- Bitcoin’s 24H cumulative internet taker quantity enters inexperienced territory after weeks of sell-side dominance.

- Regardless of short-term optimism, long-term taker flows stay detrimental, signaling warning for a full pattern reversal.

Bitcoin [BTC] seems to be regaining power as promoting stress from aggressive takers continues to say no. With no main macro headwinds in sight, BTC could also be heading in the right direction for reasonable progress this week.

How sustainable is the rally?

24-hour internet taker quantity reveals bullish transition

Bitcoin’s Cumulative Internet Taker Quantity – 24H has seen a notable shift over the past month.

This metric, which measures the aggressiveness of market individuals, had spent a lot of February deep in detrimental territory — with internet taker quantity plunging as little as -$1B.

Nevertheless, in latest days, the cumulative determine has moved again into constructive territory. This transition means that aggressive consumers have began dominating the market once more after weeks of heavy sell-side management.

Supply: X

Historic patterns point out that each time this metric shifts from detrimental to constructive, BTC’s value tends to reply with a gradual uptrend.

The latest uptick aligns with BTC’s ongoing restoration from sub-$80K ranges to over $87K.

Lengthy-term Bitcoin Internet Taker quantity nonetheless bears scars of promoting

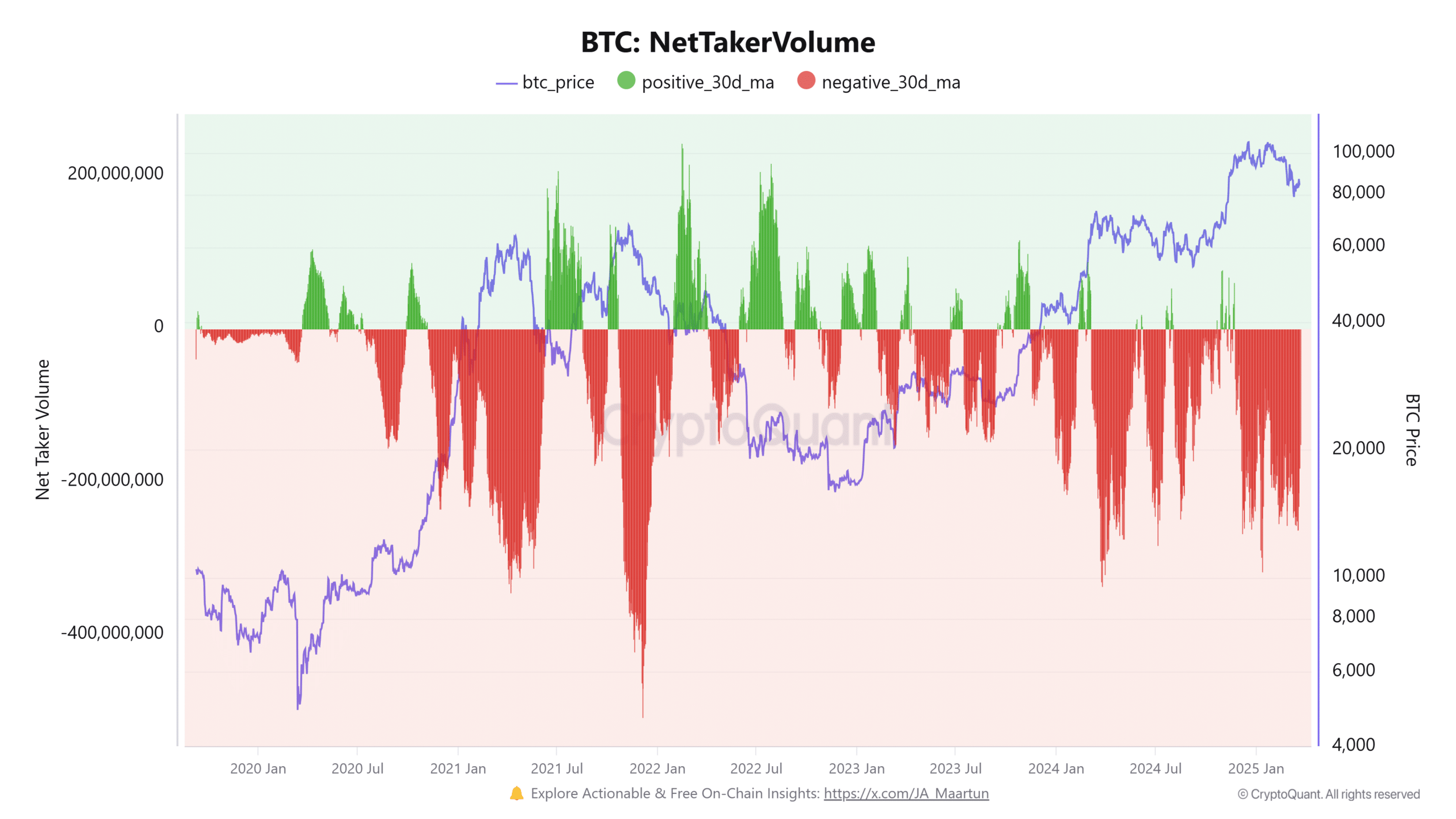

Whereas the 24-hour metric flashes bullish indicators, the longer-term Internet Taker Quantity – 30-day shifting common gives a extra tempered outlook.

