- Bitcoin has seen a rally in purchase calls on social media.

- Nevertheless, the coin stays liable to a correction within the brief time period.

Bitcoin’s [BTC] social exercise has seen a major uptick because the cryptocurrency market anticipates the approval of the spot Ethereum [ETH] Trade-Traded Fund [ETF].

In a latest publish on X (previously Twitter), Santiment famous that the surging social media discussions concerning the main cryptocurrency asset have been largely optimistic, with the market making extra purchase calls than promote calls.

When an asset sees a surge in purchase calls amongst its merchants on social media, they’re expressing optimistic sentiment concerning the asset’s continued worth progress. Some merchants even think about it a superb entry level, perceiving costs as low and due for an upswing.

BTC holders should look earlier than the leap

Whereas this will likely provide a superb entry alternative for some, “paper hands” have been identified to promote when an asset’s social exercise will increase like this.

It is because the surge in BTC purchase calls amongst its merchants is commonly on account of hypothesis and never backed by a corresponding demand for the coin. Due to this fact, newer traders who want extra conviction within the coin’s long-term potential is perhaps hesitant to carry throughout these intervals even with optimistic social sentiment.

Additionally, short-term merchants usually see the surge in purchase calls as a possibility to revenue. Therefore, a short lived sell-off is feasible even amidst general bullish sentiment.

Furthermore, BTC’s Market Worth to Realised Worth (MVRV) ratio returned a excessive worth of 153.19% at press time. The metric tracks the ratio between the coin’s present market worth and the typical worth of every acquired token.

Supply: Santiment

When it surges on this method, the asset is alleged to be overvalued, and on common, coin holders are sitting on income. This will likely result in a spike in promoting stress as traders usually tend to take income when the potential return is excessive.

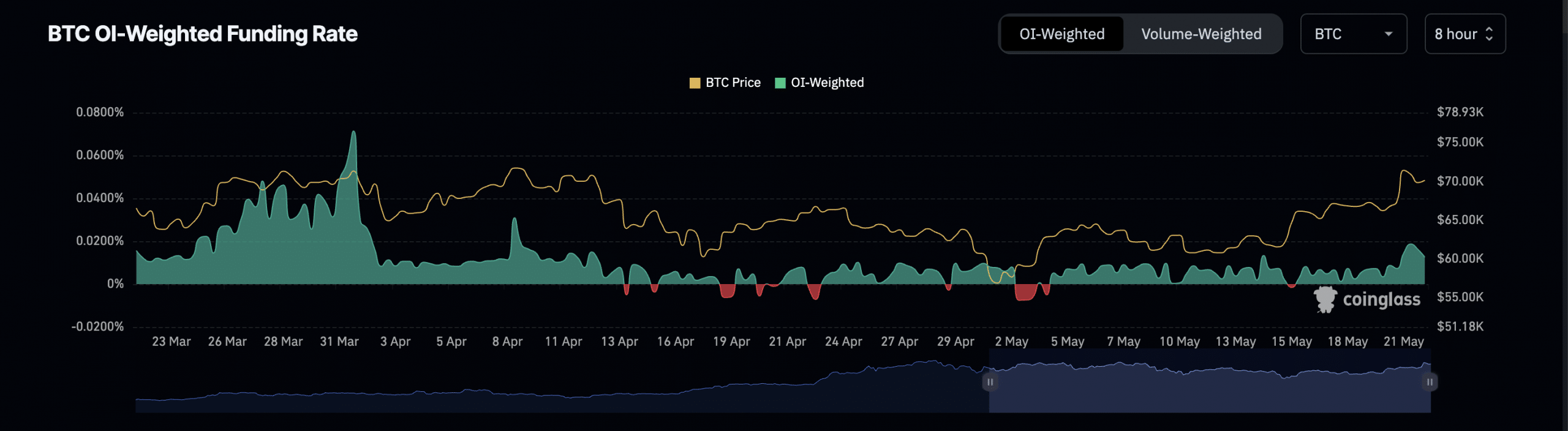

The rise in BTC’s funding charges additionally heightens the chance of a short-term correction in its worth. On twenty first Could, the coin’s funding charge throughout cryptocurrency exchanges was 0.018%, its highest stage in a month, based on Coinglass’ information.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

Supply: Coinglass

Typically, when an asset’s futures funding charge rallies, it’s a bullish sign, suggesting a robust demand for lengthy positions.

Nevertheless, when it will get too excessive and turns into unsustainable, it could lead to compelled promoting by leveraged lengthy positions. This will likely set off worth swings and lead to sudden worth drops.