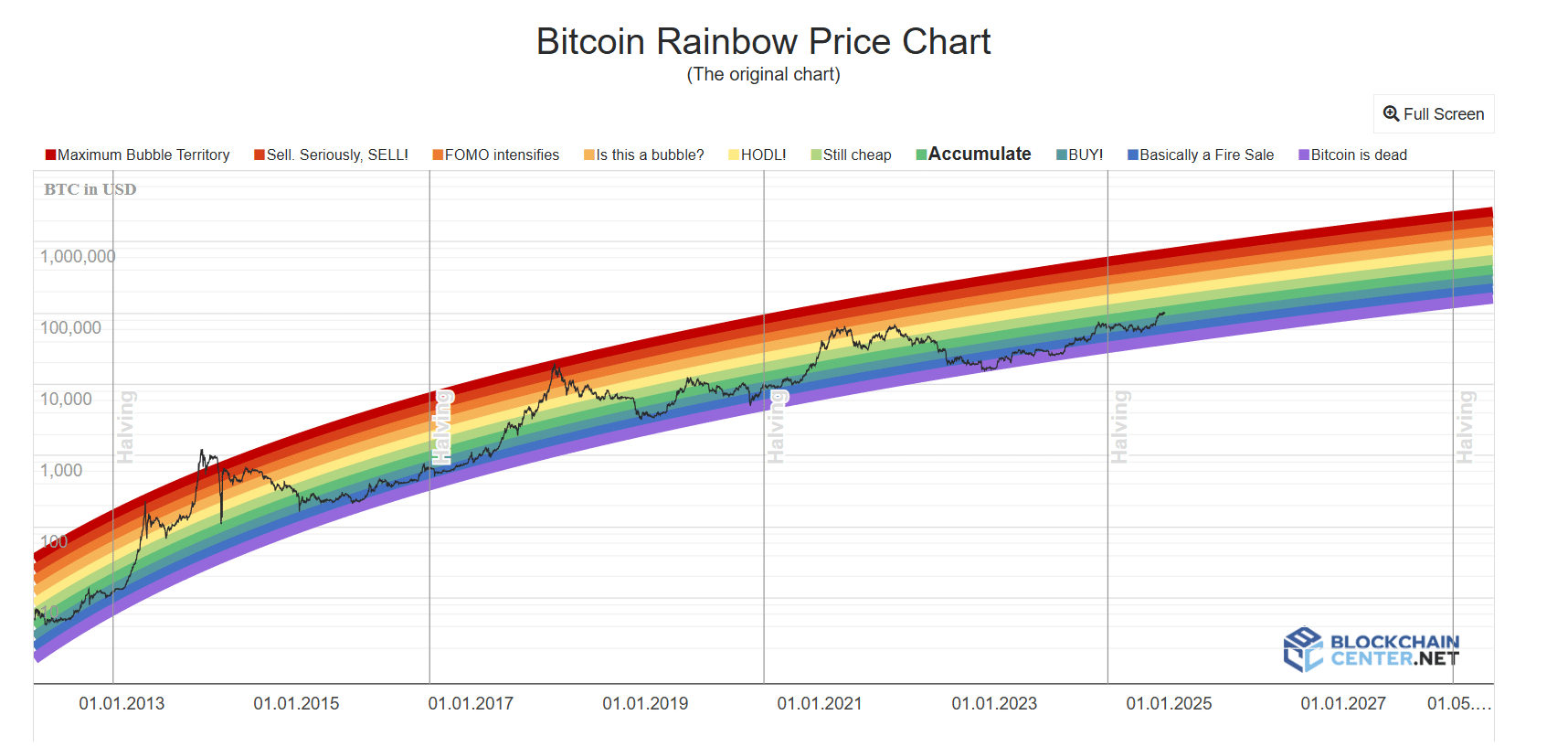

Bitcoin’s [BTC] rainbow chart has reignited hopes of a $500K worth peak on this cycle. Latest developments recommended an extended, extra prolonged trajectory than earlier runs.

In contrast to the final cycle, which stalled earlier than reaching the “extreme phase,” present developments confirmed stronger momentum.

Since November, crucial indicators and evolving market dynamics have bolstered the case for Bitcoin to chart new highs and probably hit $500k. Right here’s what might drive Bitcoin to its subsequent all-time excessive.

Bitcoin: What might trigger the doable surge?

Bitcoin’s developments since November highlighted its rising legitimacy as a monetary asset. Sovereign wealth and pension funds have elevated their publicity.

BlackRock’s iShares IBIT Bitcoin ETF attracted over $17 billion in inflows, showcasing surging institutional demand.

Spot BTC ETFs globally have additionally pushed liquidity, boosting accessibility and bridging conventional finance with crypto.

Technological developments just like the Lightning Community are enhancing Bitcoin’s utility. Sooner, low-cost transactions are strengthening its adoption for sensible use circumstances.

In the meantime, macroeconomic circumstances, comparable to a weakening U.S. greenback and inflation issues, have bolstered Bitcoin’s position as a decentralized retailer of worth.

With regulatory readability, technical progress, and favorable macro developments aligning, Bitcoin seems set for vital development. These components gasoline hypothesis a few $500K supercycle goal.