This chart reveals that detrimental internet taker flows dominate the broader pattern, with persistent crimson bars indicating the cumulative stress from sellers.

Supply: CryptoQuant

Though there have been brief bursts of constructive internet taker quantity in latest months, these have but to ascertain a constant inexperienced run.

This means that whereas sellers could also be backing off within the brief time period, the market nonetheless carries overhang from earlier aggressive promoting phases.

A full shift to a sustained inexperienced part on this chart would strengthen the bull case considerably.

BTC value closes above key help

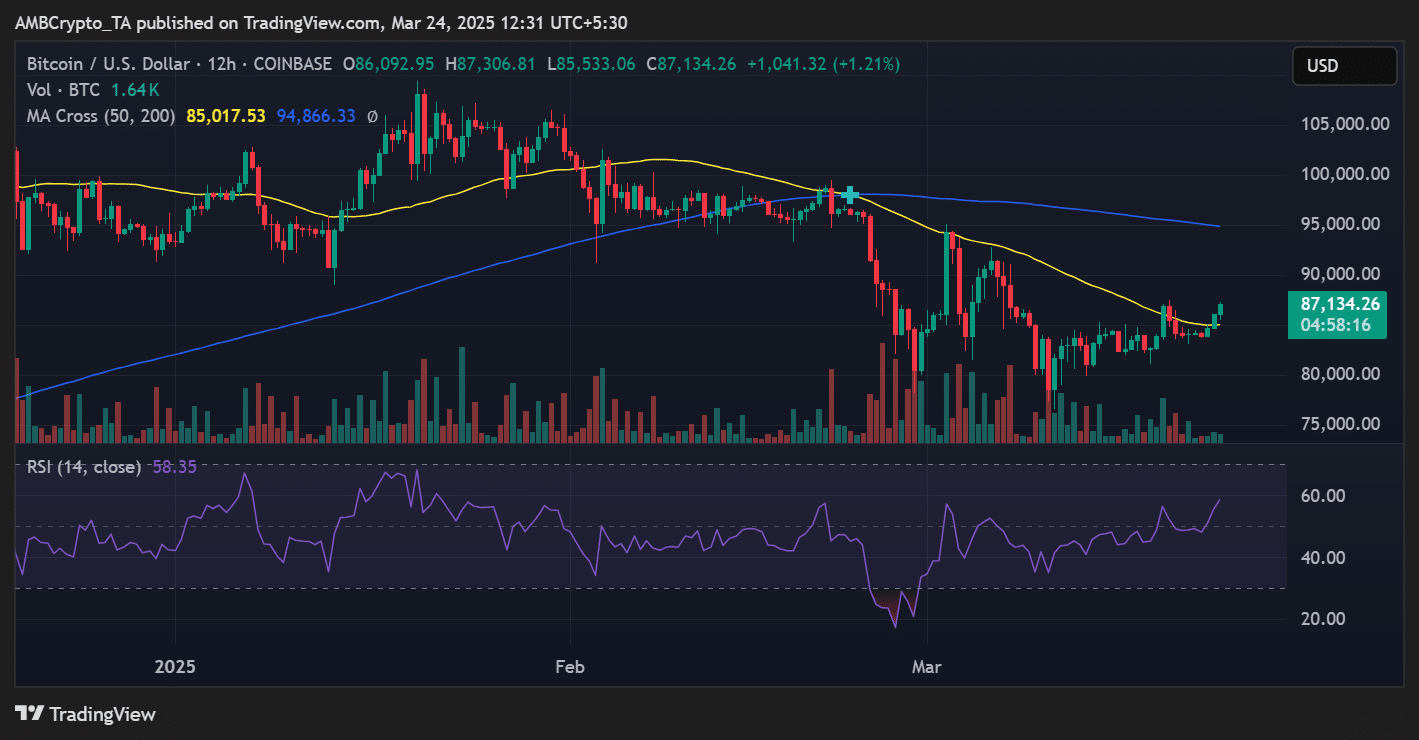

On the value entrance, Bitcoin broke by the 50-day Shifting Common [MA] at $85,017 and was buying and selling at $87,134.

The 12-hour chart additionally confirmed enhancing momentum, with the Relative Power Index [RSI] rising to 58.35 — nearing bullish territory however not but overbought.

Supply: TradingView

Quantity remained comparatively secure, but when BTC clears the 200-day MA resistance at $94,866, it may open a path to retesting the $95K–$100K area. Nevertheless, rejection close to that band would indicate extra sideways motion.

What to anticipate this week?

The important thing variable is whether or not purchaser demand can maintain the momentum with out exterior catalysts. Thus far, information suggests an honest risk-reward setup for a continued restoration.

Nonetheless, cautious optimism is warranted, particularly with BTC approaching a psychologically important resistance zone.

Bulls may push towards increased targets if cumulative internet taker quantity holds above zero and BTC stays above its 50-day MA.

Alternatively, a drop again under $85K would sign weak point and probably reintroduce short-term bearish stress.