- BTC whales now maintain 20% of the BTC provide.

- BTC has risen to round $55,000 within the final 24 hours.

Bitcoin [BTC] accumulation by sure addresses has notably elevated in latest months. The buildup is considerably greater when evaluating the amount held by these addresses to 6 months in the past.

A extra constructive signal emerges when these growing holdings are in contrast with the change reserves over the identical interval.

Bitcoin whales accumulate an additional 5%

Latest information from IntoTheBlock confirmed that Bitcoin addresses holding 100-1,000 BTC have considerably elevated their accumulation.

These addresses now maintain over 4 million BTC, representing over 20% of the whole Bitcoin provide.

This notable improve mirrored a 5% rise in holdings in comparison with six months in the past. At the moment, these whale addresses held round 3.82 million BTC.

This progress in accumulation underscores the rising confidence in Bitcoin’s long-term potential, notably amid risky market situations.

The substantial improve in holdings by these addresses prompt that bigger buyers, or whales, are positioning themselves for future positive factors.

Bitcoin’s change reserve continues to deplete

The latest accumulation of Bitcoin by massive addresses is certainly a bullish signal, and the present pattern of the Bitcoin change reserve additional reinforces this constructive outlook.

Based on an evaluation of the change reserve information on CryptoQuant, Bitcoin reserves on exchanges have been in consecutive decline.

As of this writing, the change reserve stood at round 2.68 million BTC, a lower from roughly 2.93 million BTC six months in the past.

Supply: CryptoQuant

This constant decline within the change reserve, paired with the expansion in BTC accumulation by addresses holding 100-1,000 BTC, signifies that many holders have chosen to carry onto their BTC somewhat than promote or commerce it.

By shifting their Bitcoin off exchanges, these holders are signaling a long-term maintain technique, typically suggesting rising confidence in future worth appreciation.

The shrinking change reserve mixed with the elevated accumulation suggests a tightening provide, doubtlessly resulting in upward worth strain.

BTC’s worth rises

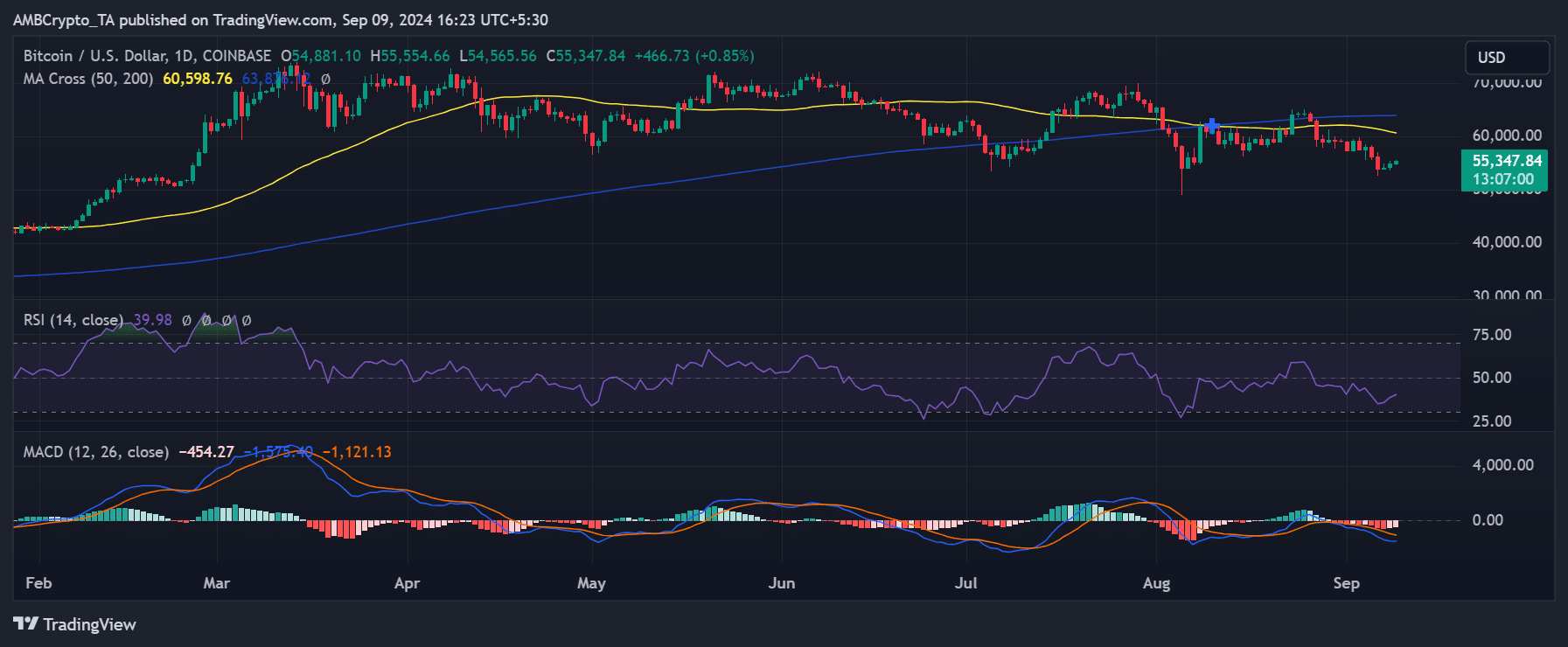

Within the newest buying and selling session, Bitcoin noticed a rise of over 1%, pushing its worth to round $54,881, based on an evaluation of its each day worth chart.

As of this writing, Bitcoin has risen additional to roughly $55,300, with a slight improve of lower than 1%.

Supply: TradingView

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Wanting again on the worth pattern from when the buildup section started, BTC was buying and selling above $60,000. Because of this early accumulators are at present holding their property at a loss.

Nevertheless, if BTC can break above the $65,000 worth vary, these early accumulators would shift into vital revenue territory.