- Shopping for strain on BTC was rising, which advised a continued worth hike.

- Nonetheless, a number of technical indicators hinted at a correction.

Bitcoin [BTC] buyers loved a lot revenue final week because the coin’s worth surged by double digits. Because of the value rise, bullish sentiment across the coin elevated, inflicting a file drop within the provide of BTC on exchanges. Will this propel additional worth rises?

Buyers are shopping for Bitcoin

CoinMarketCap’s information revealed that Bitcoin witnessed an over 11% worth hike within the final seven days. At press time, the king coin was buying and selling at $67,866.54 with a market capitalization of over $1.34 trillion.

In truth, AMBCrypto reported earlier that there have been probabilities of BTC shifting above $67k. Because of the most recent worth enhance, over 50 million BTC addresses have been in revenue, which accounted for greater than 94% of the overall variety of BTC addresses.

Whereas all this occurred, a key BTC metric reached a file low. To be exact, Bitcoin’s provide on exchanges dropped to the bottom within the final 5 years. A drop on this metric signifies that buyers have been shopping for BTC in anticipation of an additional worth rise.

Due to this fact, AMBCrypto checked different datasets to seek out out whether or not shopping for strain was excessive.

The place is BTC headed?

AMBCrypto’s evaluation of CryptoQuant’s information established the aforementioned truth. Bitcoin’s alternate reserve dropped sharply during the last months, indicating a transparent motive of buyers to purchase the king coin.

Supply: CryptoQuant

Lengthy-term holders have been keen to carry their cash, which was evident from the coin’s inexperienced binary CDD. Issues within the derivatives market additionally regarded fairly optimistic.

The coin’s funding fee was rising, which means that lengthy place merchants have been dominant and have been keen to pay brief merchants. Moreover, Bitcoin’s taker purchase/promote ratio indicated that purchasing sentiment was dominant within the derivatives market.

Supply: CryptoQuant

Nonetheless, US buyers have been pondering in any other case. This was evident from the low Coinbase premium, which means that promoting sentiment amongst US buyers was dominant. Rising promoting strain may put an finish to BTC’s bull rally.

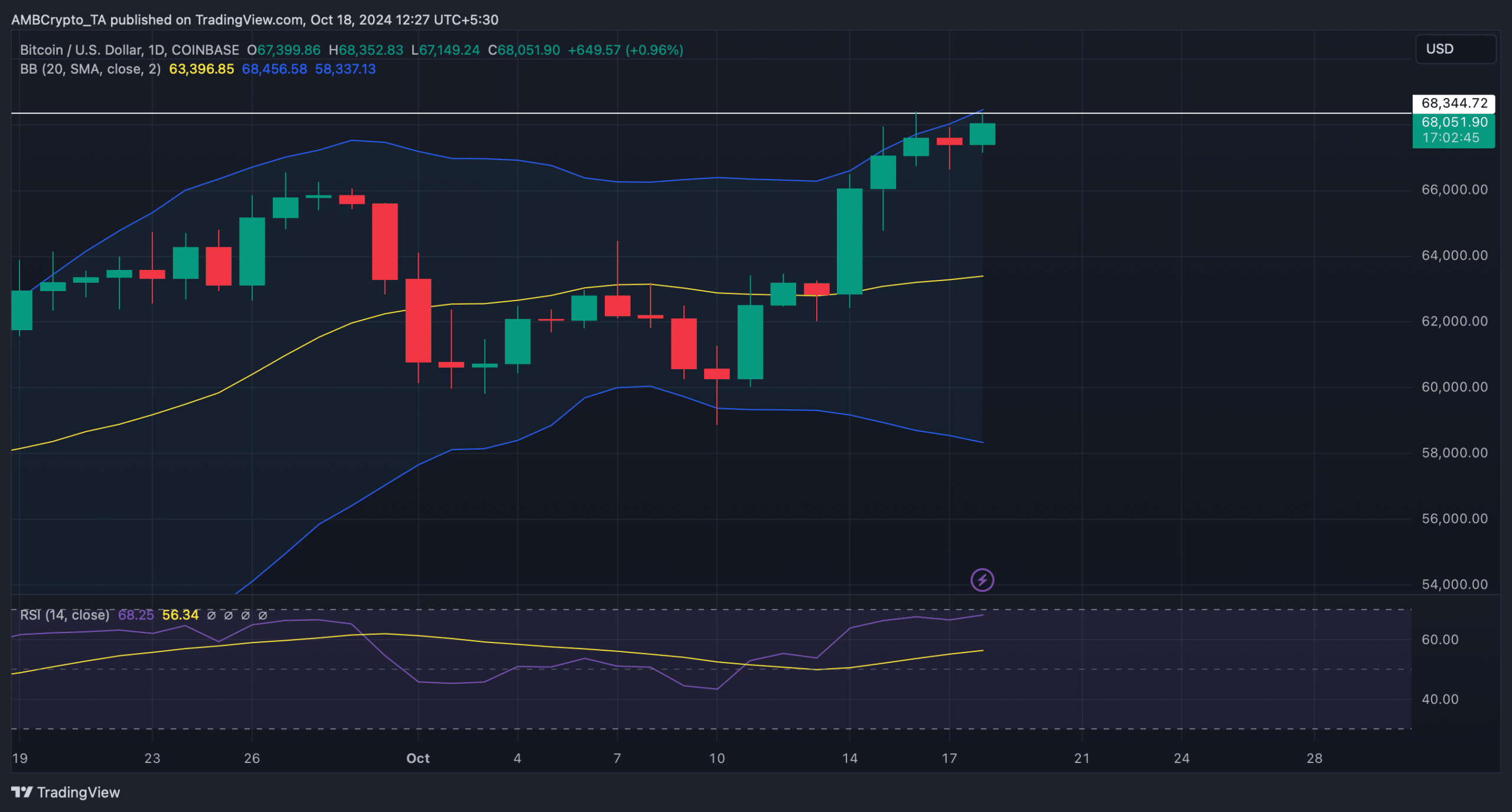

Due to this fact, AMBCrypto deliberate to try Bitcoin’s day by day chart to higher perceive which approach the king coin was headed. As per our evaluation, Bitcoin was testing its resistance on the $68k mark. Nonetheless, the market indicators advised a rejection.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

As an illustration, BTC’s worth touched the higher restrict of the Bollinger Bands, which regularly causes worth corrections.

Moreover, the Relative Power Index (RSI) was additionally about to enter the overbought zone. If that occurs, promoting strain may rise, which could lead to a worth drop within the coming days.

Supply: TradingView