- Dormant Bitcoin value $681M was moved, pushing $37.4B in on-chain quantity—the best in seven months.

- Bitcoin inflows to exchanges rise, suggesting potential promoting stress as BTC stabilized round $61K.

A serious Bitcoin [BTC] transaction involving a dormant pockets moved 10,158 BTC, valued at roughly $681 million, into circulation.

This huge switch resulted in $37.4 billion in complete on-chain quantity, the best recorded in seven months.

This exercise was recognized by Santiment, a blockchain analytics platform, and is elevating consideration available in the market. Traditionally, the reactivation of stagnant Bitcoin causes upward value actions.

This occasion underscores a shift in conduct amongst long-term holders, as a substantial quantity of beforehand inactive BTC has re-entered the market.

The transaction was additionally tied to information from Lookonchain, suggesting that it might have a ripple impact available in the market.

Surge in on-chain exercise

The $37.4 billion in on-chain transaction quantity occurred on a single day, marking the most important every day quantity for the reason that twelfth of March 2024.

This spike was pushed largely by dormant Bitcoin being moved into circulation, suggesting that giant holders have gotten extra energetic.

Santiment famous that the “Age Consumed” indicator, which tracks the motion of older BTC that had remained idle for a very long time.

The Age Consumed metric noticed a pointy rise, signaling that a good portion of the transaction quantity got here from older, inactive Bitcoin.

This motion is usually interpreted as an indication of renewed exercise amongst whale accounts, with potential future impacts on Bitcoin’s value path.

Supply: X

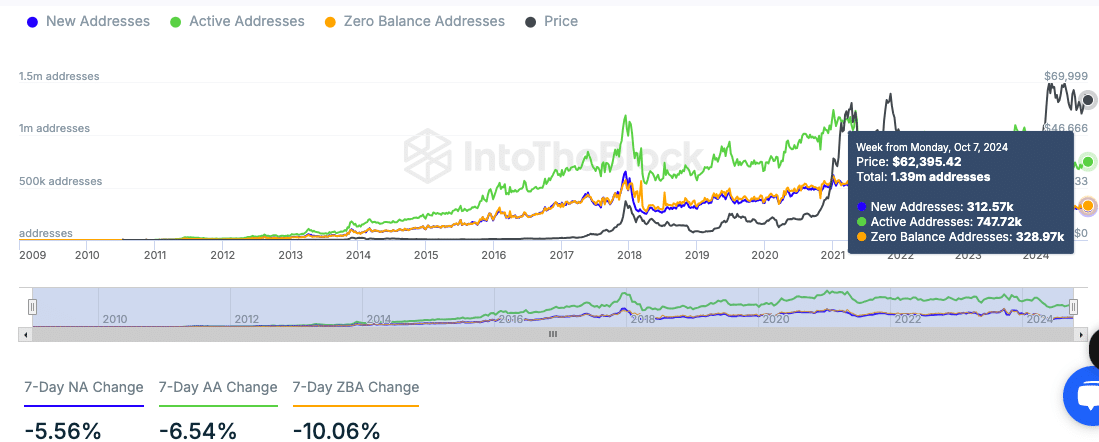

Bitcoin community metrics present blended alerts

Whereas on-chain quantity has spiked, some key metrics for Bitcoin addresses have seen a decline.

Information from IntoTheBlock revealed a drop in new, energetic, and zero-balance addresses over the previous week.

New addresses decreased by 5.56%, energetic addresses by 6.54%, and zero-balance addresses by 10.06%, with the overall variety of energetic addresses standing at 747.72k as of the seventh of October.

Supply: IntoTheBlock

This decline in handle exercise might point out short-term cooling in community participation. Nevertheless, Bitcoin’s value stays comparatively robust, with latest market exercise exhibiting resilience.

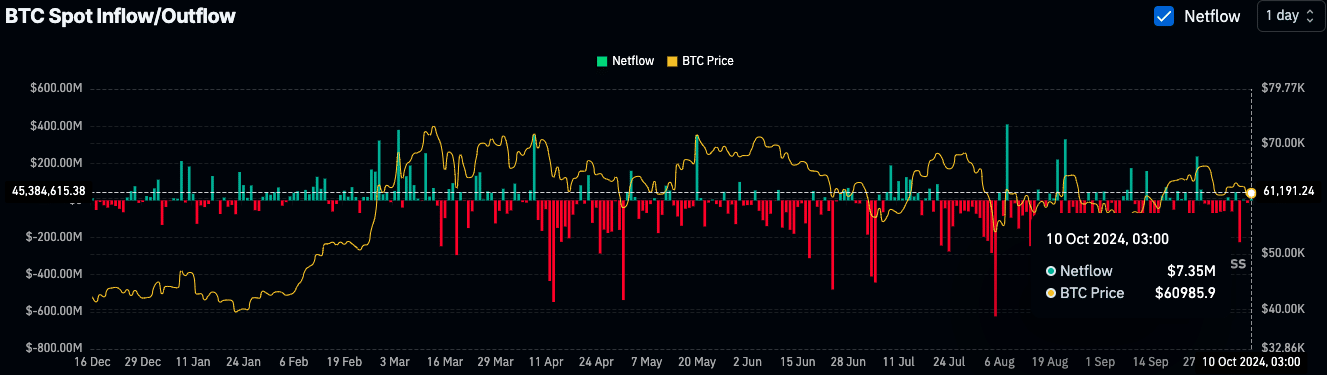

Potential promoting stress

AMBCrypto’s evaluation of Bitcoin spot inflows and outflows confirmed the motion of extra BTC into exchanges. As of the tenth of October, there was a internet influx of $7.35 million.

Optimistic inflows sometimes level to potential promoting stress, as merchants switch Bitcoin to exchanges for potential liquidation.

This minor influx suggests some merchants could also be positioning themselves to promote, however it isn’t giant sufficient to sign a big market shift.

Supply: Coinglass

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Bitcoin’s value stood at $60,947 at press time, exhibiting a slight dip from the earlier week.

Regardless of the inflows, the value has remained comparatively steady. So, promoting stress is probably not robust sufficient to trigger main downward motion at this level.