- Over $2.5 billion value of Bitcoin shorts liquidations had been reportedly behind the slight restoration.

- BTC is anticipated to be extra unstable in direction of the top of the week as sentiment improves.

Bitcoin [BTC] was again above $60,000 as soon as once more as sentiment improved barely. Leveraged shorts liquidations could have had one thing to do with the marginally bullish end result.

Bitcoin and total crypto market sentiment was in excessive worry through the weekend, however there was some restoration within the final three days.

The most recent knowledge from the worry and greed index indicated a gradual restoration, with the index at 30 as per press time readings.

Supply: various.me

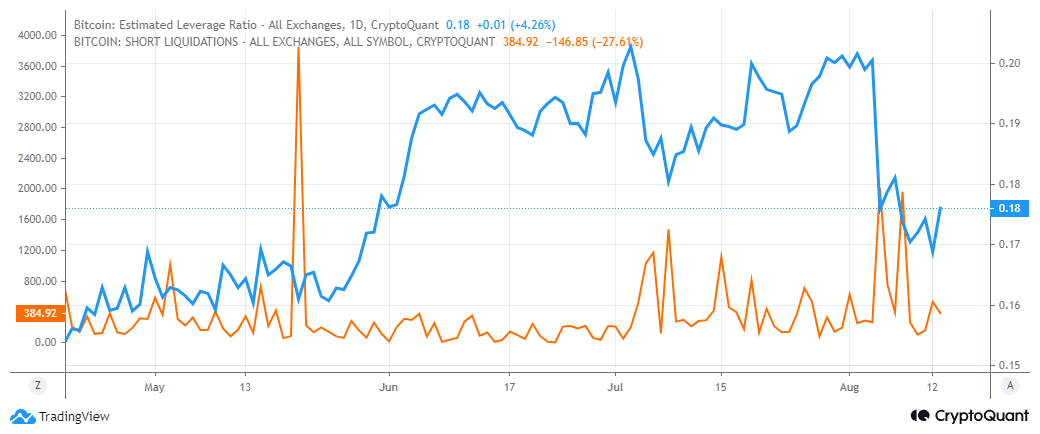

Bitcoin’s bullish momentum could have additionally been fueled by the liquidation of leveraged brief positions. Latest knowledge steered that over $2.5 billion value of leveraged brief positions had been just lately liquidated.

This resulted in some shopping for strain.

On-chain knowledge from CryptoQuant confirmed that Bitcoin registered a 231% surge in shorts liquidations on the twelfth of August. The urge for food for leverage briefly tanked to 2-month lows earlier than adopting an uptrend.

Supply: CryptoQuant

After evaluating Bitcoin’s heatmap, we discovered that there have been 81.5 million internet longs on Binance between $60,852 and $60,880.

This, mixed with the surge within the uptick in estimated leverage ratio, in addition to the bettering sentiment, steered a gradual shift in direction of bullish optimism.

Is Bitcoin headed for extra volatility forward?

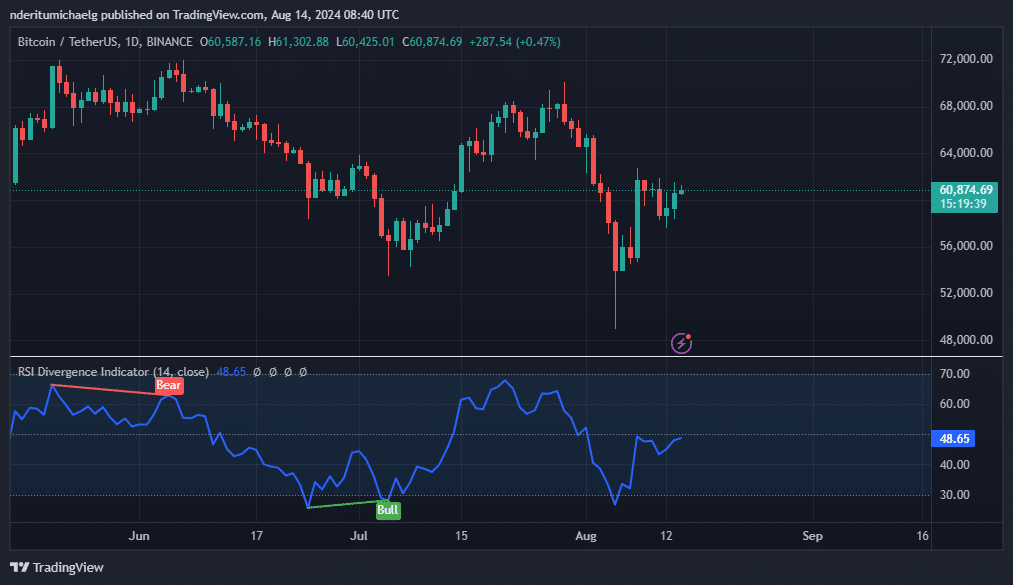

Bitcoin had a $60,890 price ticket at press time. The next push will see it retest the $61,700 stage, the place it has been dealing with resistance and low demand recently.

Unsurprisingly, this worth vary additionally coincided with the 50% RSI stage. This is able to clarify why shorts had been loading up close to this stage, in anticipation of extra draw back.

Supply: TradingView

A cocktail of low demand and shorts liquidations has saved costs inside a slim vary for the previous couple of days. Nonetheless, there might also be a 3rd cause.

The market tends to expertise low exercise forward of main financial knowledge. Adopted by a surge in exercise as a response when the info is launched.

The market has been trying ahead to a number of financial knowledge this week. This contains producer worth knowledge (PPI), which was launched yesterday.

CPI knowledge slated to return out in the present day could set off extra volatility and doubtlessly a robust directional transfer out of the present vary.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Bitcoin’s present stage highlighted the state of uncertainty out there. The surge in leverage brief positions suggests rising bearish expectations.

Alternatively, the market sentiment gave the impression to be bettering in the previous couple of days. This alerts a big likelihood of a rally past the present resistance.