- $244M Bitcoin in new shorts will probably be liquidated at $61K, and $9.17B Bitcoin at $68K.

- Nonetheless, the realized worth, excessive whale ratio, and new ATH in cash provide recommend shopping for BTC.

The Bitcoin [BTC] market is at the moment unsure, struggling to take care of a transparent upward trajectory after recovering from the downturn on the fifth of August, attributable to Japan shares crash.

As of time of press, BTC remained just below the $60K stage, however challenges remained. A cluster of 4,000 new shorts lie in wait, with spot promote orders simply above $61K.

So, BTC might break the $60K worth stage in a single day, however stall at $61K. This was the draw back as high-leverage lengthy liquidations loomed across the $58K worth mark.

Supply: Coinglass

Moreover, $9.17 billion in Bitcoin shorts may very well be liquidated if BTC reaches $68K, which additionally threatens its means to succeed in new highs.

Nevertheless, different knowledge helps BTC’s continued restoration, doubtlessly reaching a brand new ATH by This autumn 2024 or Q1 2025.

Bitcoin: Shopping for alternative forward?

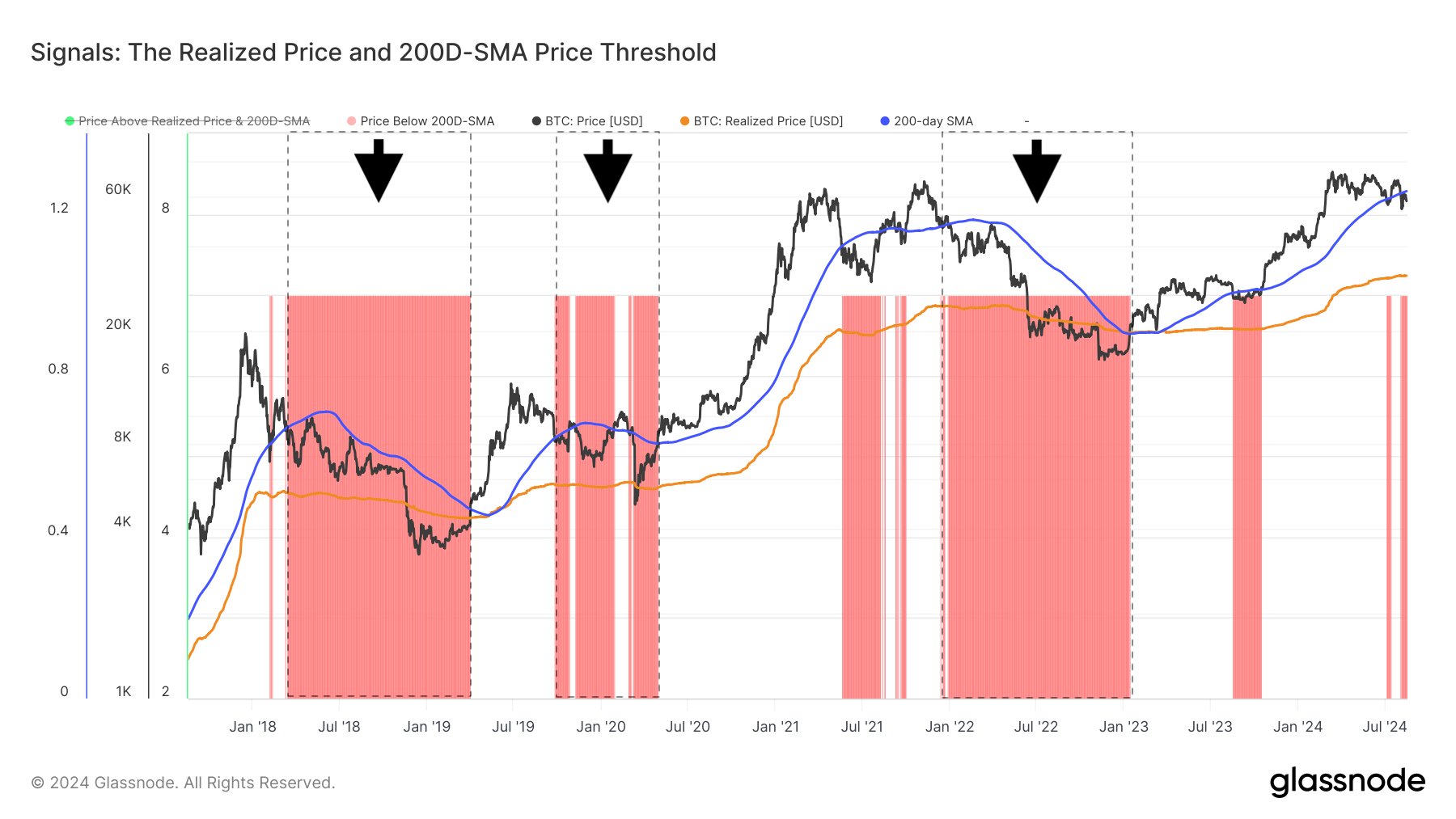

