- Bitcoin could possibly be on the verge of one other rally based on its Puell A number of.

- Bullish optimism and excessive greed could level to doable reversal.

The bullish Bitcoin [BTC] momentum that we noticed in October and the primary half of November seems to be fading out. However what’s subsequent for the king of the cryptocurrencies as 2024 approaches its conclusion?

A current CryptoQuant evaluation reveals some insights with regard to Bitcoin’s subsequent potential transfer primarily based on the Puell A number of. The latter evaluates mining revenues relative to market actions.

Based on the evaluation, the Puell A number of not too long ago pushed nearer to its 365-day shifting common.

Supply: CryptoQuant

If the Puell A number of crosses the shifting common, it might sign the beginning of one other main bull run. This evaluation was primarily based on related observations prior to now when the identical indicators interacted.

Ought to Bitcoin holders anticipate extra upside?

The CryptoQuant evaluation means that Bitcoin could regain the momentum within the coming days or perhaps weeks. Nonetheless, it is only one indicator and the market dynamics should still shift within the coming days.

For instance, miner income has traditionally been a dependable indicator for demonstrating market sentiment.

Miner reserves are likely to soar when miners anticipate increased BTC costs to allow them to HODL and promote increased. The newest miner reserve information signifies that reserves dipped to 2024 lows on 18th November.

Supply: CryptoQuant

The miner reserves could point out a scarcity of robust incentive to HODL. Nonetheless, it’s value noting that Bitcoin has been hovering close to its ATH which can encourage miners to promote a few of their cash.

The chance of an surprising selloff

One other potential cause why miner reserves have been near their backside could possibly be that there are expectations of a large pullback after the current rally. In different phrases, there’s rising uncertainty about BTC’s subsequent transfer.

Bitcoin concern and greed index was at 90 or in excessive greed which is the very best degree it has been in months. Main pullbacks have traditionally taken place in excessive greed eventualities therefore the priority that it might pull off an honest retracement in an surprising method.

Then again, optimism stays excessive particularly in gentle of the altering international liquidity circumstances as rates of interest drop. Additionally, the current U.S elections offered optimism for the crypto market because the nation ushers in a pro-crypto administration.

Learn Bitcoin (BTC) Worth Prediction 2024-25

These elements point out that the rally is probably not near a cycle peak. Whales are nonetheless accumulating which indicators that they could possibly be getting ready for an additional main transfer.

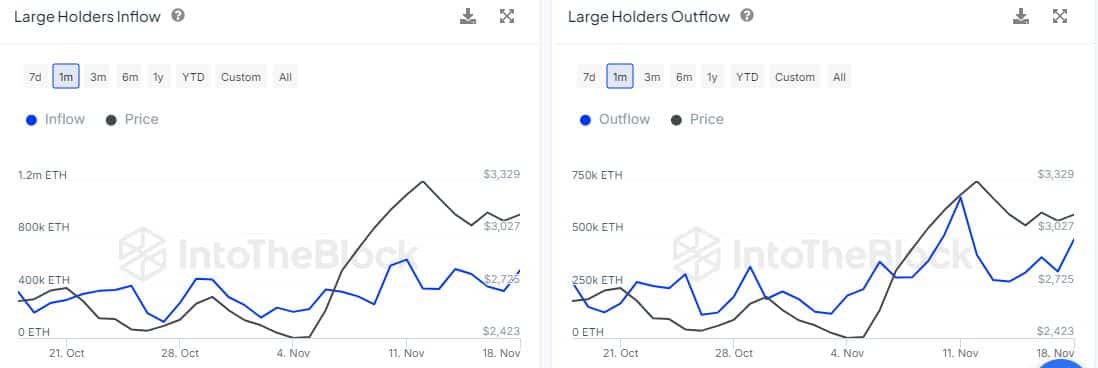

Supply: IntoTheBlock

Inflows into massive holder accounts peaked soared to greater than 516,000 BTC within the final 24 hours. Outflows from whale addresses have been decrease at simply over $471,000.