Bitcoin not too long ago dropped under the 200-day Easy Transferring Common however has double bottomed, a key indicator for long-term developments continuation.

In a bull market, this dip can current a shopping for alternative, suggesting a possible rebound.

Nevertheless, if Bitcoin’s worth stays under the 200-day SMA for an prolonged time frame, it might sign the start of a bear market.

Supply: Glassnode

Regardless of this danger, analysts consider that Bitcoin is unlikely to enter a protracted downturn at this stage.

The present scenario suggests a brief dip quite than the beginning of a bearish part, with a powerful chance for restoration and continued development.

Whale accumulate as world liquidity surges

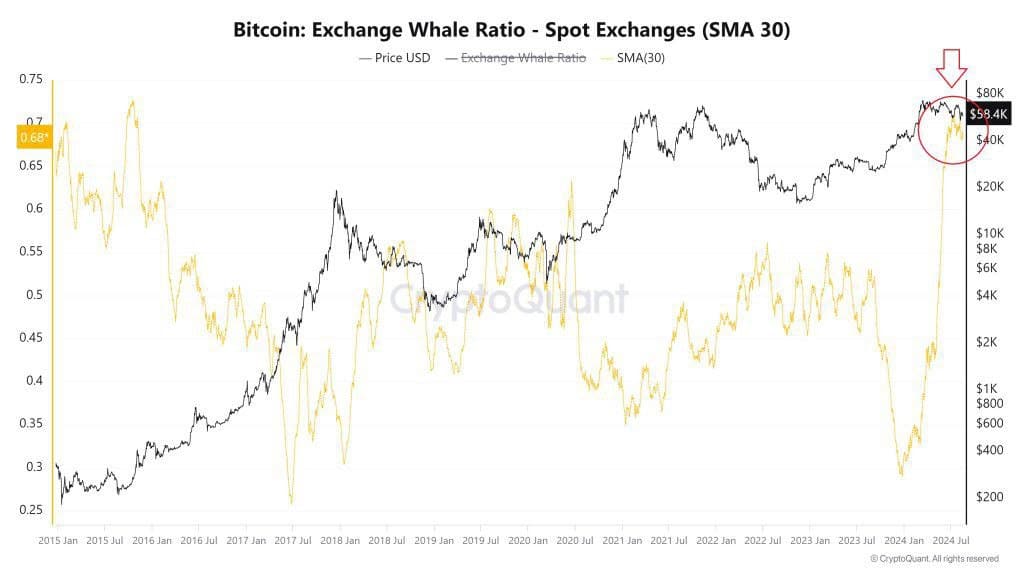

Bitcoin whales are additionally rising their holdings, indicating a possible worth rise. Analysts word that giant traders and merchants are shopping for in the course of the worth dips, a sample that usually results in worth spikes.

This pattern, coupled with latest halving occasions and rising institutional curiosity by way of Bitcoin ETFs, means that Bitcoin’s costs might rise quickly.

Supply: CryptoQuant

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

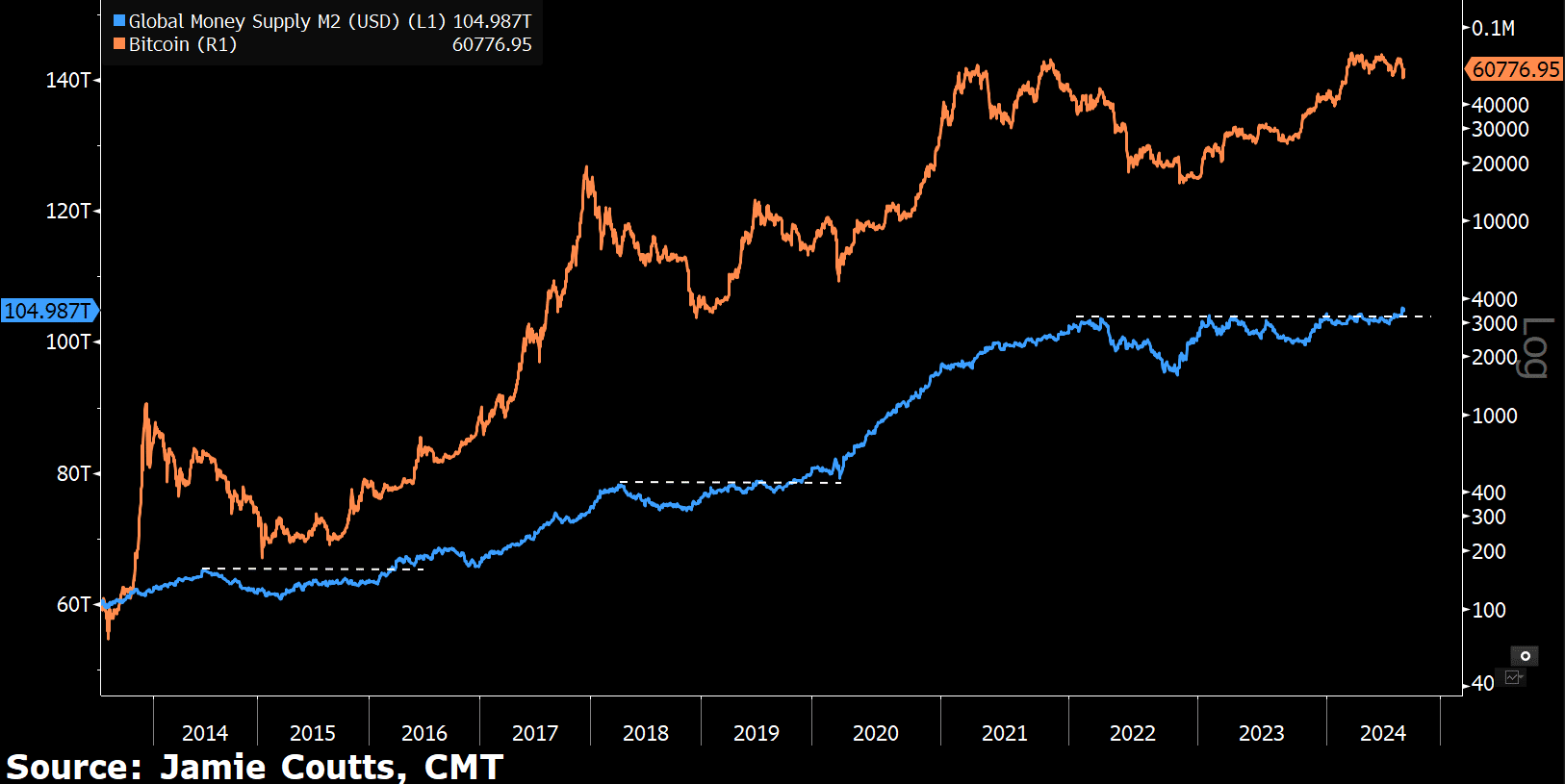

The worldwide cash provide has additionally reached a brand new all-time excessive, boosting shopping for energy and certain rising Bitcoin’s worth.

With more cash in circulation, shopping for strain rises, making Bitcoin a powerful long-term funding. The continual enhance in cash provide helps Bitcoin’s potential for future positive factors.

Supply: Jamie Coutts, CMT